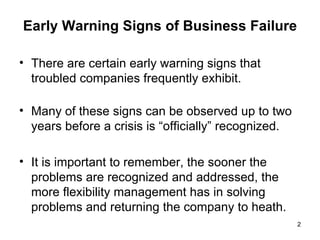

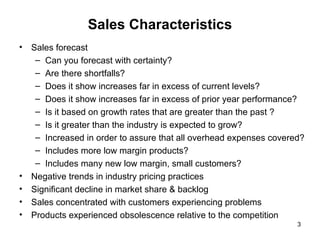

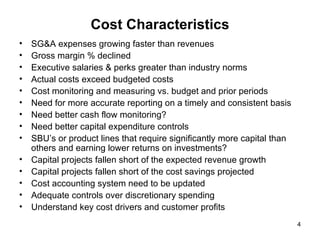

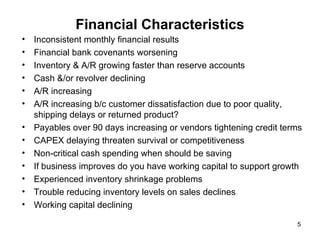

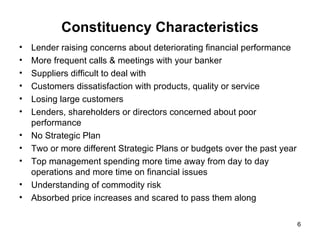

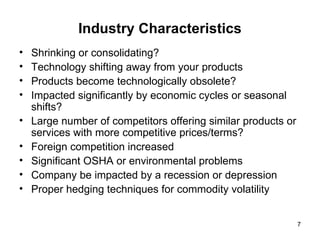

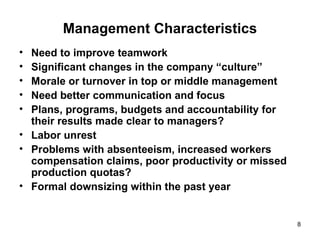

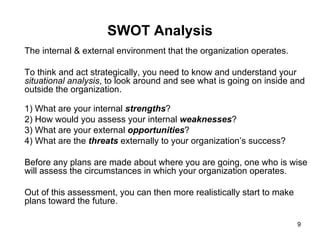

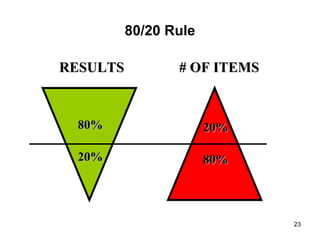

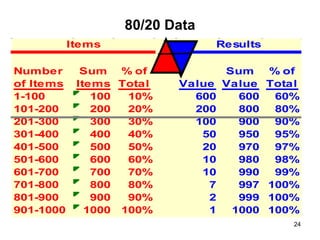

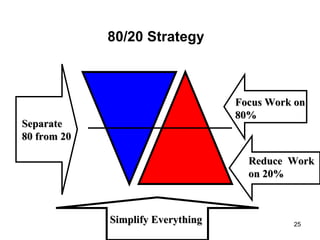

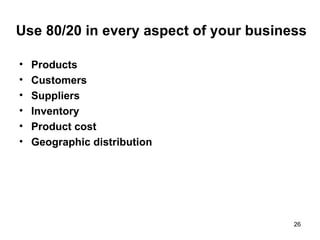

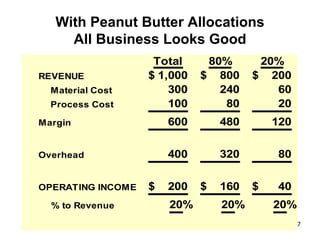

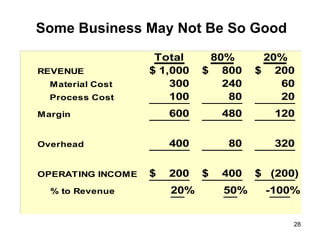

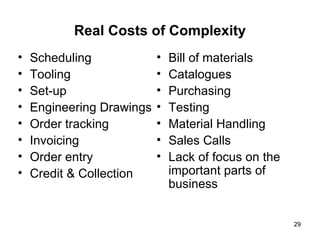

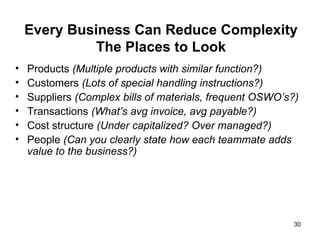

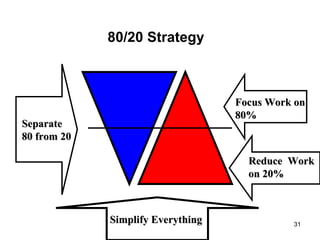

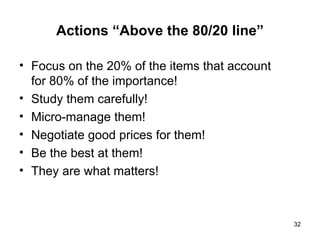

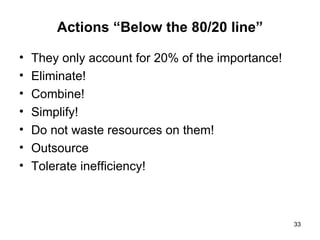

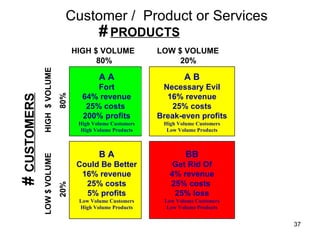

