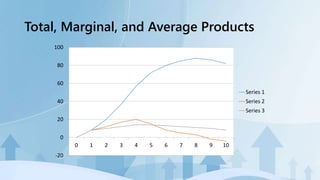

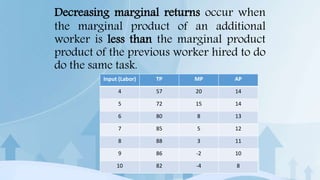

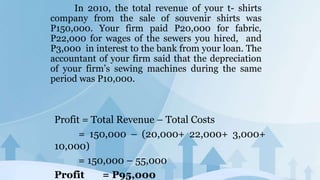

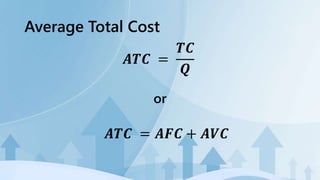

This document discusses key concepts related to production and costs. It defines the four factors of production as land, labor, capital, and entrepreneurship. It explains the differences between short-run and long-run production and explores production functions and schedules. The document also covers total, marginal, and average products as well as the law of diminishing returns. Finally, it discusses different cost concepts including fixed costs, variable costs, total costs, and average and marginal costs.