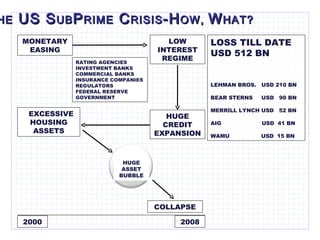

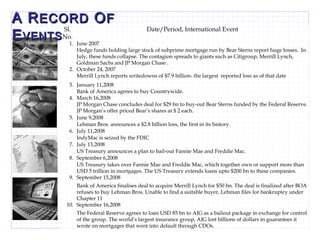

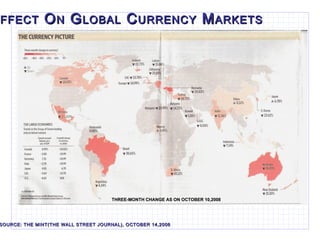

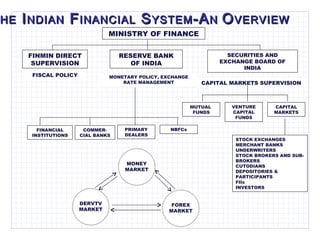

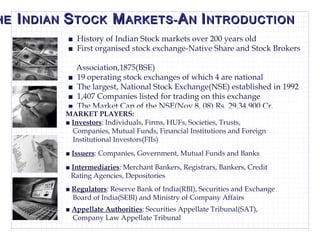

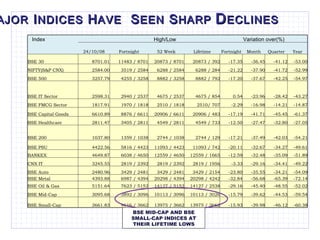

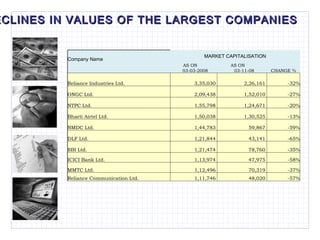

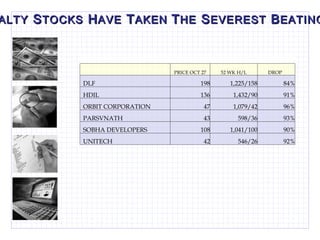

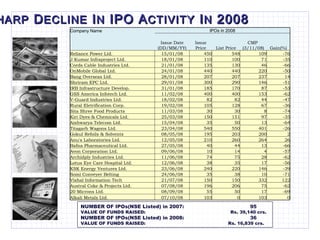

Indranil Deb presented at the Symbiosis Institute of Management Studies on November 11, 2008. The presentation covered several topics related to the global financial crisis including the growth of global financial assets from $12 trillion in 1980 to $118 trillion in 2003, the shift away from banks towards market institutions, and the impact of the US subprime crisis which began surfacing in 2007. Effects of the crisis included losses totaling over $512 billion, the bankruptcy of Lehman Brothers, and declines in global stock markets and currencies from late 2007 through 2008.