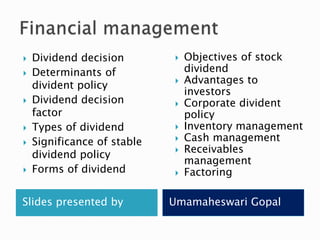

Financial Management- Dividend decision and Working capital management

- 1. Slides presented by Umamaheswari Gopal Dividend decision Determinants of divident policy Dividend decision factor Types of dividend Significance of stable dividend policy Forms of dividend Objectives of stock dividend Advantages to investors Corporate divident policy Inventory management Cash management Receivables management Factoring

- 2. Decision factor High percentage of dividend Maximum earnings per share Portion of the earnings distributed among the shareholders. High or low dividend While declaring dividend: Issue high dividend- less retained earning- negative results on the wealth of the company Issue low dividend- increase retained earnings- positive reflects on the wealth of the company.

- 3. Earnings retainment Distribution authority Stability of earnings Financing policy of the company Liquidity of funds Dividends policy of competitive concerns Past dividend rates Debt obligation Ability to borrow Growth needs of the company Profit rates Legal requirements Policy of control Corporate taxation policy Tax position of shareholders Effect of trade policy Attitude of interested group

- 4. Long term Wealth maximization Long term decision- company will pay dividend only when there is no profitable investment opportunites Wealth maximisation decision- Higher value to the near dividends than the future values in the market.

- 5. Constant percentage In addition to constant Constant dividend per share Constant percentage of net earnings Small constant dividend per share plus extra dividend Dividend as fixed percentage of market value- shareholders often translate their dividend income into the percentage returns of market price of the shares.

- 6. Necessities of it Current trend & expectations Confidence among shareholders Investors desire for current income Institutional investor’s requirements Stability in market prices of shares Raising additional finances Spreading of ownership of outstanding shares Reduces the changes of loss of control Market for debentures and preference shares

- 7. forms why Stock dividend Scrip dividend Property dividend Cash dividend stock property dividendscash scrip

- 8. why How is it helpful? Advantages: Maintainance of liquidity postion Satisfaction of shareholders Economical issue of captialisation Remedy for undercapitalisation Conservation of cash Lower rate of dividend Financing expansion programmes Transferring the formal ownership of surplus and reserves Enhanced prestige Widening share market True presentation of earning capacity

- 9. What do I get as an investor? How is it beneficial for the company? Increase in their equity Marketability of shares is increased Increase in income Increase demand for shares Disadvantages A. for company Increase in capitalisation Issue of bonus shares increase more liability on the company on future dividends Prevents new investors form becoming shareholders Control over the management

- 10. Policies in india How do they affect? Payout ratio Stability of dividends

- 11. What is WC? CA-CL= WC Inventory management It refers to stocks, raw materials,components,spares or working progress maintainedin an organisationto have continuousproductionand sales. It involvescontinuousflow of raw materials to productiondepartment. An efficient system of inventory management directlycontributesto the growth of profitabilityof the business concern. Due to inflationand the conceptof time value of money, inventorymanagement hasgained important regognition in the day to day management of businessunits.

- 12. Why is it required? Scope and significance? To provide continuous supply of raw materials to carry out uninterrupted production To reduce the wastages and to avoid loss of pilferage, breakage and deterioration. To exploit the opportunities available and to reduce the cost of purchase. To introduce scientific inventory management techniques To provide the right materials at right time, from right sources and at right prices. Demand of good of ultimate consumers on time. Avoid excess and inadequate storing of materials Quality of raw materials Reduce order placing and receiving costs to the minimum.

- 13. Methods How is it different? 1.Fixation of levels Maximum level Reorder level Minimum level Danger level 2. ABC analysis 3. Economic order quantity 4. Perpetual inventory system 5.VED analysis 6. FSN analysis 7. Periodical inventory valuation

- 14. What is cash managment Why? Cash is the most liquid asset that a business owns. It includes money and such instruments as cheques, money orders and bank drafts. Rate of inflow of receipts and rate of outflow of cash disbursements. A corporate financial officer should plan his cash and credit sources in such a way that the normal operations of the corporation are not disrupted by cash and credit sources in such a way that the normal operations of the corporation are not because of liability to finance them.

- 15. To make cash payments To maintain minimum cash reserve Motives of Holding cash: Cash is held by the firm with the following motives: 1. Transaction 2. Precautionary 3. Specualtion 4. Compensatory

- 16. Budgeting and forecasting Planning and optimizing Cash planning Managing the cash flows Optimum cash level Investing idle cash Cash forecasting and budgeting: Short term forecasting methods 1. Receipts and disbursement method 2.Adjusted net income method 3.long term forecasting

- 17. What are the models/ What do they specify? To maintain the sound liquidity position of the firm. Availability of cash to meet the firm’s obligations when they become due. Decision influenced by trade off between risk and return. Investment in marketable securities Safety Maturity Marketability Cash mgt models Baumol model Miller-orr model Orgel’s model

- 18. Short or long As loans or other forms? Long term financing Short term financing Spontaneous financing Creditors and bills payable Cost free Utilise sources to the fullest extent Lt Loans from F.I Floating of debentures Issue of shares Raising funds by internal financing

- 19. Current trend in inventory management Is it helpful? Finance Maintainance of accounts Collection of debts Protection against credit risks Additional charge along with interest and funded amount to the factor Pricing of factoring services: Administrative aspect:0.5-2.5% Interest charges : 80%

- 20. Full Factoring This is also known as "Without Recourse Factoring ". It is the most comprehensive type of facility offering all types of services namely finance sales ledger administration, collection, debt protection and customer information. 2. Recourse Factoring The Factoring provides all types of facilities except debt protection. This type of service is offered in India. As discussed earlier, under Recourse Factoring, the client's liability to Factor is not discharged until the customer pays in full. 3. Maturity Factoring It is also known as "Collection Factoring ". Under this arrangement, except providing finance, all other basic characteristics of Factoring are present. The payment is effected to the client at the end of collection period or the day of collecting accounts whichever is earlier. 4. Advance Factoring This could be with or without recourse. Under this arrangement, the Factor provides advance at an agreed rate of interest to the client on uncollected and non-due receivables. This is only a pre-payment and not an advance. Under this method, the customer is not notified about the arrangement between the client and the Factor. Hence the buyer is unaware of factoring arrangement. Debt collection is organized by the client who makes payment of each invoice to the Factor, if advance payment had been received earlier.

- 21. 6. Invoice Discounting In this arrangement, the only facilityprovidedby the Factor is finance.In this method the client is a reputed company who would like to deal with its customers directly, includingcollection, and keep this Factoring arrangement confidential. The client collects paymentsfrom customer and hands it over to Factor. The risk involvedin invoice discounting ismuch higher than in any other methods. The Factor has liberty to convert the facilityby notifyingall the clients to protect his interest. This service is becoming quite popularin Europe and nearly one third of Factoring business comprises this facility. 7. Bulk Factoring It is a modified version of Involve discountingwherein notificationof assignment ofdebts is given to the customers. However, the client is subject to full recourseand he carries out his own administration and collection. 8. Agency Factoring Under this arrangement, the facilities of finance and protection against bad debtsare providedby the Factor whereas the sales ledger administration and collection ofdebts are carriedout by the client.

- 22. Major component of current assets Credit sales increases the TO and profit of the business. Ac/R or sundry debtors Main obj- to maximise sales and profit with liberal but sound credit sales policy

- 23. Thank you for reading. Your comments are appreciated!