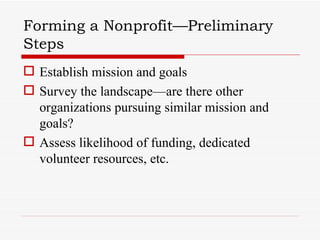

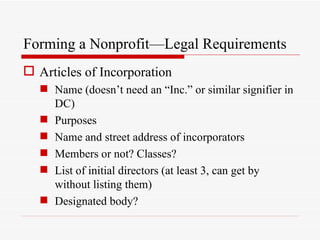

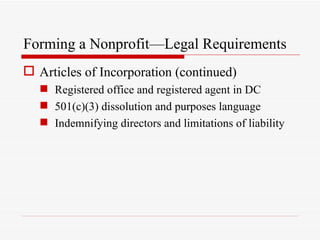

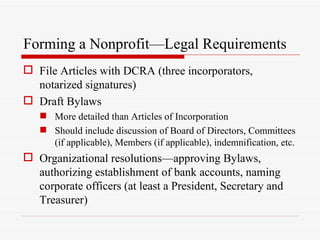

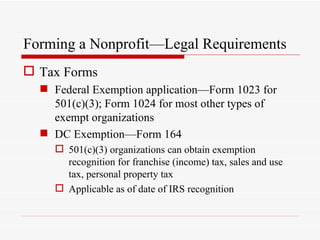

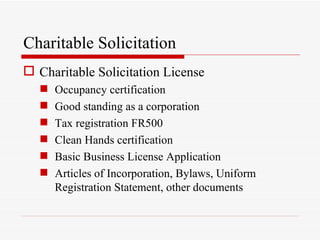

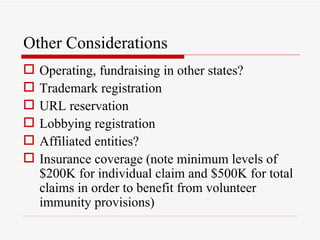

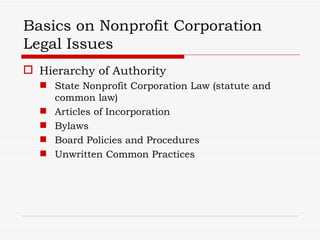

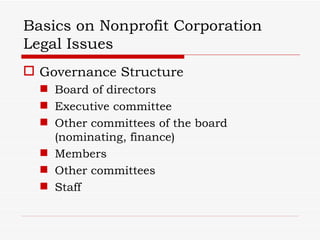

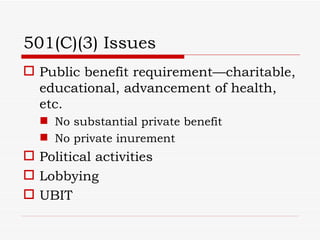

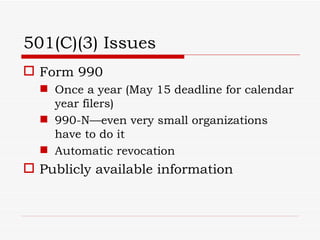

The document outlines the process of starting and operating a nonprofit organization in Washington, D.C., including preliminary steps, legal requirements, and governance issues. It details the formation process, necessary legal documents like articles of incorporation and bylaws, and specifics of tax exemption applications. Additionally, it addresses ongoing legal and operational considerations for nonprofit entities.