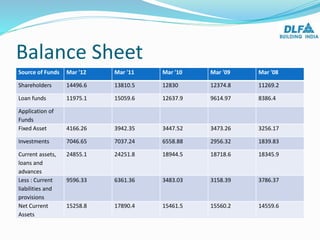

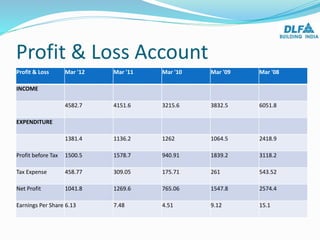

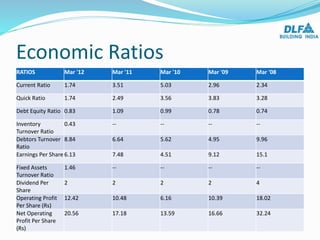

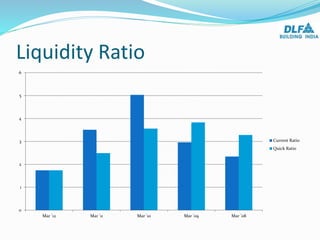

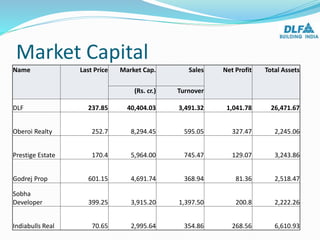

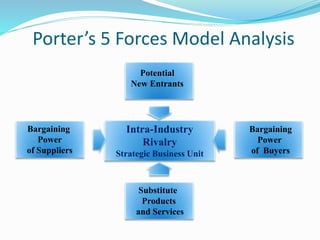

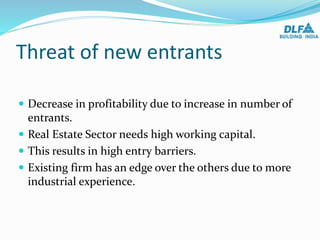

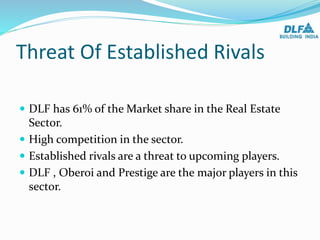

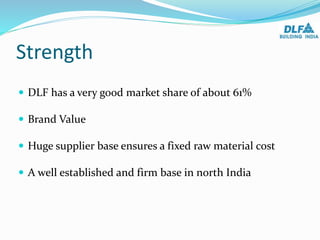

This document provides an overview of Delhi Land and Finance (DLF), India's largest real estate developer. It includes sections on the company's introduction and history, financial statements like balance sheets and profit/loss statements from 2008-2012, economic ratios for evaluating financial performance, and analyses using Porter's 5 Forces and SWOT models. DLF was founded in 1946 and has grown to become a major developer in Delhi and Gurgaon, with the chairman listed as one of the world's richest people. The document examines DLF's financials, competitive environment, strengths in brand and market share, and opportunities for geographic expansion.