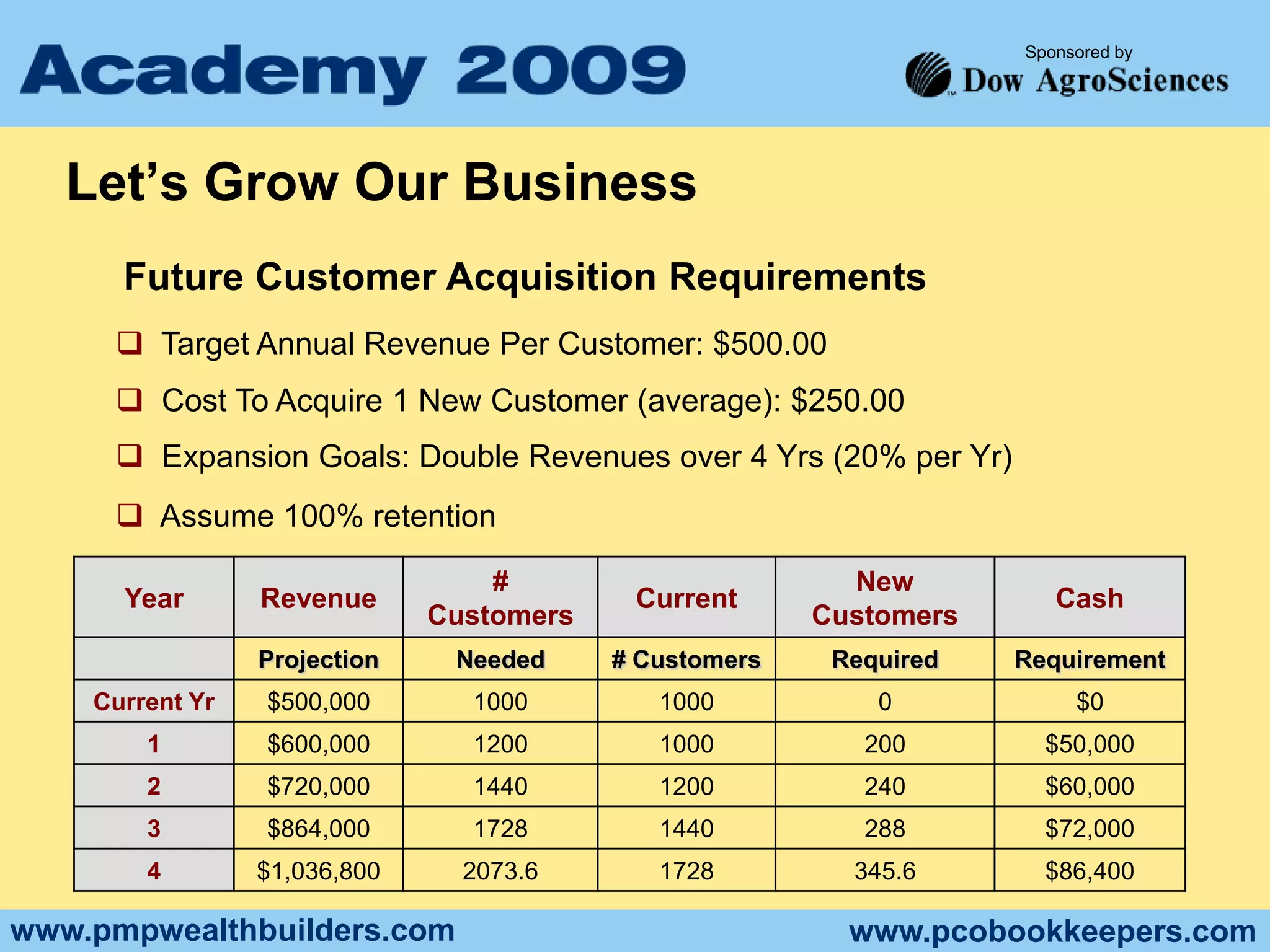

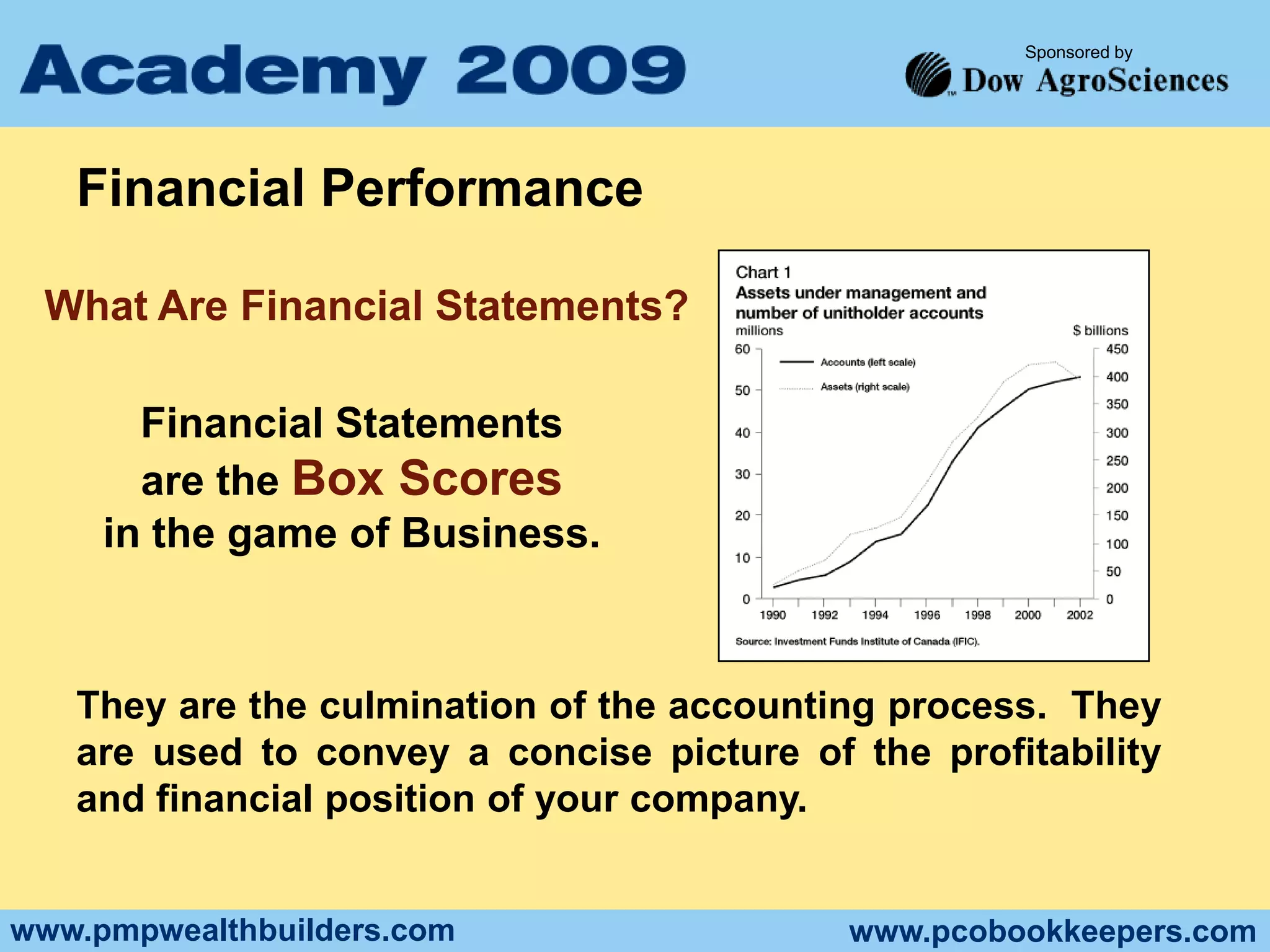

