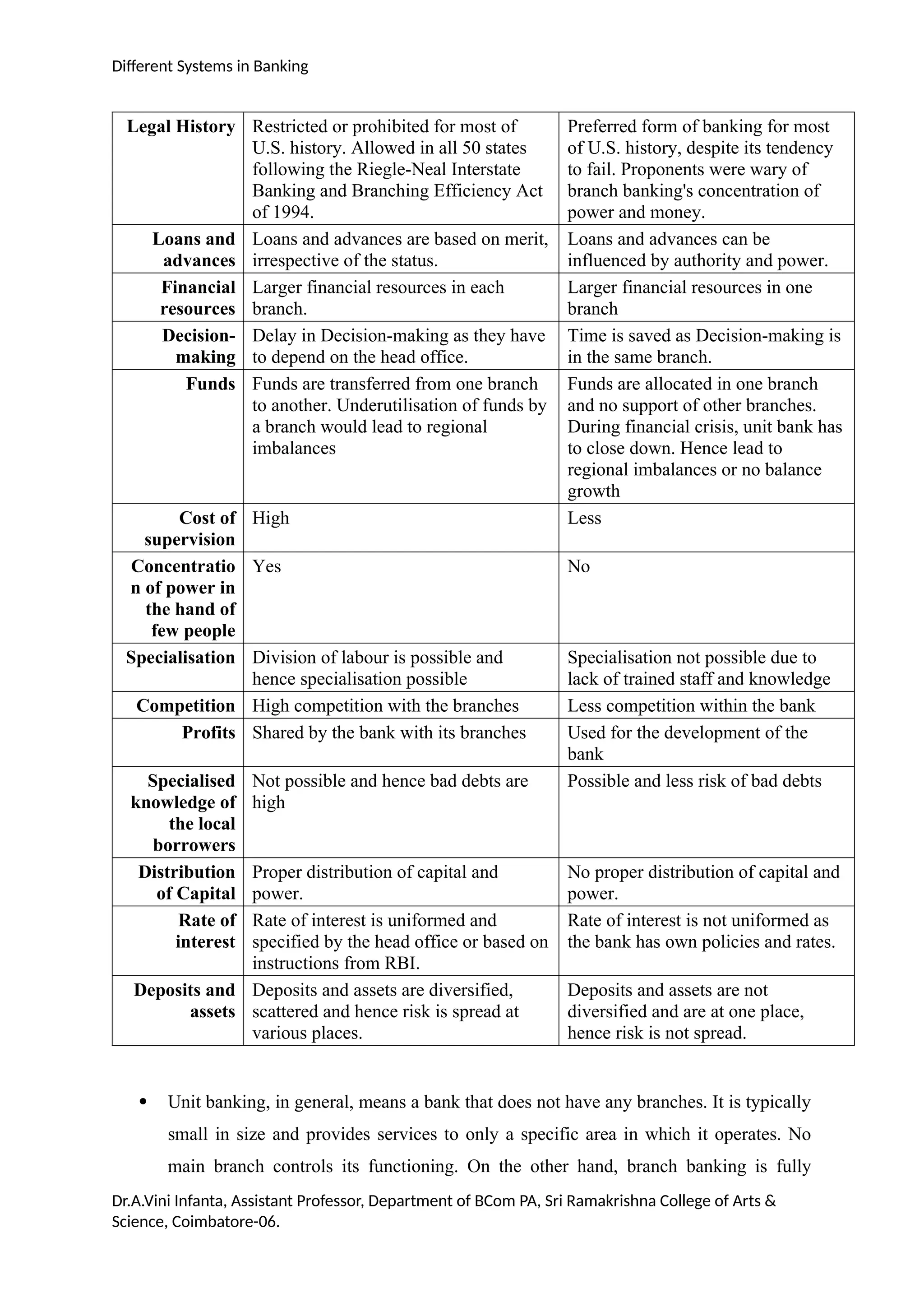

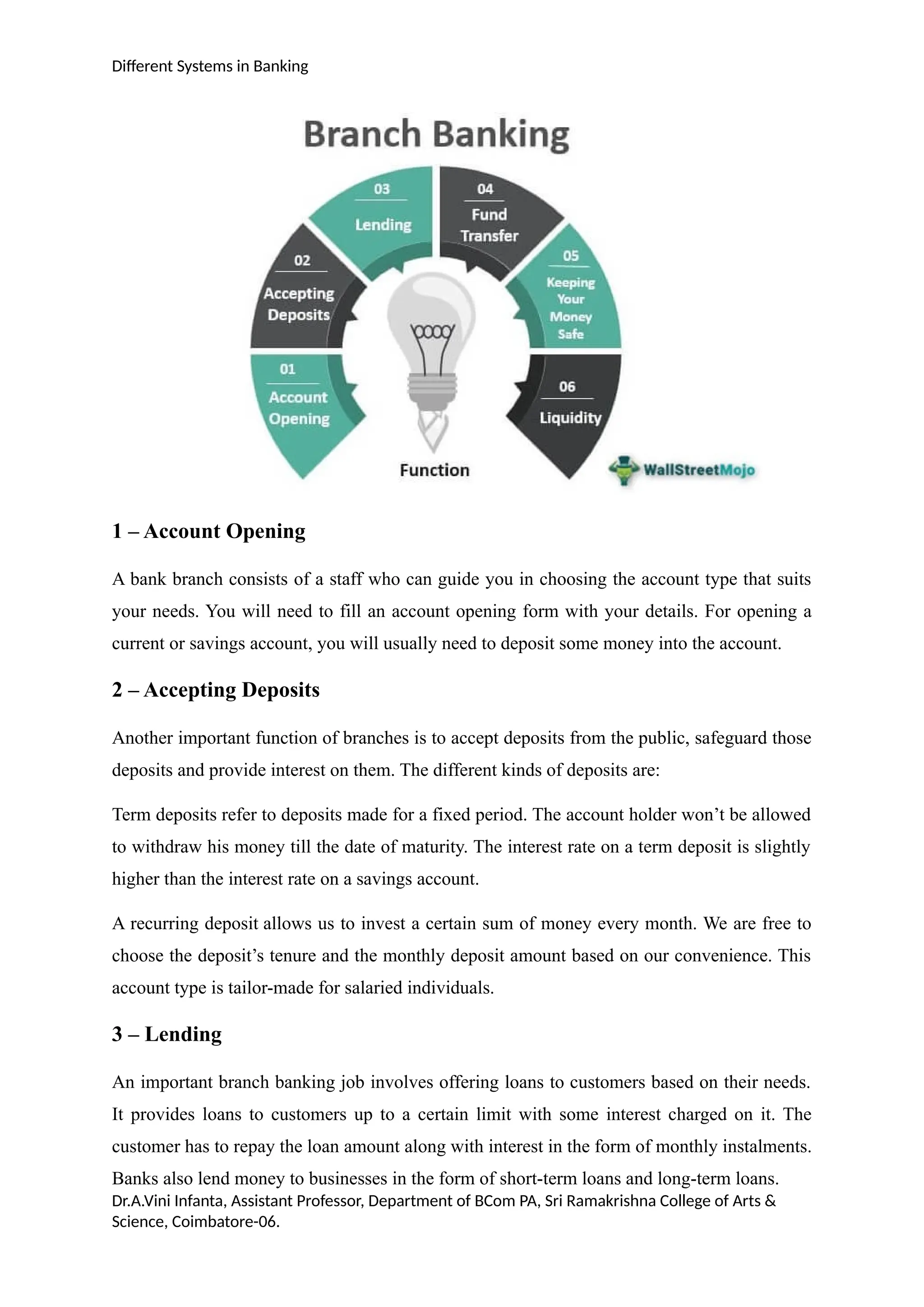

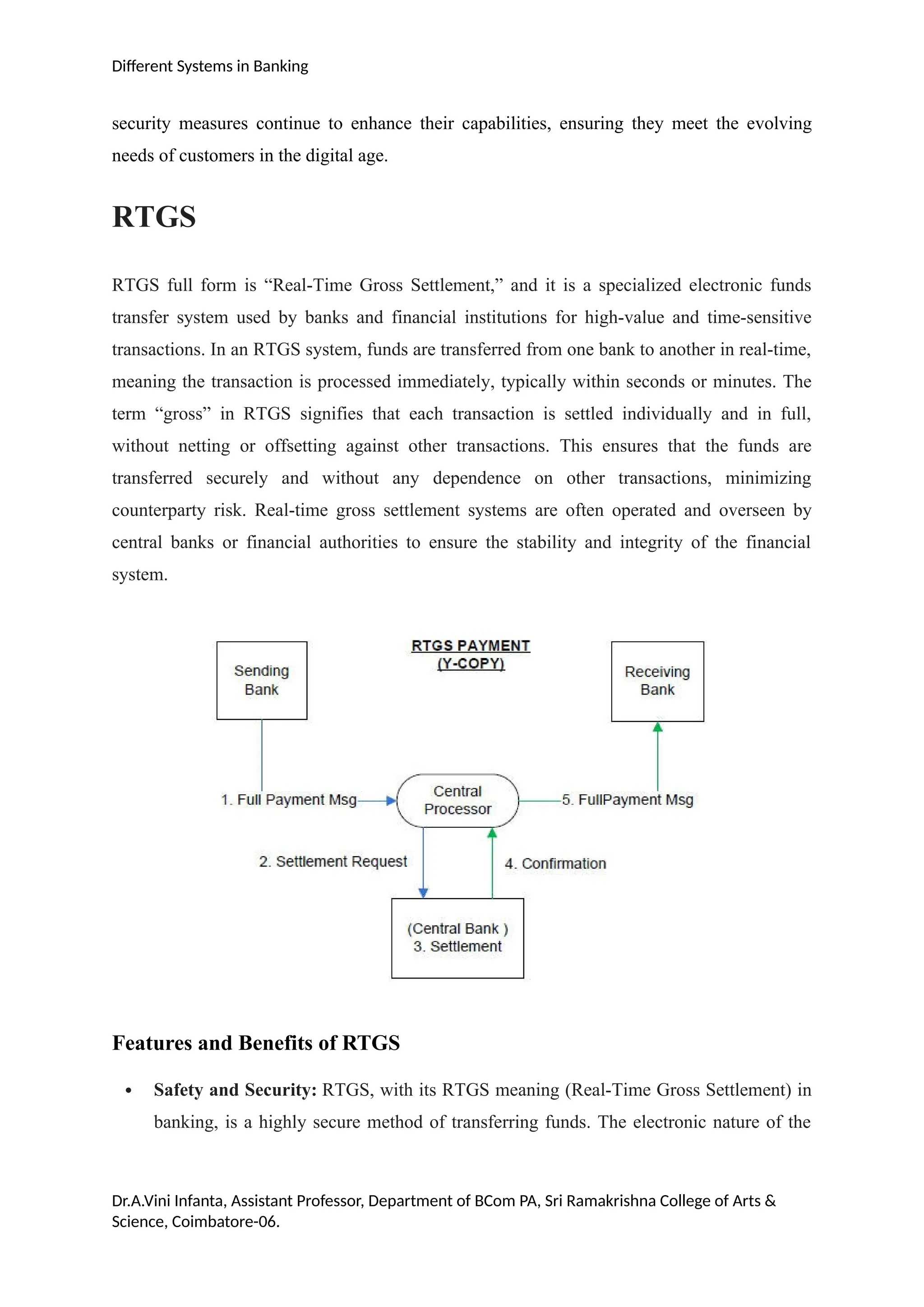

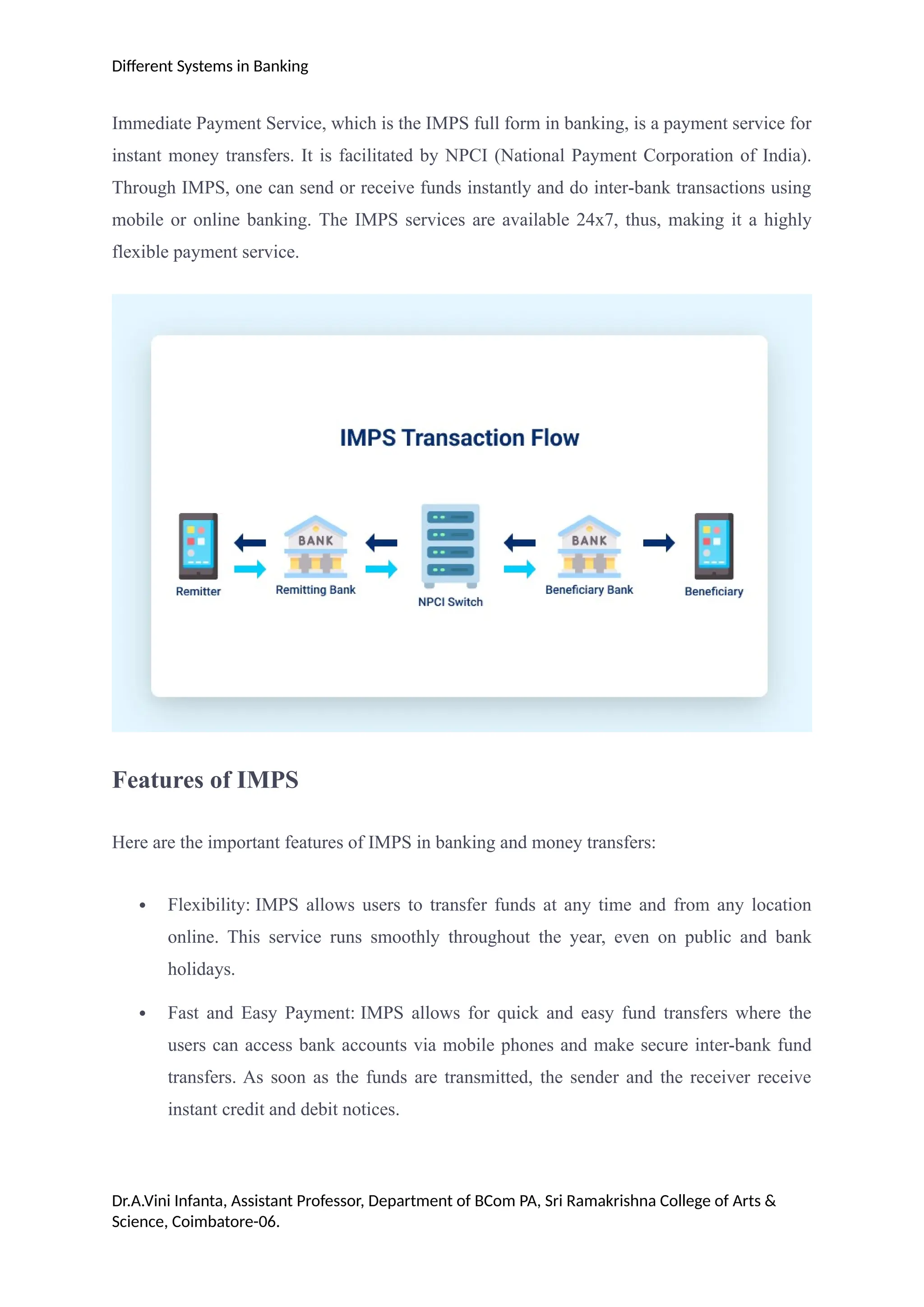

Unit banking refers to a banking practice where a single branch manages all banking activities, focusing on local services without the oversight of larger entities. It has advantages like local fund utilization, close customer relations, and immunity from regional economic fluctuations, but also disadvantages such as limited resources and risks of failure. The document contrasts unit banking with branch banking, highlighting differences in operations, decision-making, interest rates, and services offered.