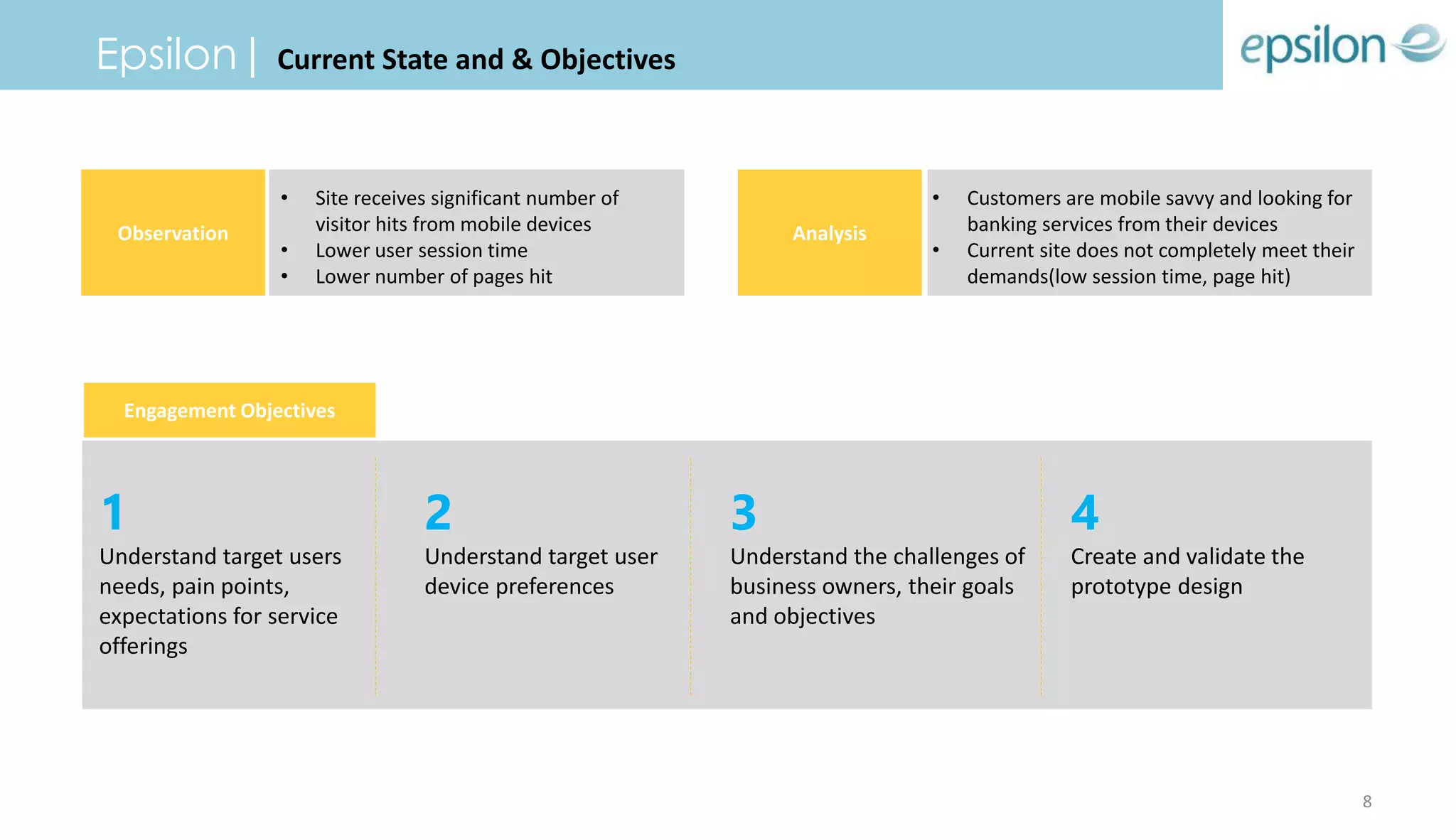

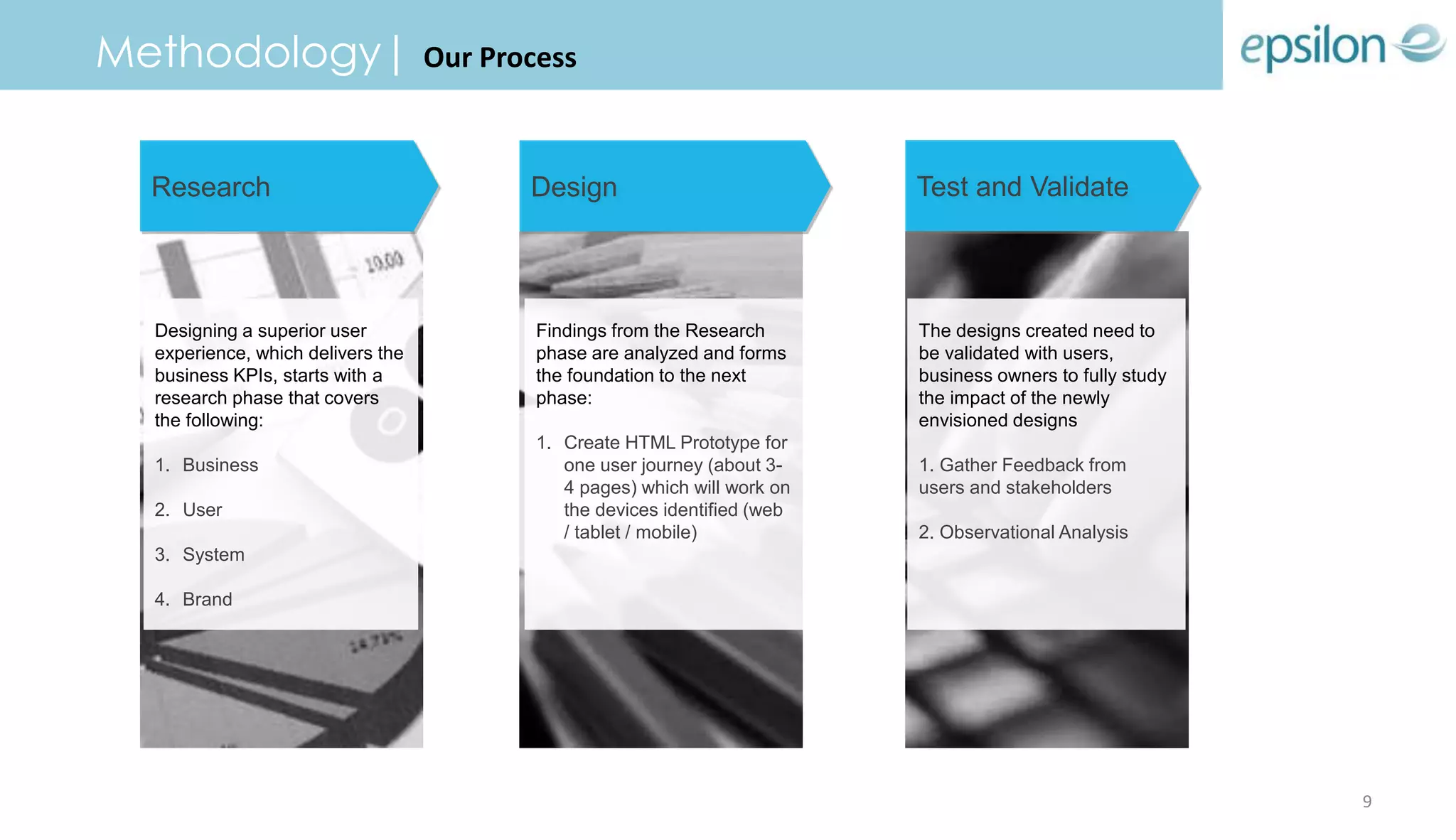

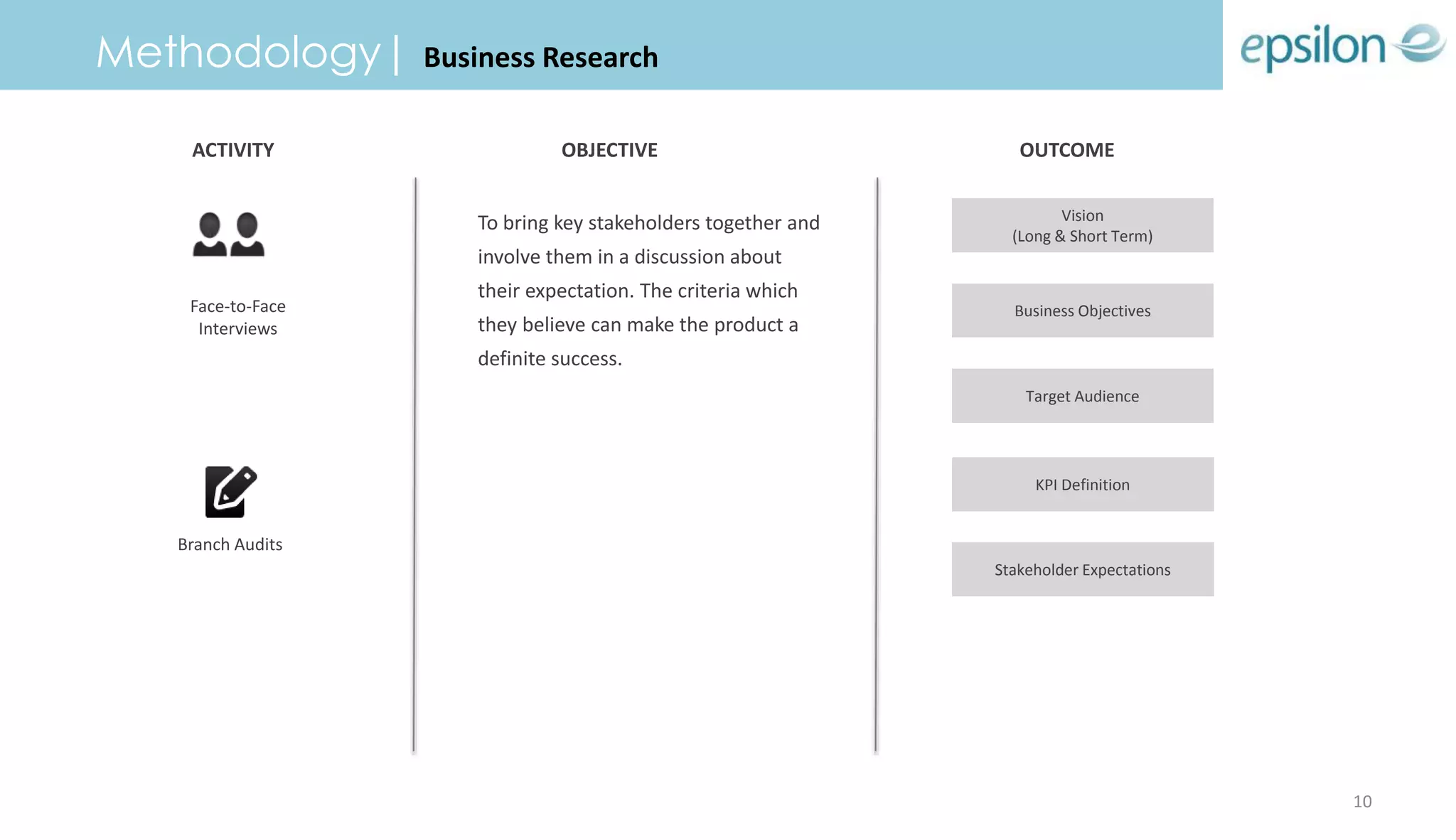

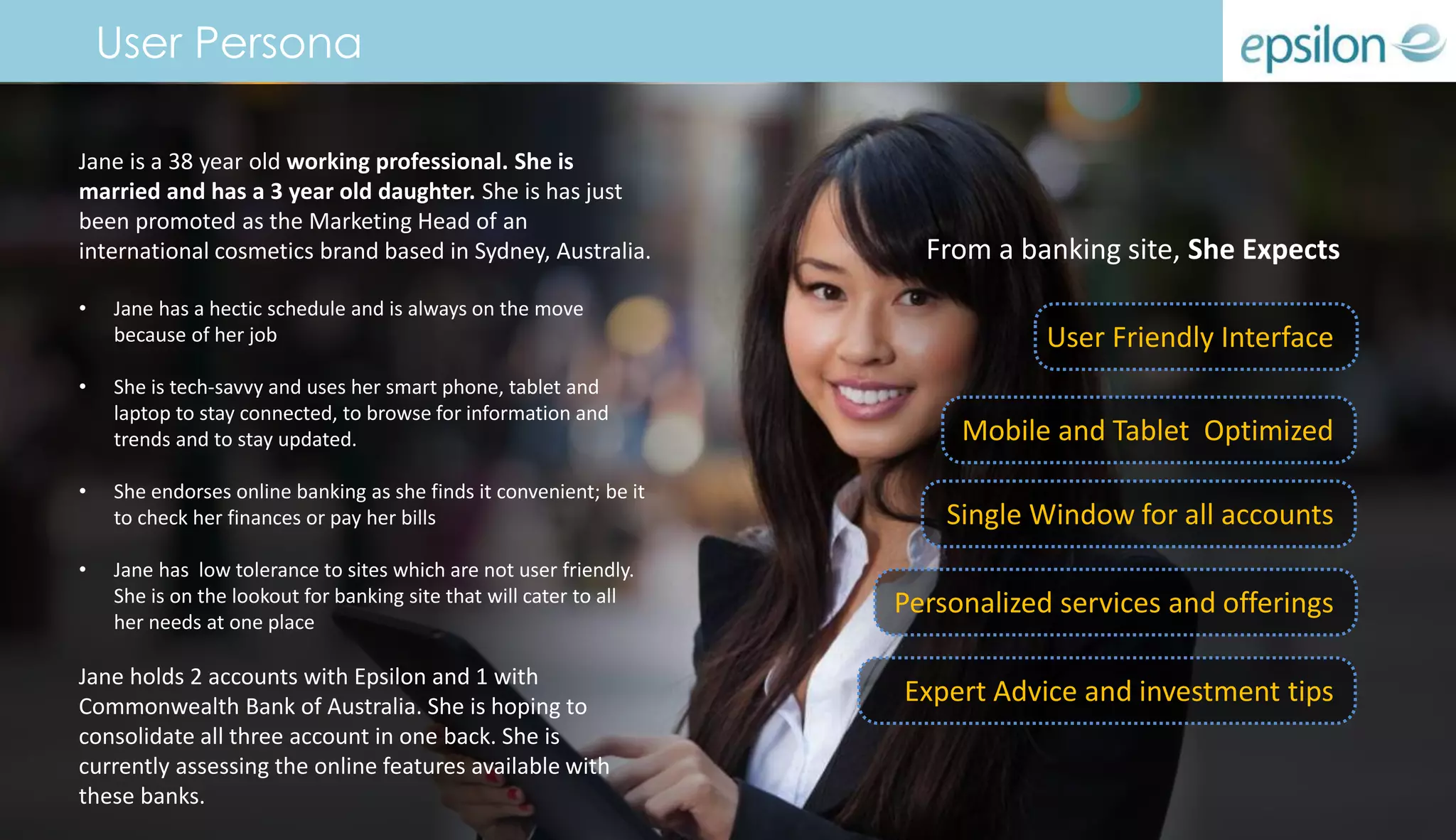