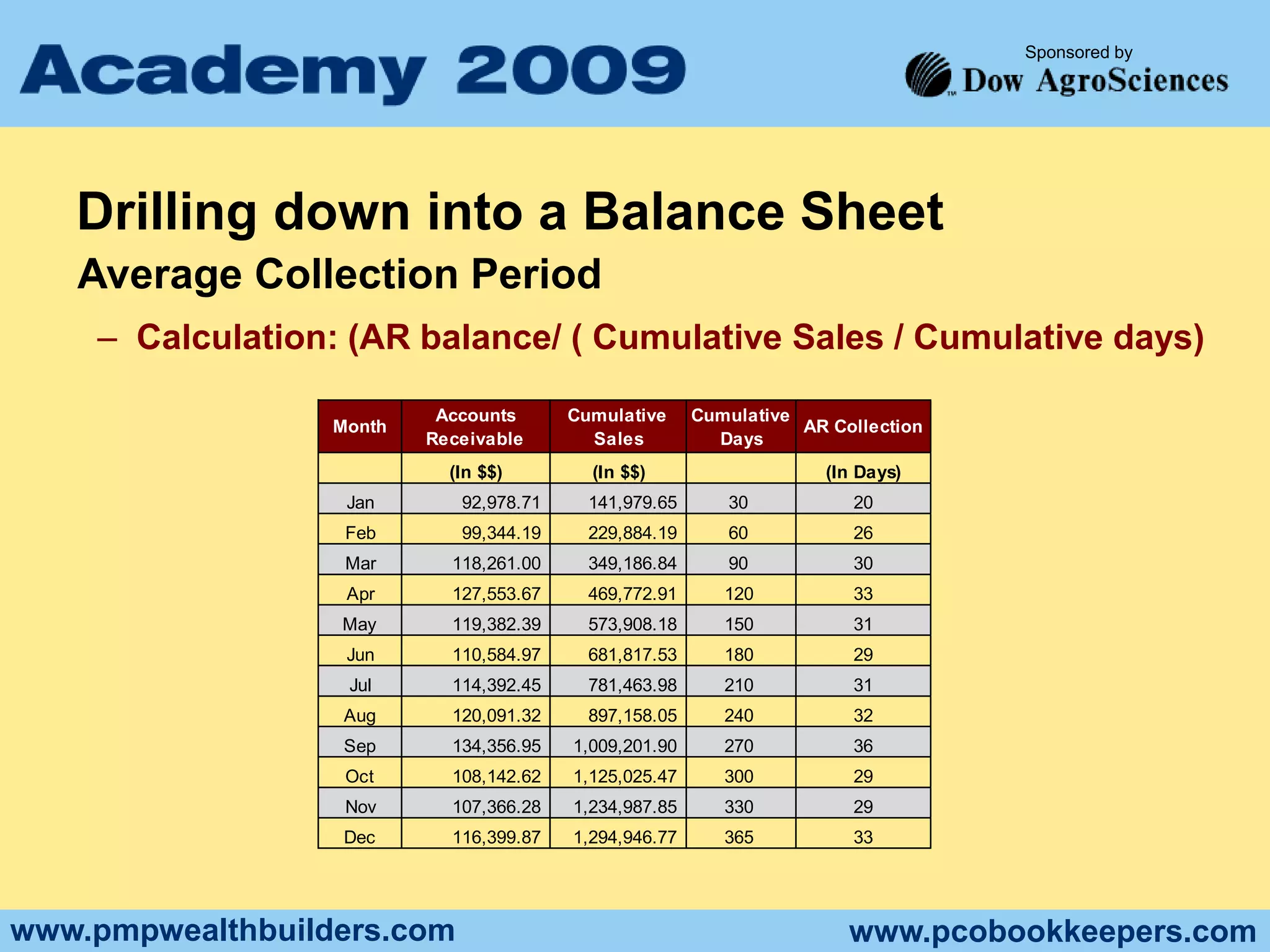

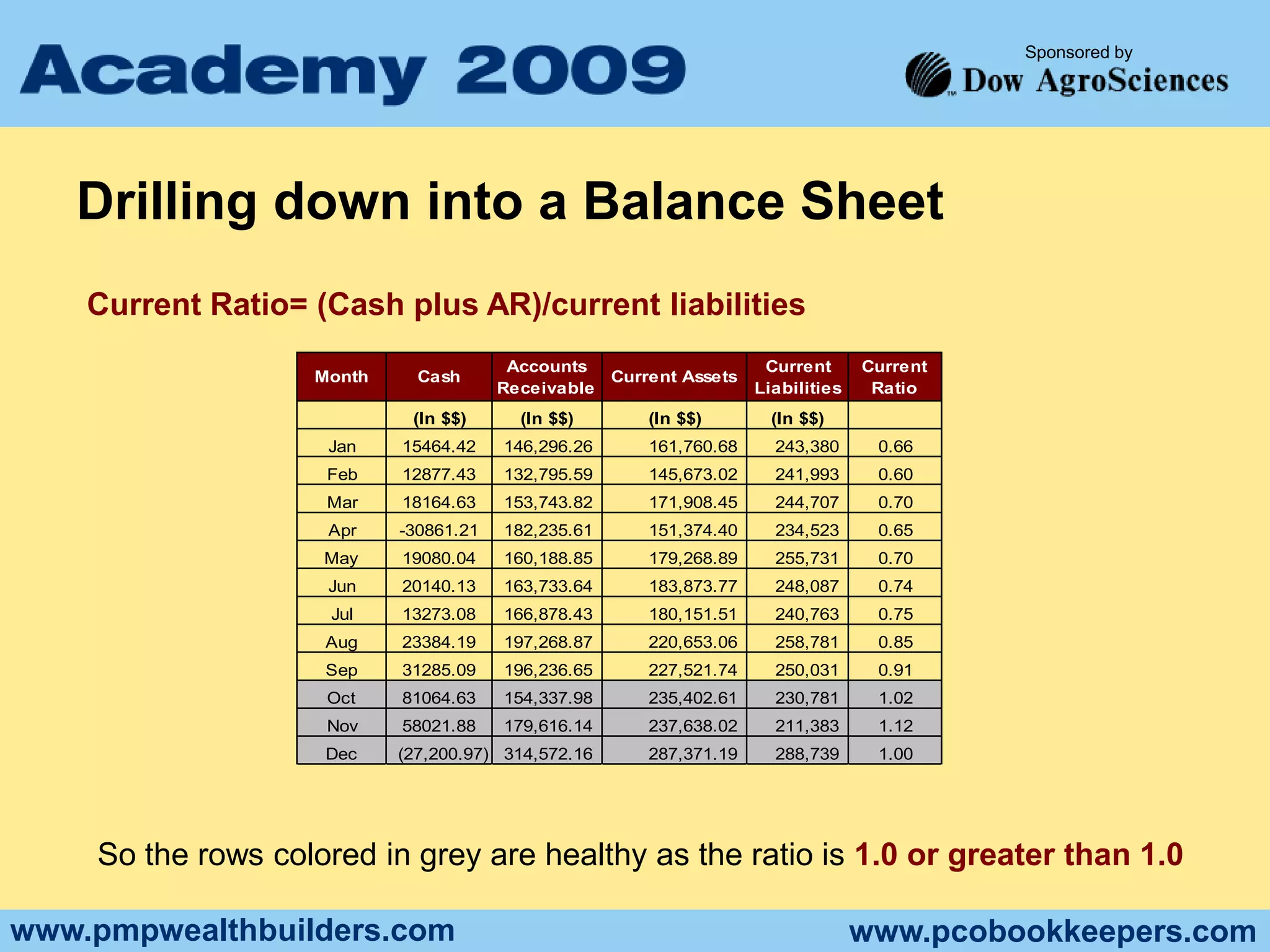

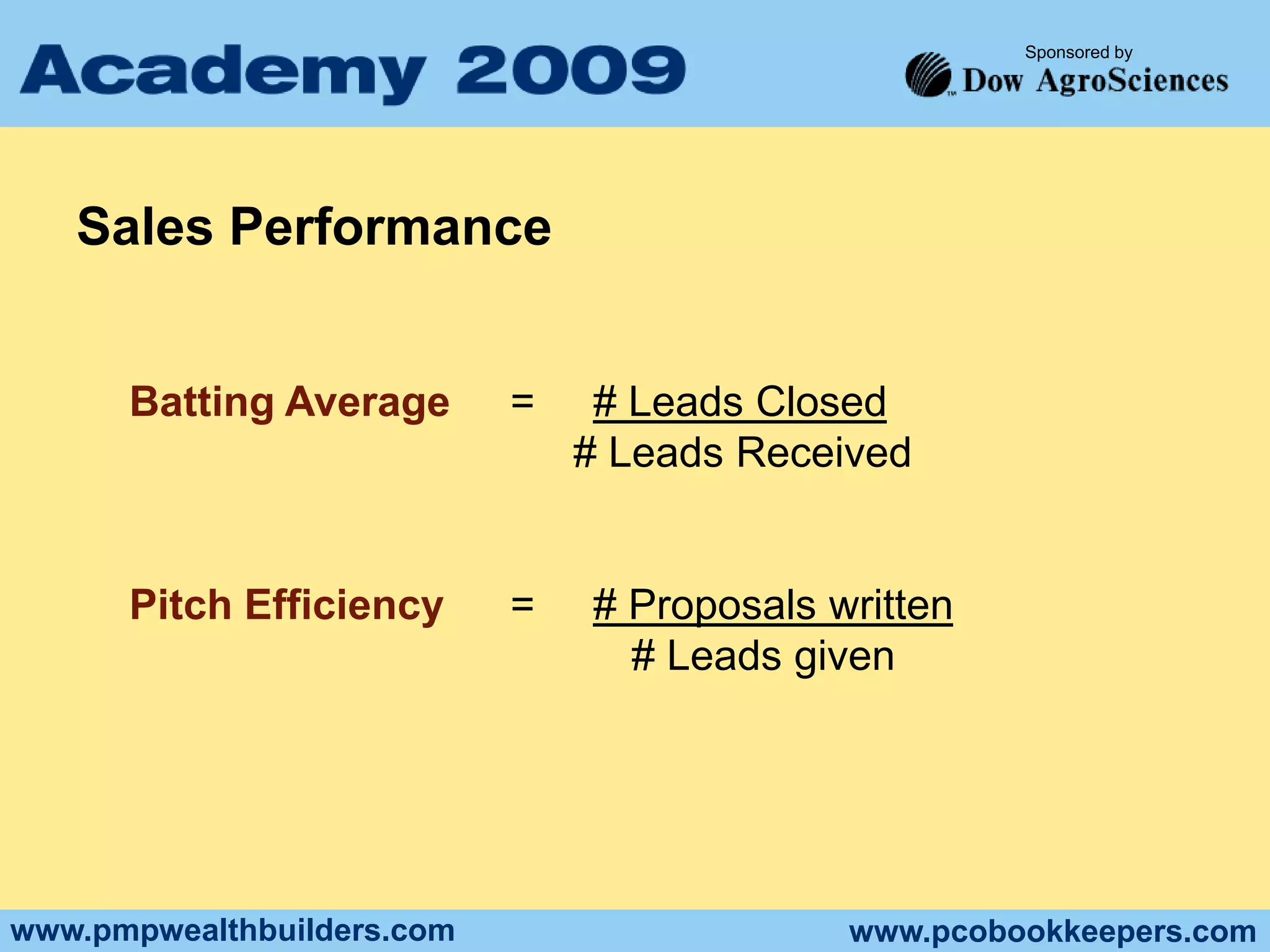

