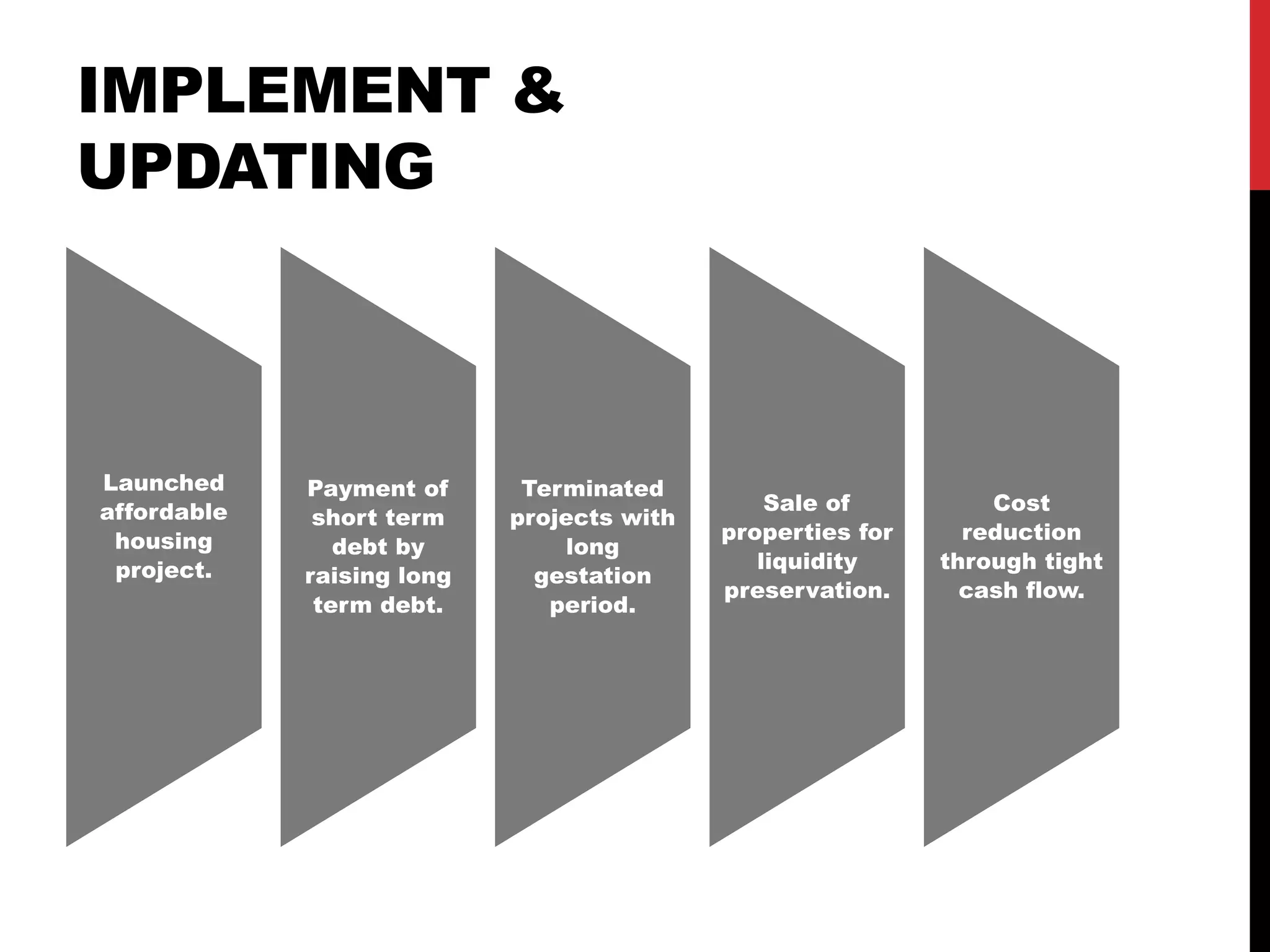

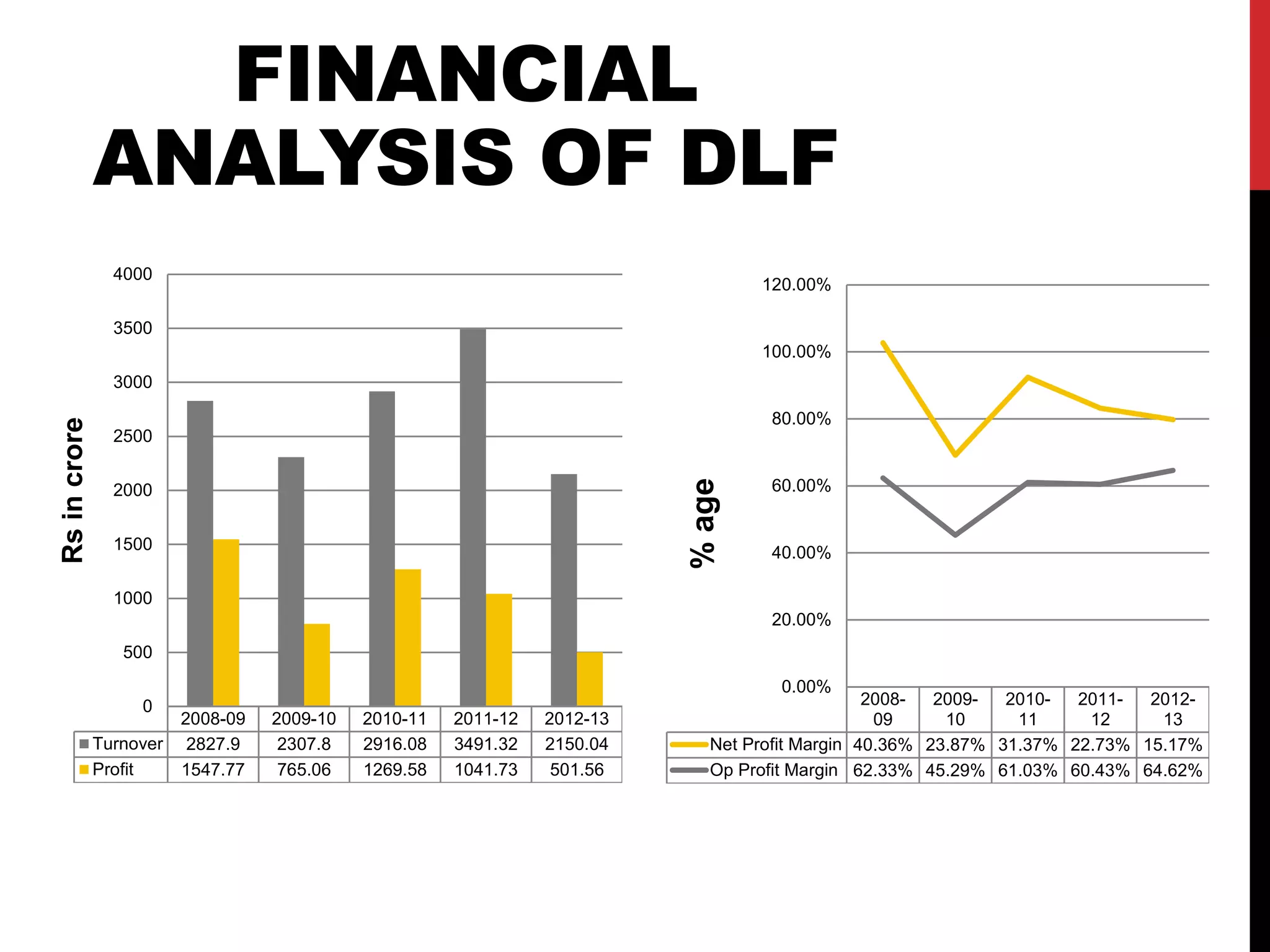

This document provides an overview and analysis of DLF Limited, the largest real estate developer in India. It discusses DLF's business model, operations across multiple cities in India, vision, current strategies, and strategic planning process. The document also includes a financial analysis showing DLF's revenues and profits from 2008-2013 and concludes that DLF is well-positioned for continued long-term growth with a mix of development and rental businesses and experienced teams to execute projects across India.