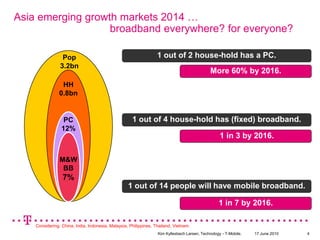

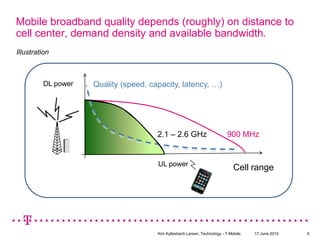

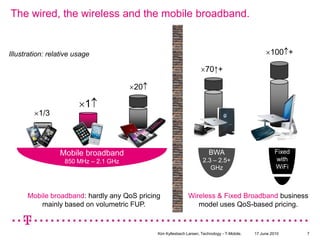

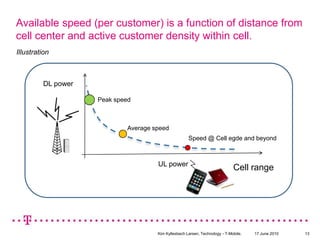

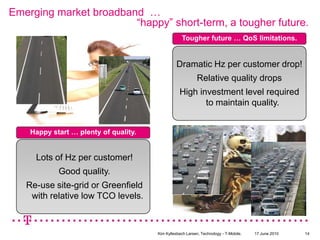

Mobile broadband demand is increasing rapidly in emerging markets due to growing internet and smartphone usage. However, providing quality mobile broadband will be challenging in these markets. Network quality will likely be lower due to higher population densities requiring the same or less spectrum per operator. This will result in fewer kilohertz available per customer and lower speeds, especially at the edge of cells. Pricing will also impact demand, with prepaid plans generating much higher usage than contract plans. The customer experience of mobile broadband in emerging markets may not match that of developed markets due to worse network quality and pricing structures unless substantial network investments are made.