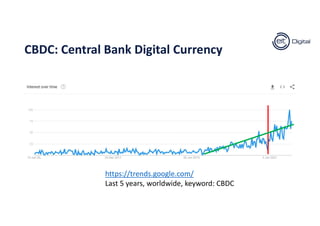

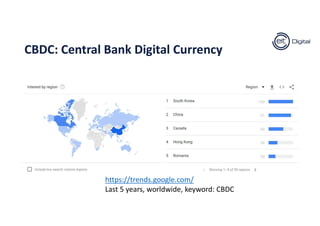

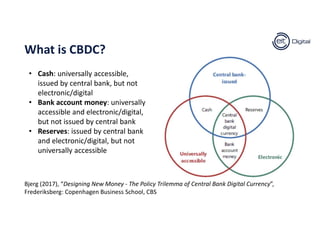

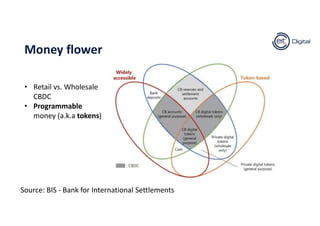

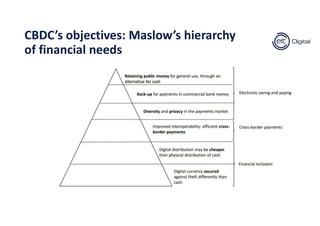

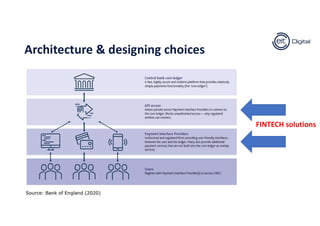

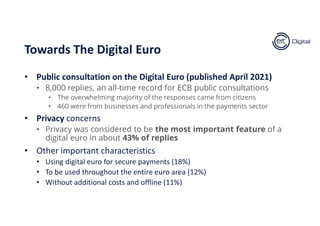

Central Bank Digital Currency (CBDC) refers to a digital form of central bank-issued currency that can be used by all citizens. While cash is universally accessible but not digital, and bank accounts are digital but not issued by central banks, CBDC aims to achieve both universal accessibility and being in digital form while still being issued by central banks. There are various design choices that central banks must make regarding CBDC including whether it is for retail or wholesale use, how programmable it can be, and what objectives it aims to achieve such as financial inclusion. National banks will play an important stakeholder role in CBDC and there are also macroeconomic and regulatory considerations for central banks to take into account regarding a CBDC.