The document provides an overview of the derivatives market. It discusses:

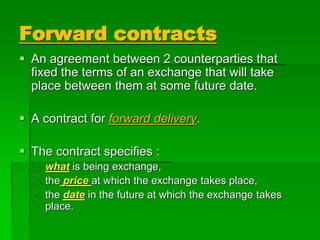

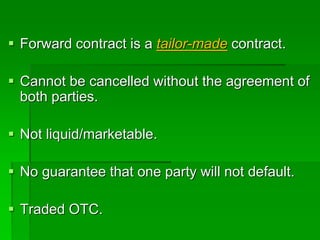

- Derivatives are financial instruments whose value is based on an underlying asset like commodities, stocks, bonds, currencies or market indexes. Common types are futures, options, forwards and swaps.

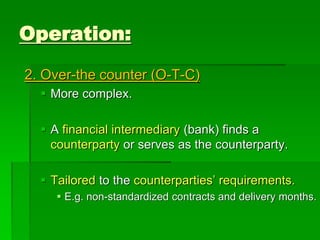

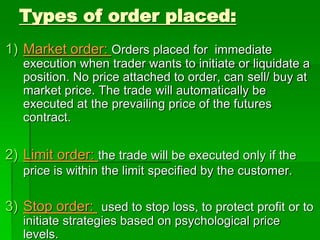

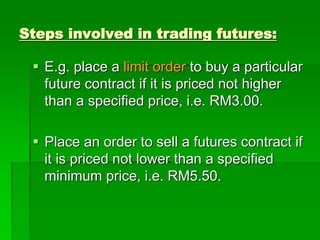

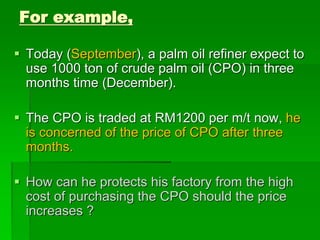

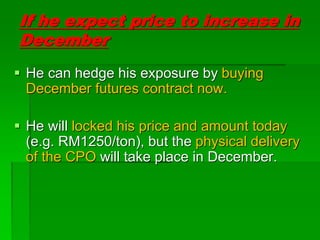

- The derivatives market allows trading of these instruments on organized exchanges or over-the-counter. It serves hedgers seeking to mitigate risk and speculators attempting to profit from price movements.

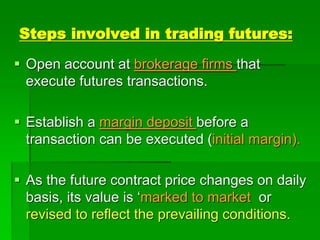

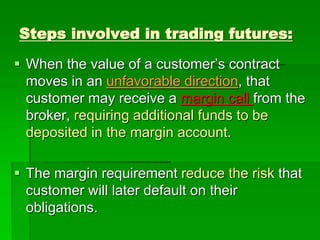

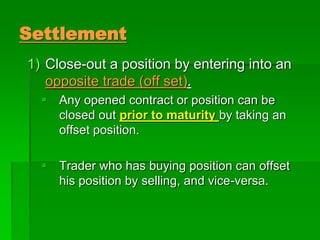

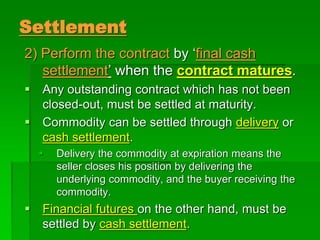

- Futures contracts standardized terms for buying or selling the underlying asset at a set price and date. They are traded on exchanges and involve daily cash settlement to account for price changes.

![Selling/ Short Hedge: Falling price

Month/Market Cash Market Futures Market

September

(Today)

•Managing RM100 m portfolio

and to hedge RM80m

(RM100m x 80%).

•Current index = 1200

•[Expect index to fall sell]

• Opening position:

• Sell 1657 September

FKLI Futures @1110

December r ber

(Later)

• Sell RM100m of portfolio at lower

price.

(Falling index as expected to 1160)

• Offsetting position:

• Buy 1657 September

FKLI Futures @1050](https://image.slidesharecdn.com/derivativemarkets-230611143304-92c30771/85/Derivative-Markets-ppt-lecture-ppt-29-320.jpg)

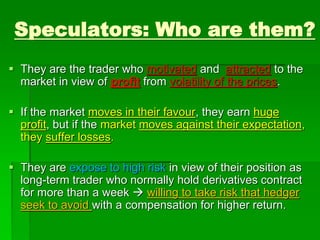

![Speculators: Who are them?

Speculators are traders who are not exposed to

price risks but accept risks motivated by profits.

They do not wish to own any physical palm oil,

thus buying and selling only contracts and not the

physical commodity.

They buy futures when they expect price to move

upward [buy low today and sell high later].

They sell futures when they expect price to move

downward [sell higher today and buy at lower later].](https://image.slidesharecdn.com/derivativemarkets-230611143304-92c30771/85/Derivative-Markets-ppt-lecture-ppt-33-320.jpg)