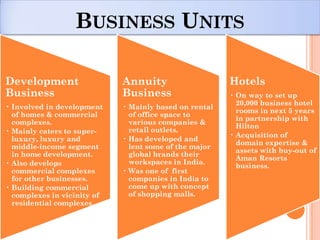

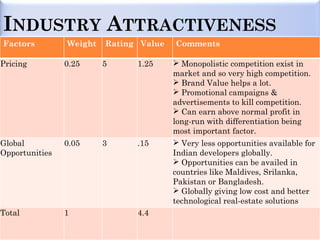

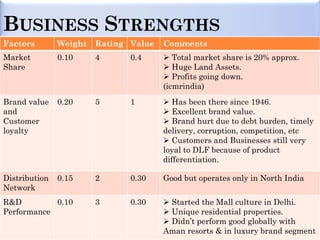

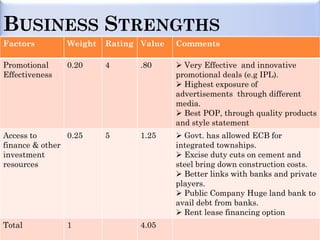

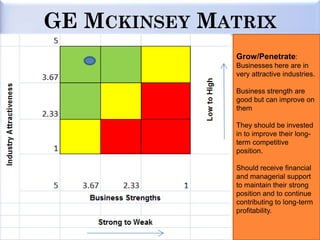

DLF is India's largest real estate company with a vision to become the world's most valuable real estate company. It operates across six business lines - development, annuity, hotels, and others. The real estate industry in India is highly attractive due to strong growth and profitability. DLF has strong brand value and access to finance, though its distribution network and R&D performance could be improved. As a leader in a growing industry, DLF's strategy is to seek dominance, grow, maximize investment, and defend its position while identifying and building upon strengths and weaknesses.