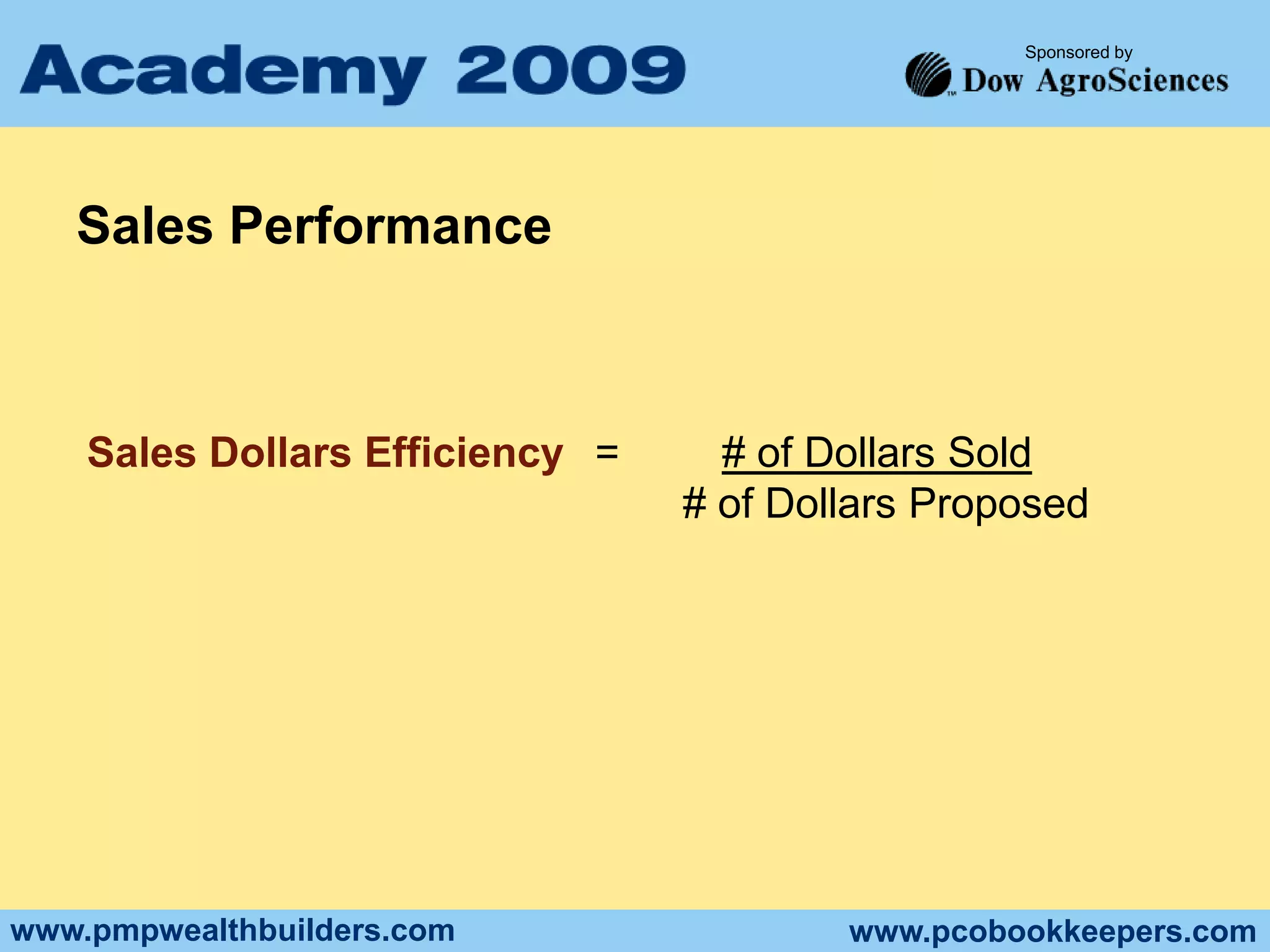

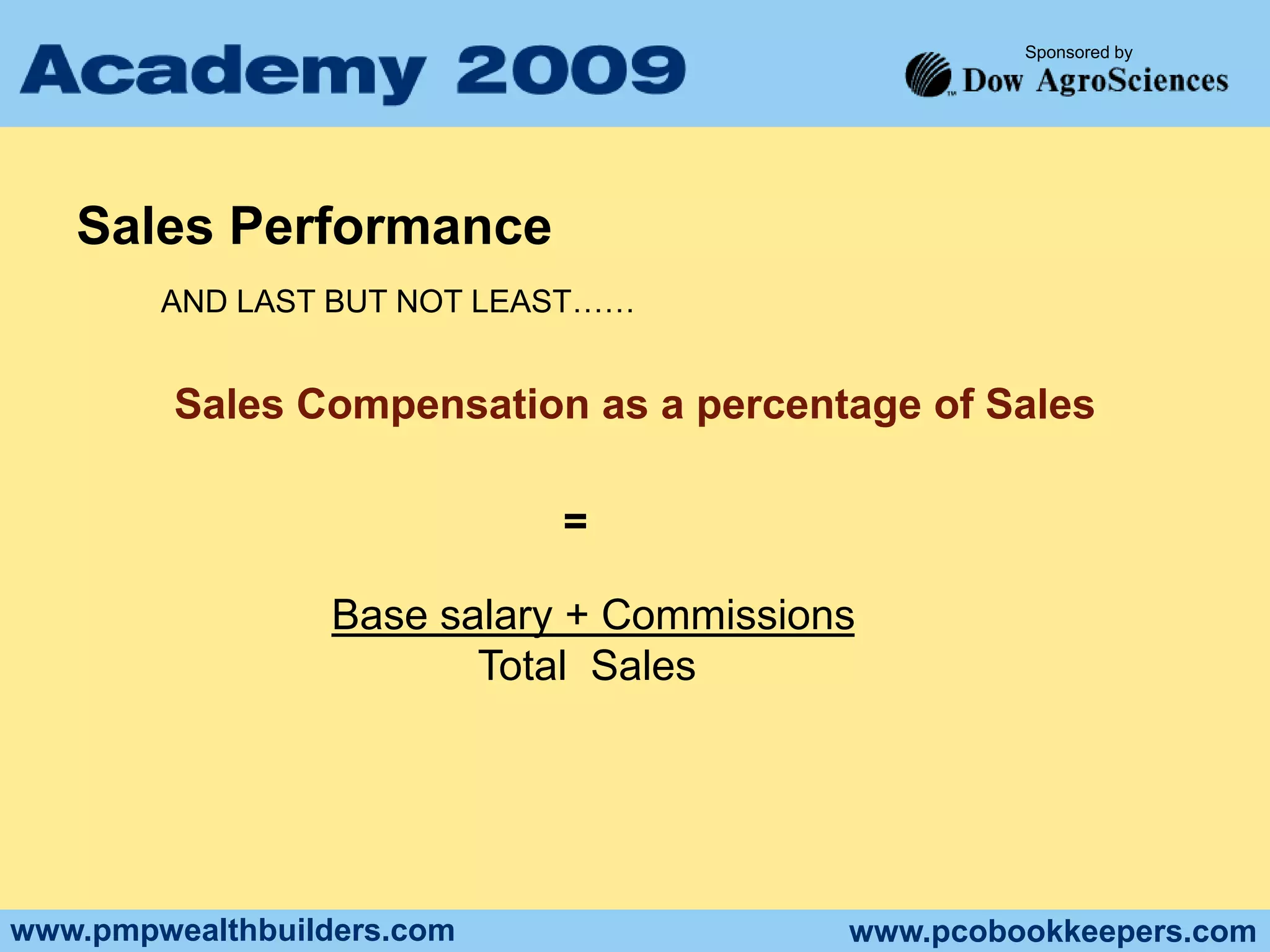

