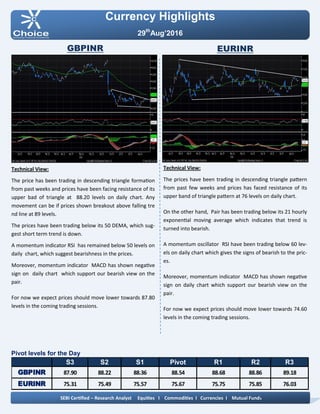

The Indian rupee depreciated marginally against the US dollar on Friday due to weak domestic market sentiments and cautious investor stance ahead of a speech by US Federal Reserve chair Janet Yellen, while inflows into Indian equities and debt markets limited losses; the US dollar index gained on risk aversion and weak US economic data, including a slight decline in second quarter GDP growth; technical analyses of various currency pairs provided forecasts for further price movements in the coming days.