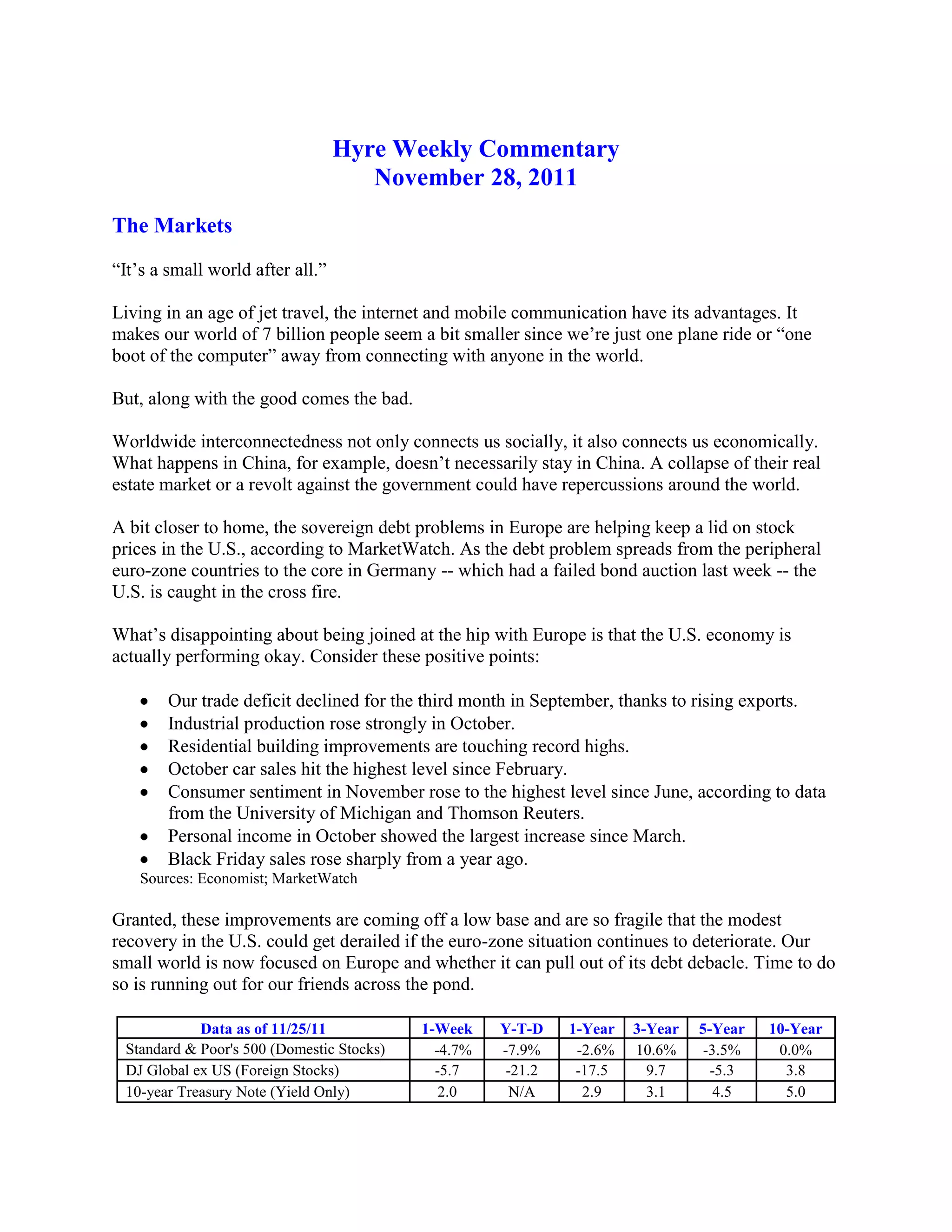

The document discusses the interconnectedness of global economies and markets. It notes that problems in countries like China can have worldwide repercussions. It also discusses the ongoing sovereign debt problems in Europe weighing on US stock prices. While the US economy is performing reasonably well, its recovery remains fragile due to uncertainty around Europe's debt situation. The document advocates for international diversification given the declining dominance of the US in global stock market capitalization.