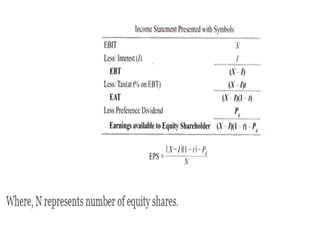

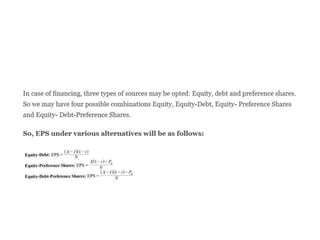

EBIT-EPS analysis evaluates different financing plans and levels of earnings before interest and taxes (EBIT) to determine which option maximizes earnings per share (EPS). It examines how financial leverage impacts EPS under varying EBIT levels or financing alternatives. The analysis helps select the optimal debt-to-equity mix and identifies indifference points that show which plans produce higher EPS above or below certain EBIT thresholds.