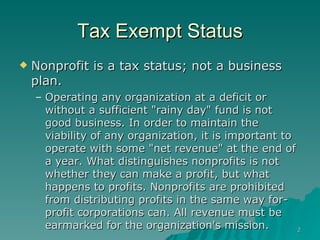

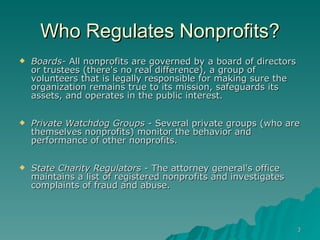

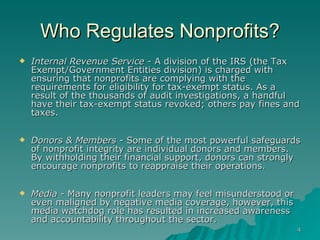

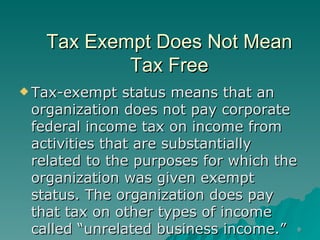

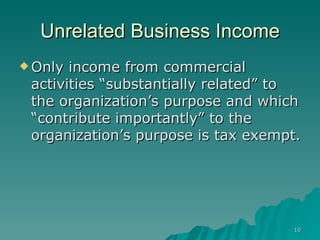

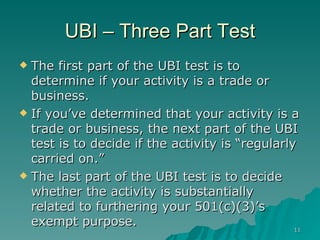

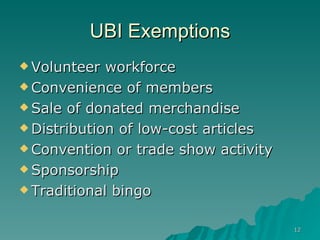

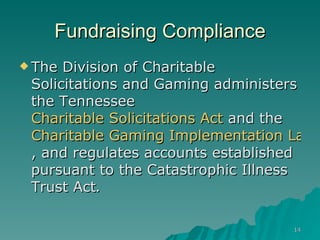

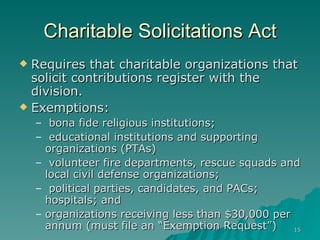

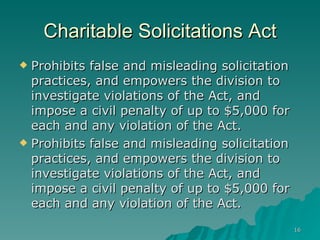

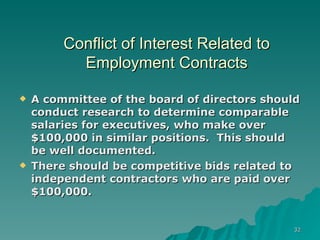

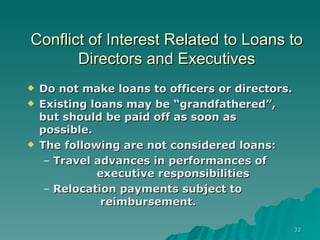

This document discusses several key issues related to corporate governance for nonprofit organizations. It covers topics like tax exempt status, regulations from various oversight bodies, restrictions on activities for 501(c)(3) nonprofits, fiduciary duties of board members, conflicts of interest, and fundraising compliance. Proper governance is important for nonprofits to maintain their tax exempt status and fulfill their missions in accordance with applicable laws and regulations.

![Contact Information Mary Neil Price – Miller & Martin PLLC [email_address] (615) 744-8480](https://image.slidesharecdn.com/habitatcorpgovernance-12519229466433-phpapp03/85/Habitat-Corp-Governance-34-320.jpg)