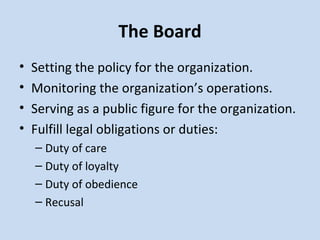

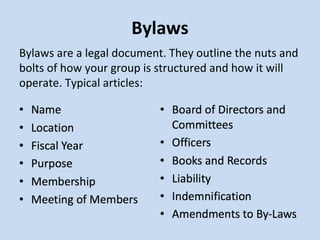

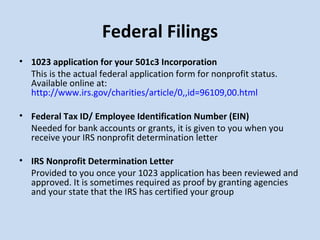

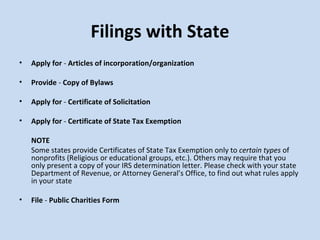

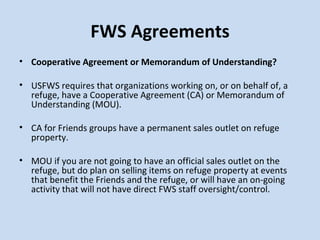

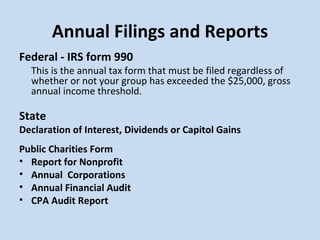

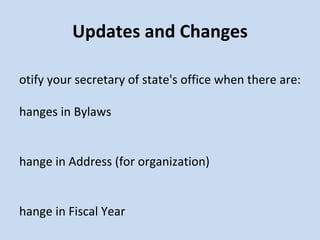

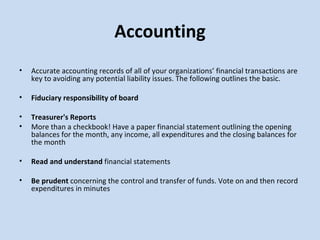

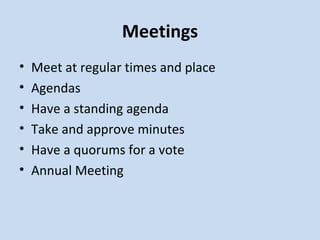

The document outlines the structure and essential management practices of friends organizations that support national wildlife refuges. It highlights the importance of partnerships, governance responsibilities, and legal obligations for nonprofit compliance. Additionally, it provides guidance on necessary filings, annual reports, and financial accountability to ensure operational integrity.