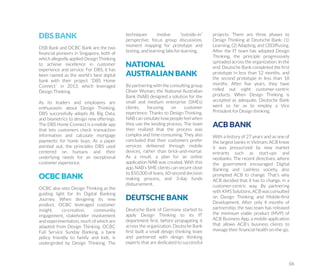

The document discusses how traditional banks are facing disruption from fintech and neobanks, emphasizing the need for design thinking to adapt to changing customer behaviors and preferences. Design thinking is presented as a human-centric approach that helps banks innovate and create more engaging customer experiences. The paper includes case studies of various banks that successfully implemented design thinking principles to enhance their services and maintain competitiveness in the digital banking landscape.