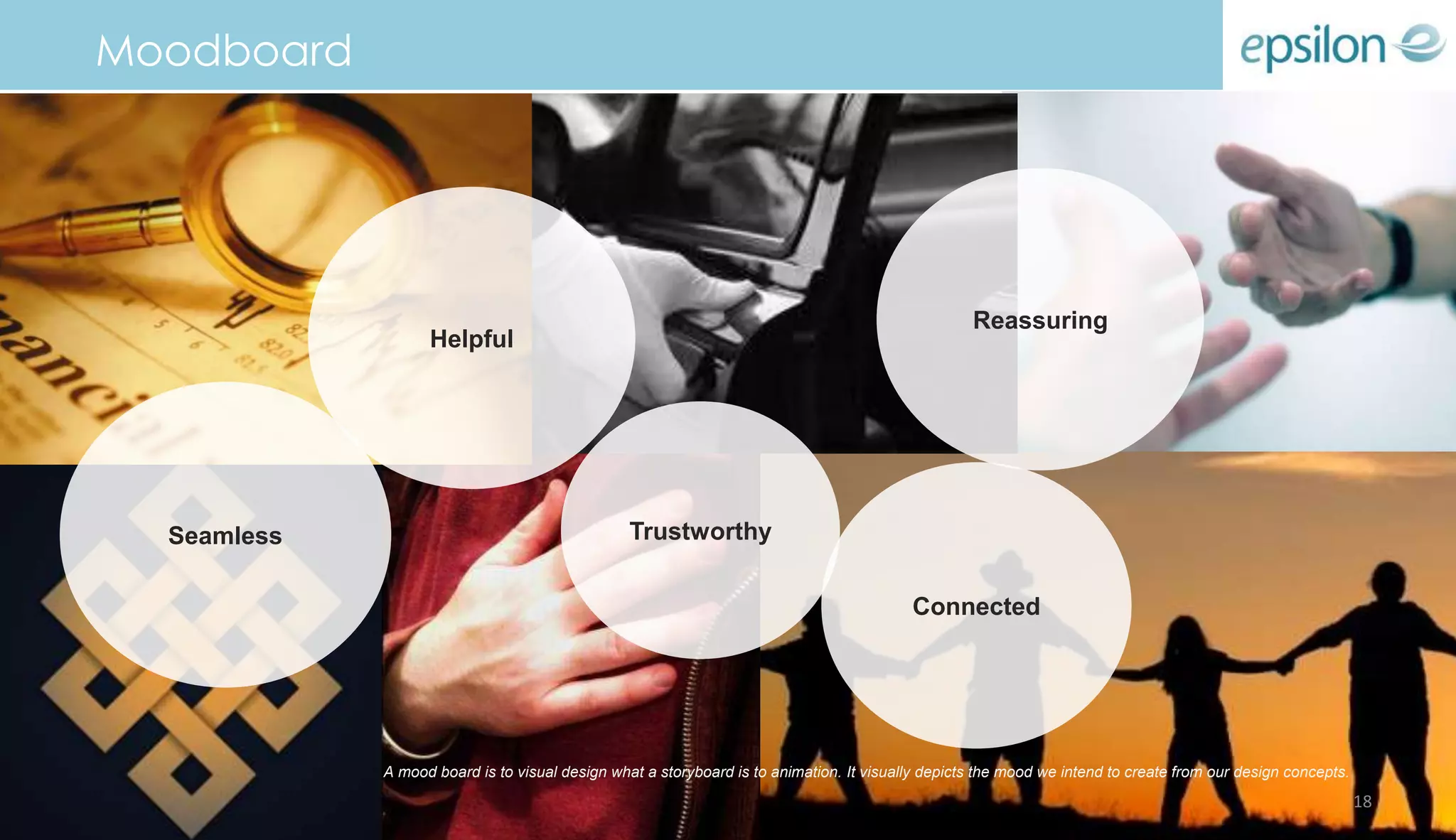

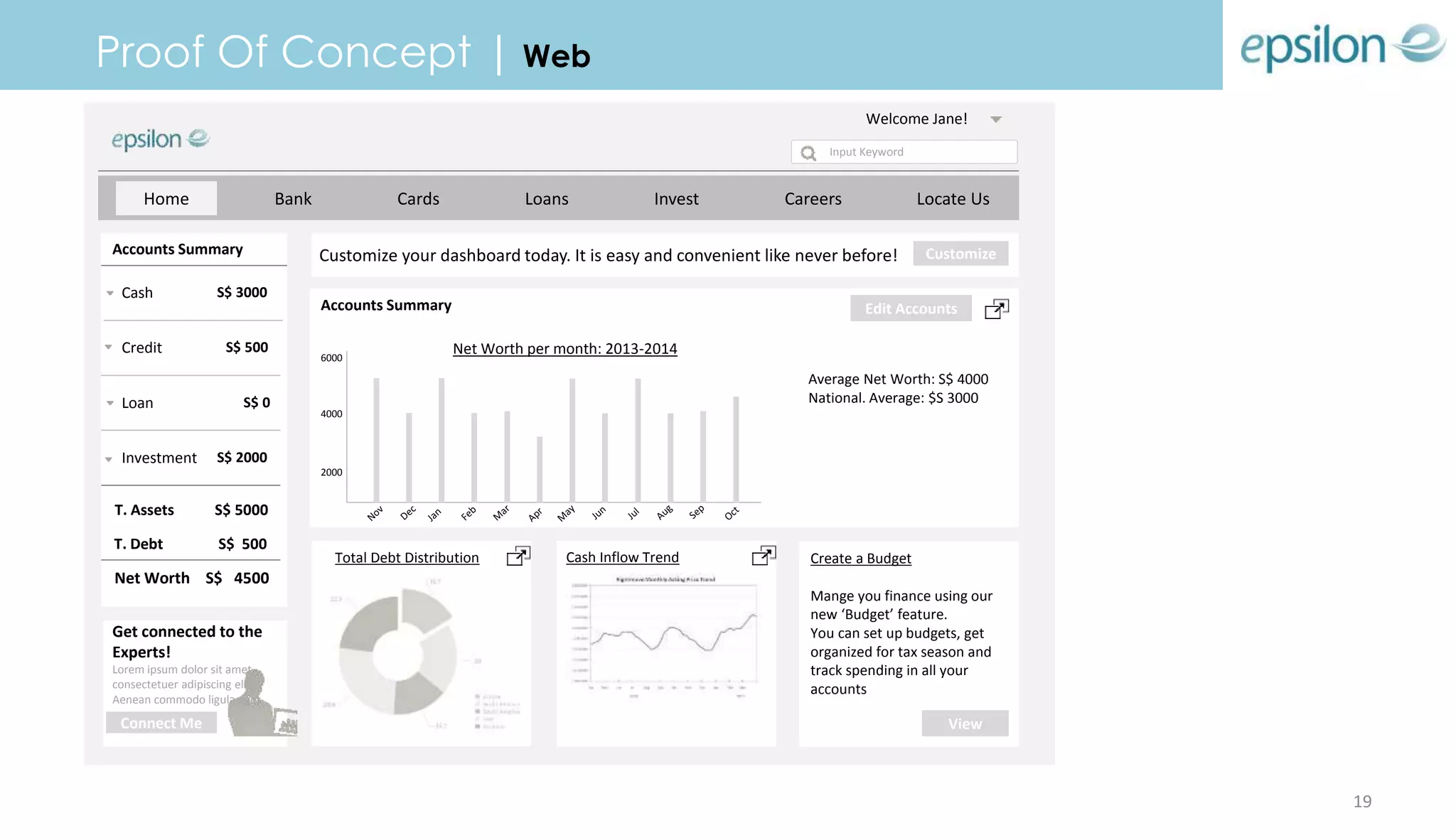

Digital technologies are transforming the banking industry and how customers interact with their banks. Banks are moving from purely transactional models to focus on building trusted partnerships with customers through advanced analytics, personalized services, and real-time interactions. Digital customers now expect convenient, intuitive experiences across all their devices. The document discusses a case study of a bank called Epsilon that aims to improve its digital customer experience. It outlines Epsilon's research methodology including analyzing customer, business, and system needs to create prototype designs for validation and feedback.