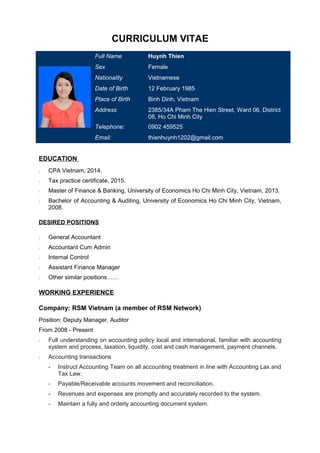

This curriculum vitae is for Huynh Thien, a Vietnamese female born in 1985 who has worked as a Deputy Manager and Auditor at RSM Vietnam since 2008. She has several accounting and finance qualifications including a CPA, tax practice certificate, and Master's in Finance and Banking. Her experience includes accounting, tax reporting, administrative tasks, internal controls, and human resources. She has excellent knowledge of Vietnamese accounting and tax law and strong computer, communication, and relationship skills.