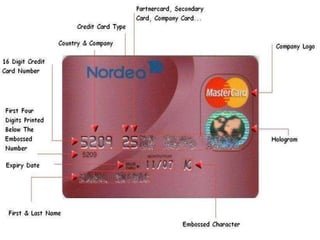

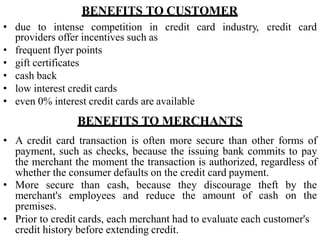

The document discusses electronic banking and differences between debit cards and credit cards. It provides details on debit cards, how they function as electronic checks withdrawing funds directly from a bank account. Credit cards are also discussed, how they allow users to revolve a balance and are charged interest. Benefits of credit cards for customers and merchants are outlined, such as incentives for customers and security compared to cash for merchants.