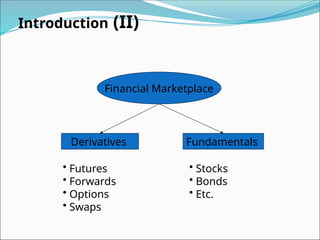

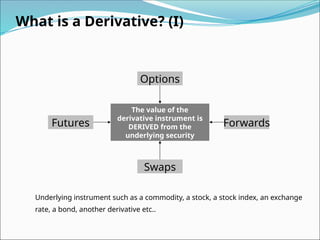

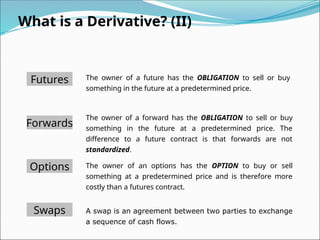

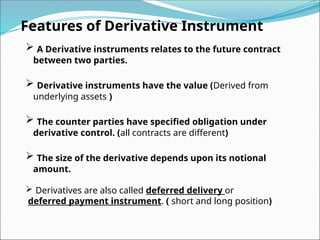

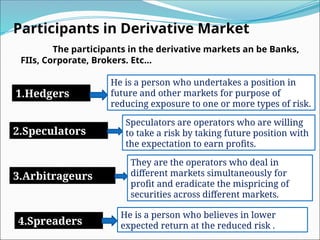

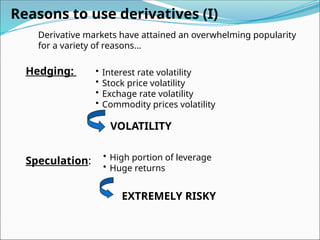

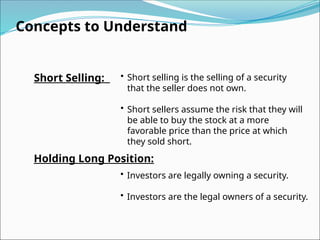

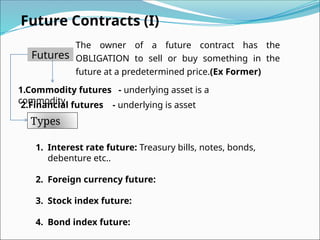

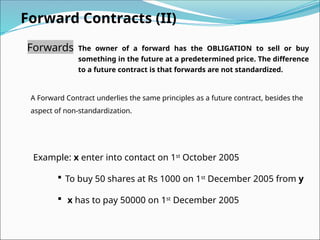

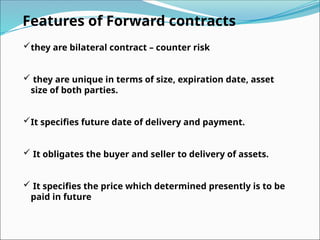

The document covers derivative instruments, explaining futures and forwards, their features, and market participation. Derivatives derive value from underlying assets and are used for hedging and speculation in the financial markets. The document also details contract specifications, payoff structures, and key concepts like short selling and maintaining long positions.