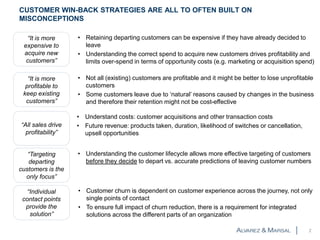

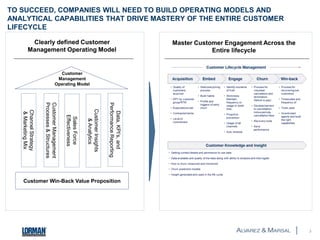

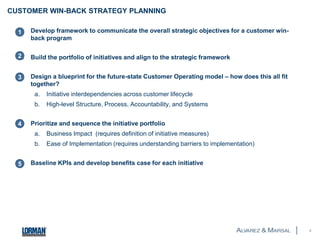

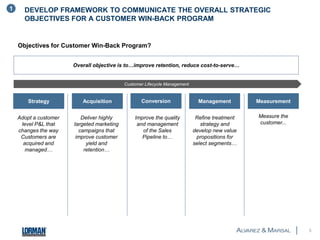

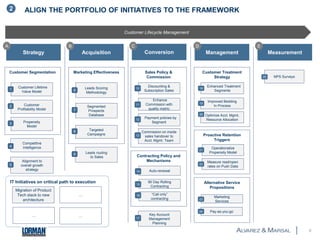

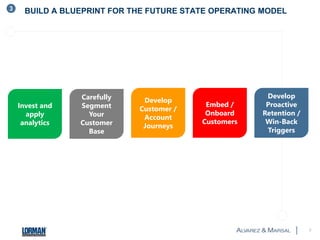

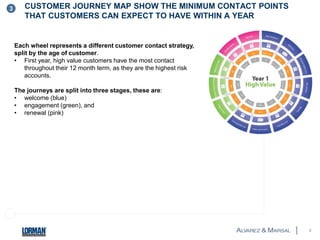

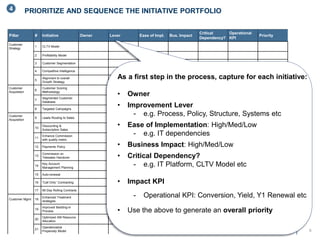

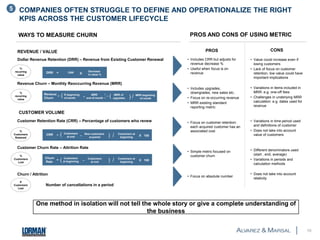

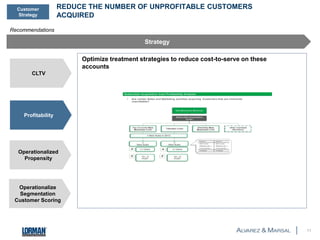

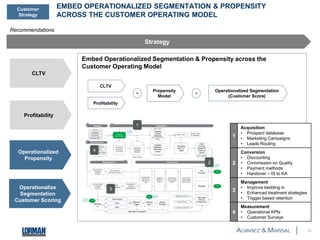

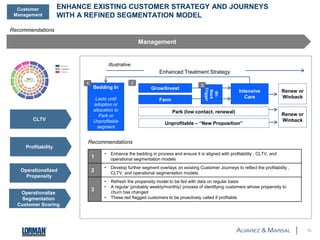

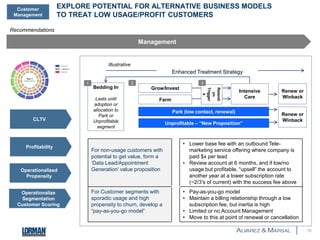

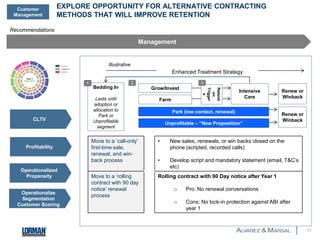

The document discusses developing an effective customer win-back strategy. It notes that win-back strategies are often built on misconceptions and that not all existing customers are profitable. It recommends understanding customer lifecycles and costs to effectively target customers. Companies need to build operating models and analytics to master the entire customer lifecycle. Developing a successful win-back strategy involves framework development, initiative alignment, operating model design, prioritization, and KPI establishment.