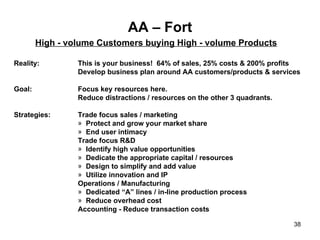

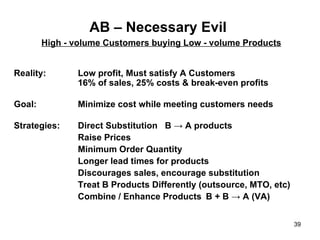

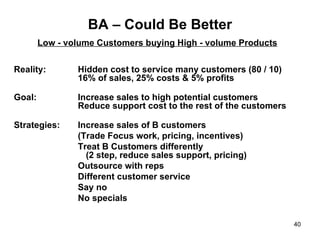

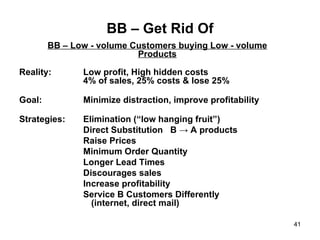

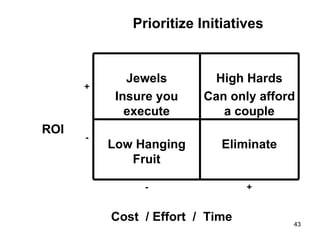

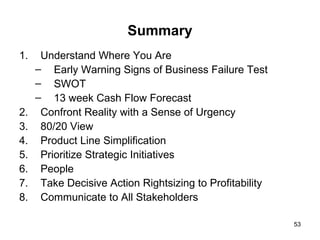

The document provides early warning signs of potential business failure across several areas including sales, costs, finances, constituencies, industry, and management. It recommends conducting a SWOT analysis and monitoring cash flow closely. Key actions include focusing on the 20% of products/customers that generate 80% of profits, simplifying product lines, and eliminating low-value work.

![Surviving 2009 to Thrive in 2010 T.D. Decker Decker Holdings (630) 776-7681 [email_address]](https://image.slidesharecdn.com/surviving2009tothrivein2010-12641622311245-phpapp02/85/Surviving-2009-To-Thrive-In-2010-1-320.jpg)