This document provides information about Director Identification Numbers (DIN) in India. It discusses:

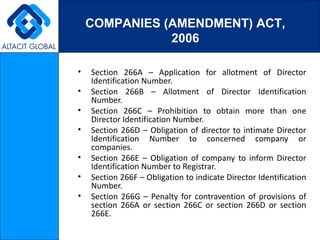

- The introduction of DIN with amendments to the Companies Act in 2006

- The relevant rules and sections of the act pertaining to DIN

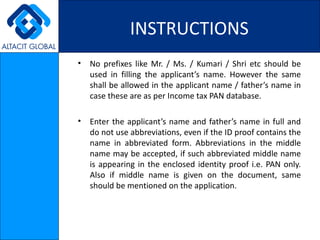

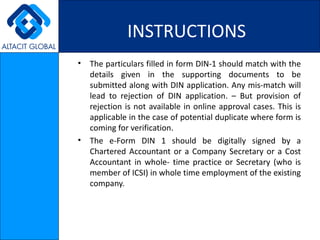

- The process for applying for a DIN online through eForm DIN-1

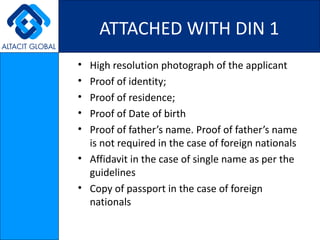

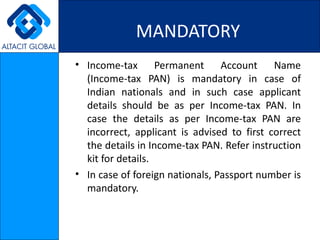

- The documentation required to apply for a DIN

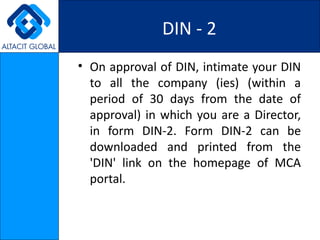

- Obligations of directors and companies to inform one another of DINs