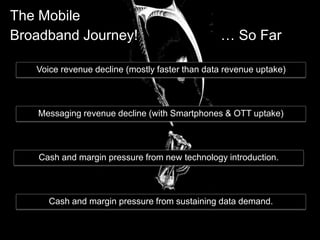

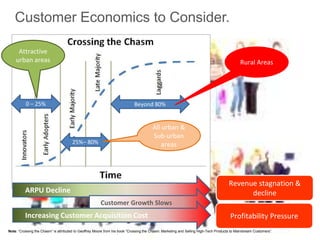

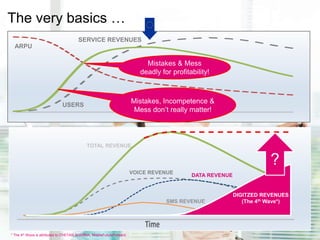

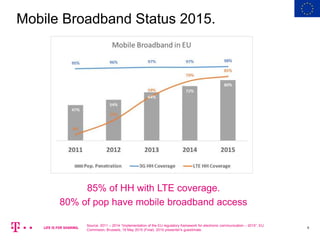

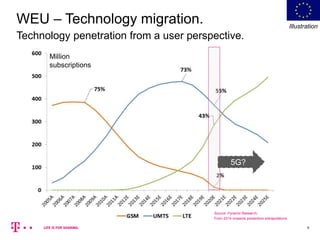

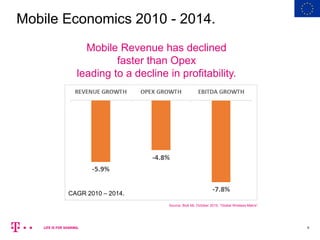

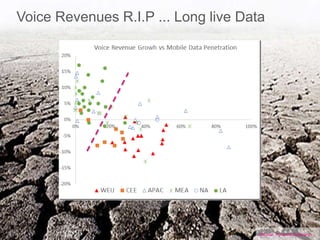

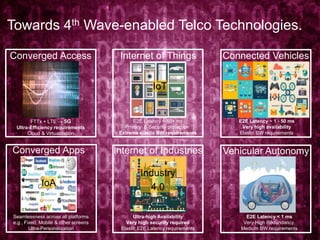

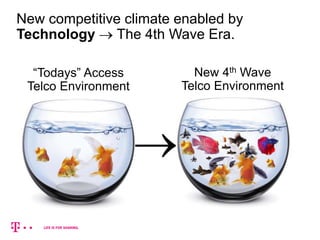

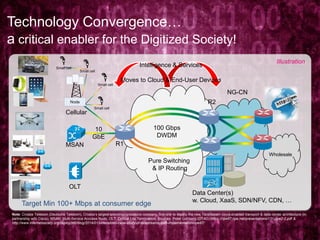

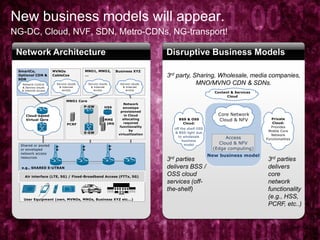

The document discusses the challenges faced by the telecommunications industry, particularly the decline in revenue from traditional services like voice and SMS, and emphasizes the shift towards new technologies such as 5G and the Internet of Things (IoT). It highlights the importance of adapting business models and leveraging technology to drive profitability in a rapidly evolving market. Additionally, the presentation outlines the potential of the digitized economy and the monetization of services in the '4th wave' of telecom evolution.