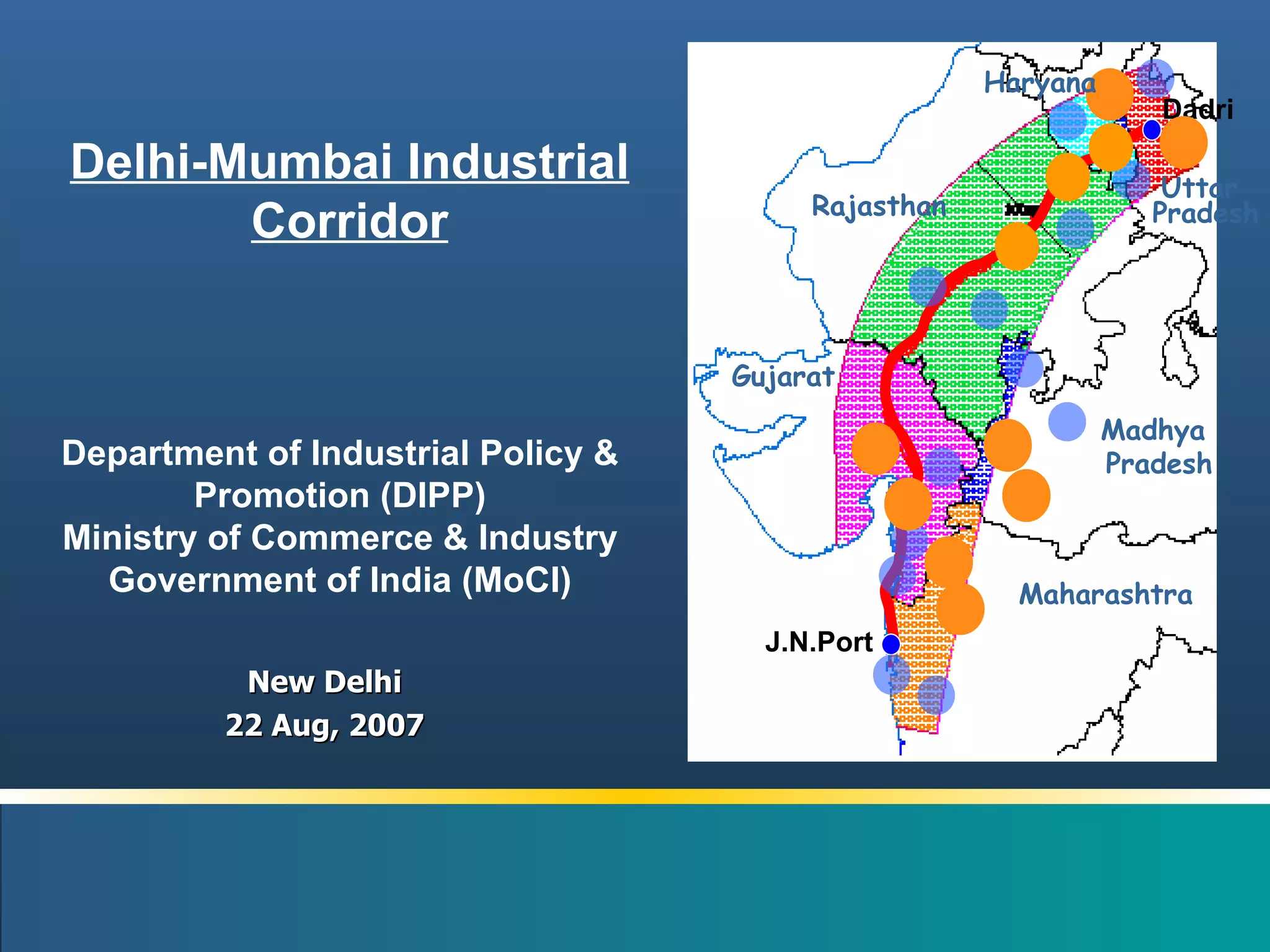

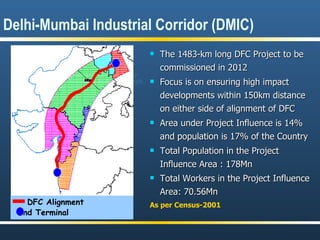

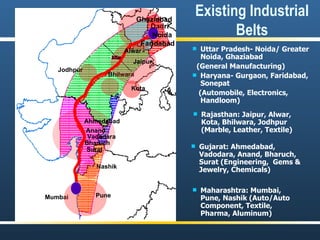

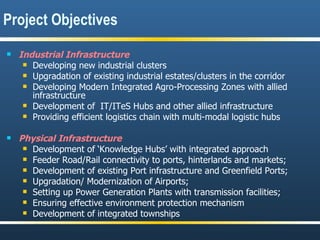

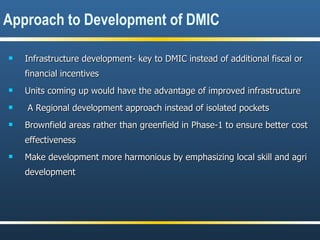

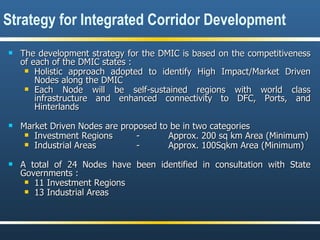

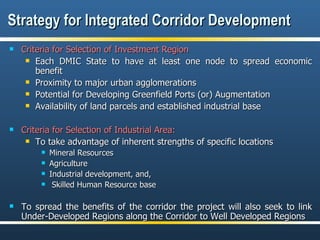

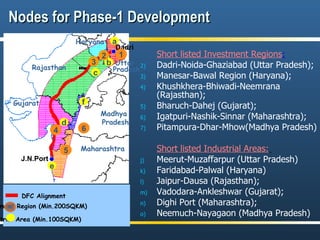

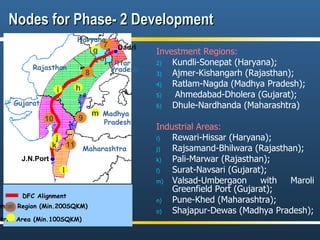

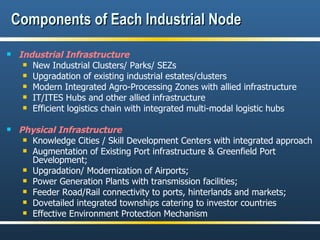

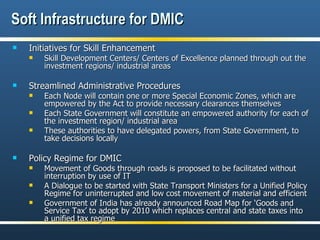

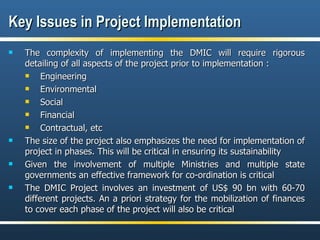

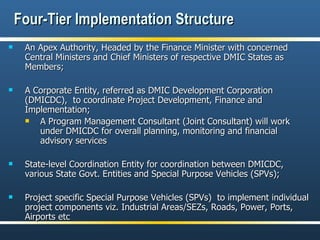

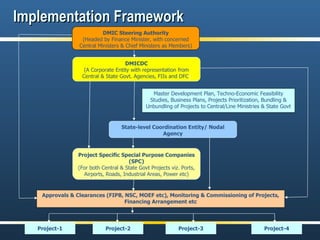

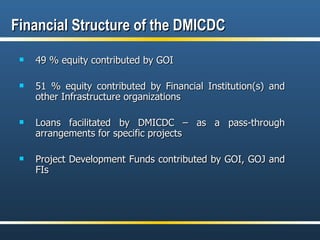

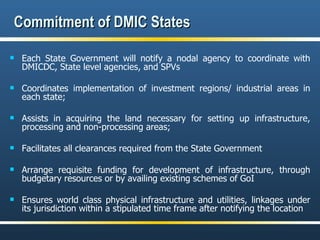