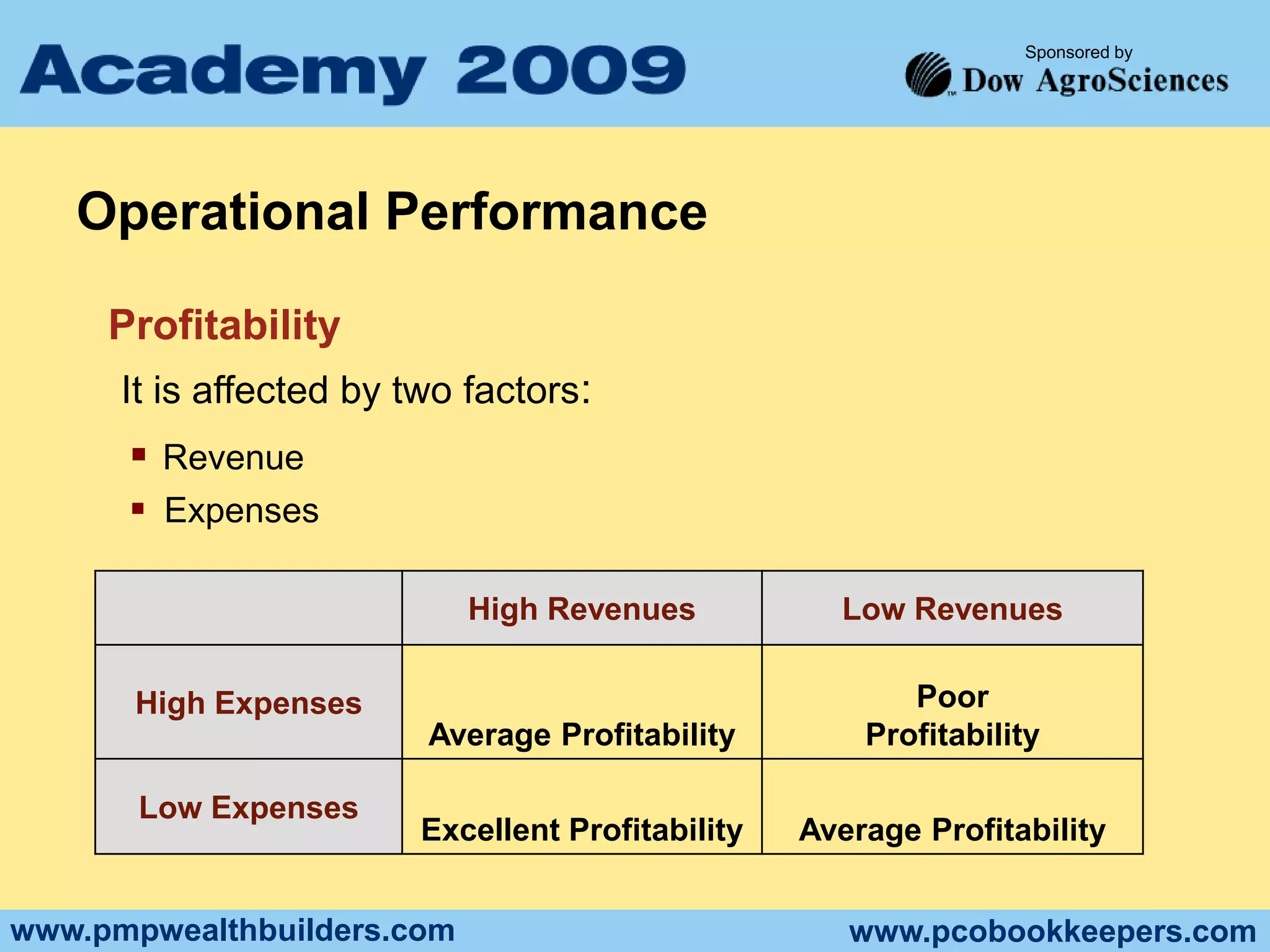

This document discusses measuring performance in pest control businesses. It covers measuring financial performance through profit and loss statements and key ratios. It also discusses measuring marketing, sales, and operational performance through metrics like leads generated, proposals written, jobs completed efficiently. Overall it emphasizes the importance of measurement and data to effectively manage a pest control business for growth.