This document provides information on tax rates under the Goods and Services Tax (GST) in India. It outlines the following key points:

- Services taxed at 5% include certain food items, job works, transport services, with full input tax credit allowed.

- Services taxed at 12% and 18% include air transport, construction, renting of guest houses, temporary transfer of IP rights, banking, insurance, software.

- Services taxed at 28% include cinema halls, water parks, sporting events, gambling.

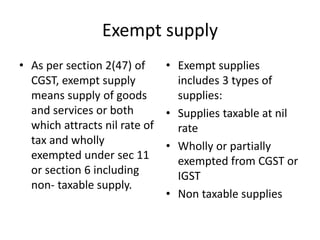

- Exempt supplies include those taxed at nil rate, wholly or partially exempt, and non-taxable supplies.

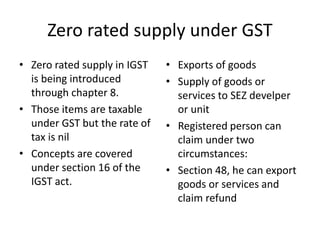

- Zero-rated supplies are exports