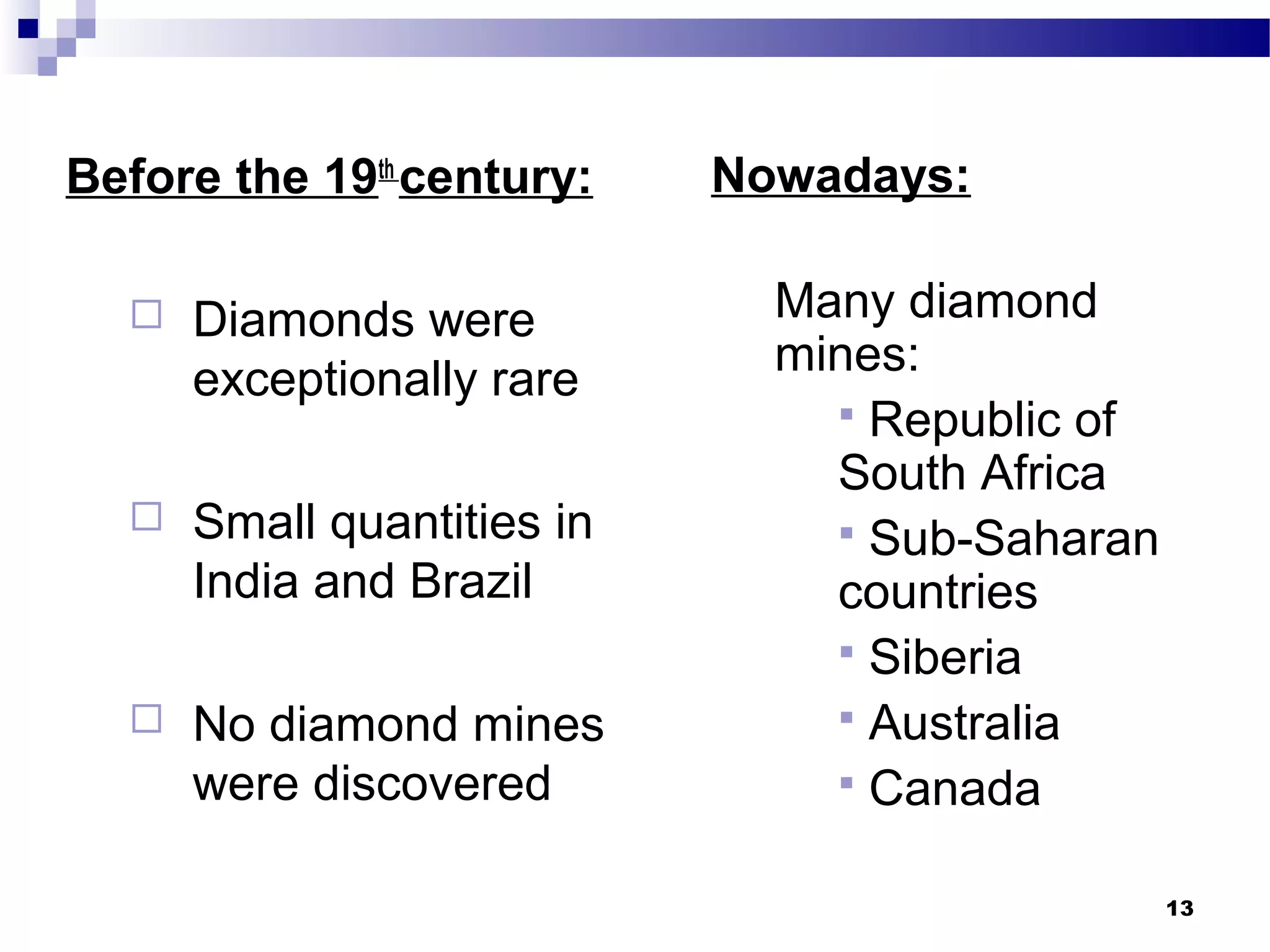

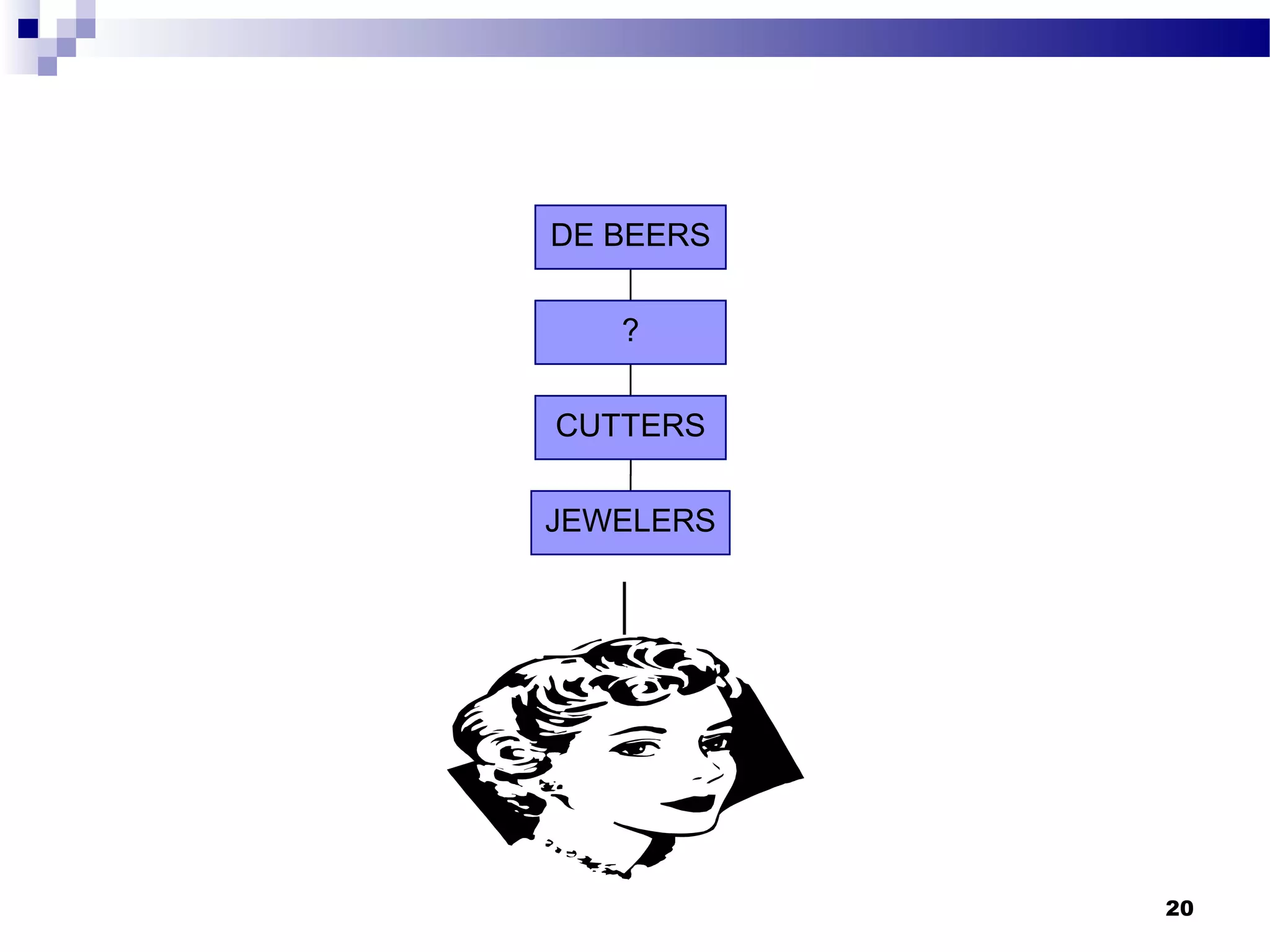

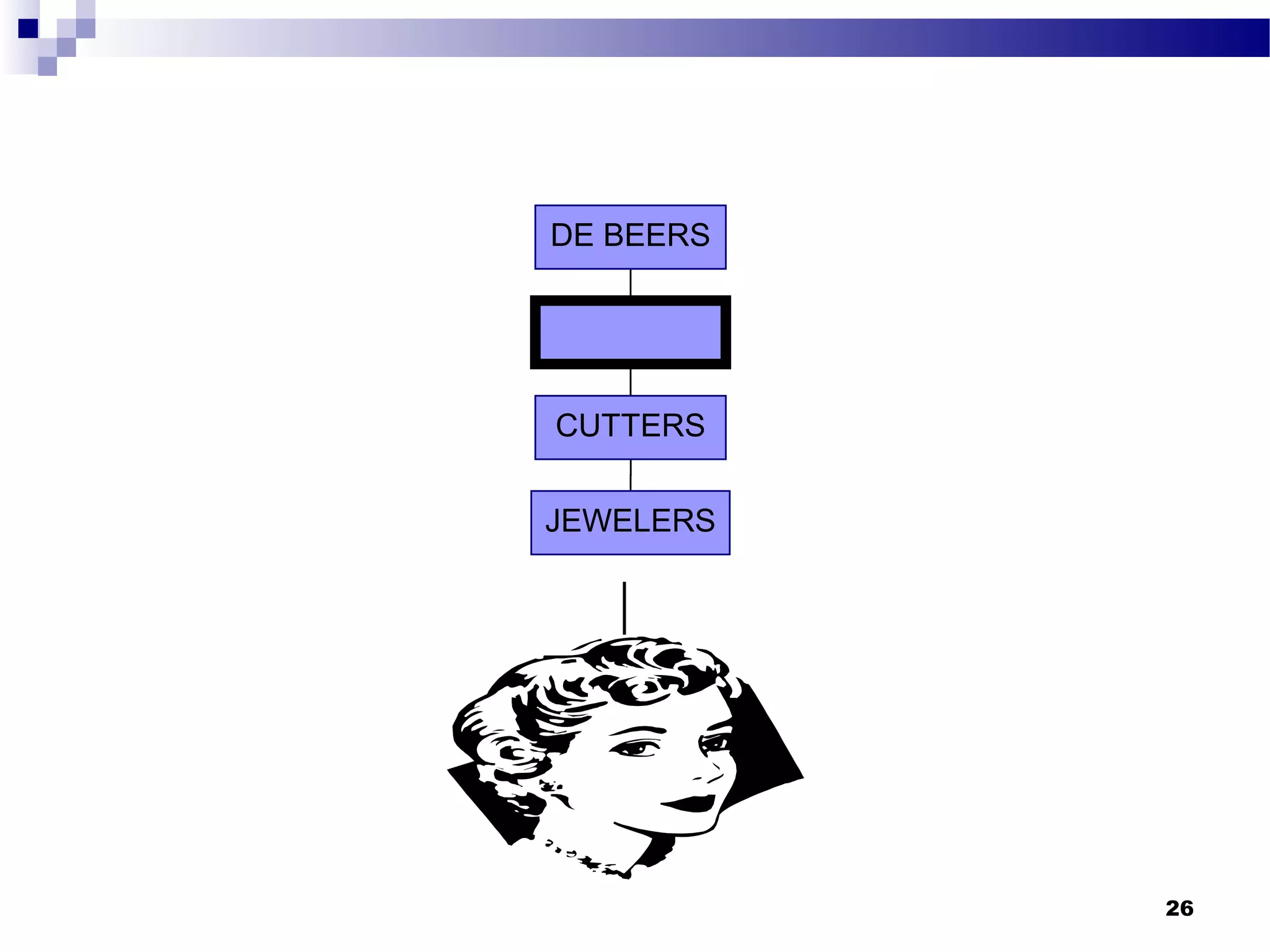

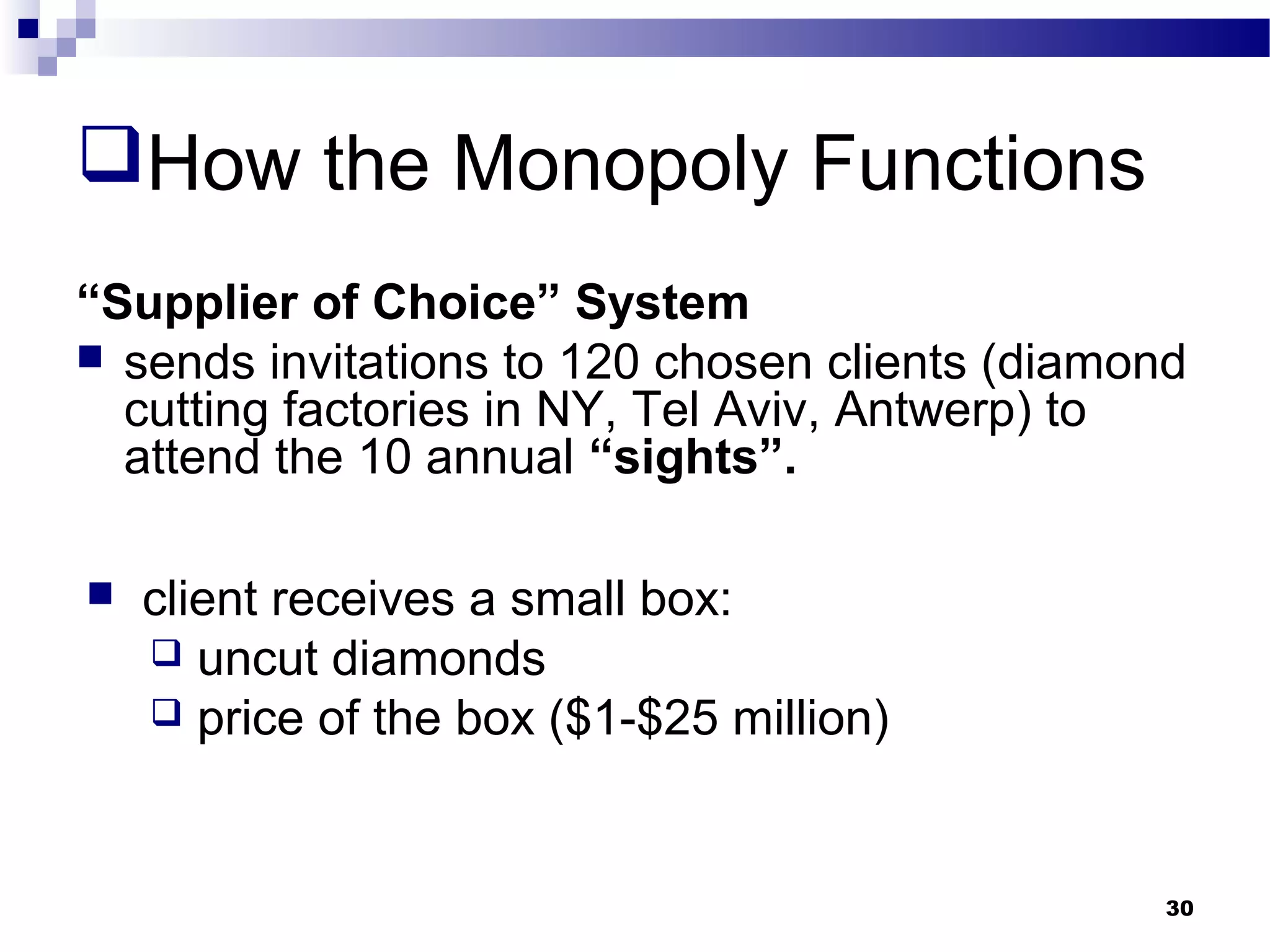

De Beers has established a monopoly in the diamond industry by controlling 70-90% of the world's rough diamond production and supply. It achieves this monopoly power by only selling diamonds to a select group of cutters and jewelers and imposing strict rules on how they can purchase and resell diamonds. This vertical integration and control of the supply chain allows De Beers to artificially restrict diamond production and supply to influence prices. However, this monopoly has also enabled "blood diamonds" to enter the market, undermining its legitimacy.