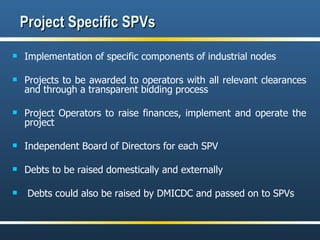

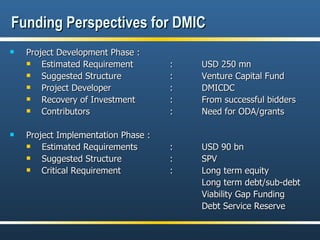

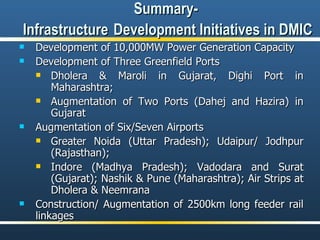

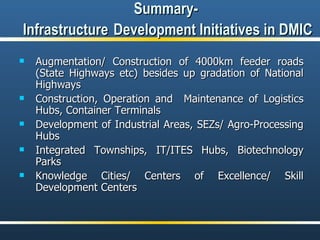

The document summarizes the Delhi-Mumbai Industrial Corridor project, a planned industrial development zone along a 1,483 km dedicated freight railway line between Delhi and Mumbai. Key points include that 24 investment regions and industrial areas have been identified for development in 6 states, with an estimated investment of $90 billion. A four-tier implementation structure is proposed, including an apex authority, corporate entity, program management consultant, and state-level coordination entities.