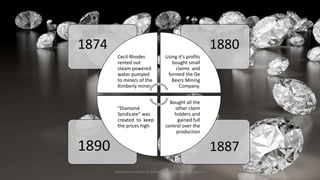

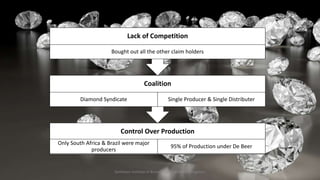

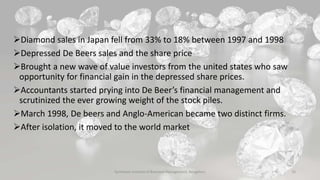

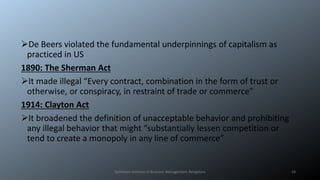

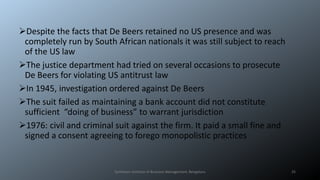

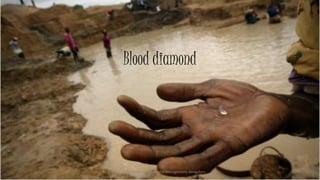

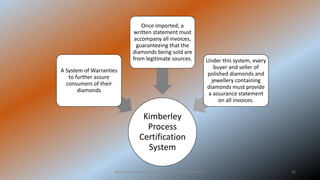

The document outlines the history and evolution of De Beers, detailing its monopoly over diamond production and pricing strategies from the late 19th century to the late 20th century. It explores the factors leading to the emergence of this monopoly, its subsequent decline due to market changes and external pressures, as well as legal issues concerning antitrust laws in the U.S. Furthermore, it discusses blood diamonds and the measures taken through the Kimberley Process to regulate the diamond trade and ensure ethically sourced diamonds.