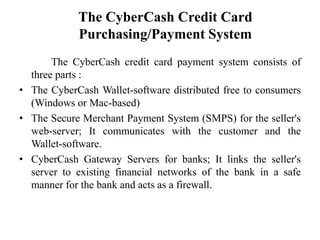

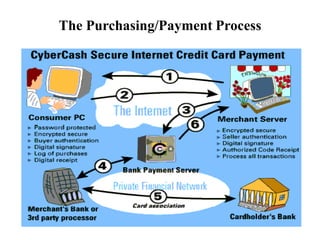

CyberCash was a digital payment system that allowed for secure online credit card transactions without merchants having to see customer credit card numbers. It used encryption and digital signatures to facilitate payments through a "digital wallet." Customers could authorize payments from their wallet, which would then be sent encrypted to the merchant's bank for processing. CyberCash aimed to make online payments safe, efficient and inexpensive by integrating with existing banking systems. It launched in 1994 and grew to process thousands of transactions daily.