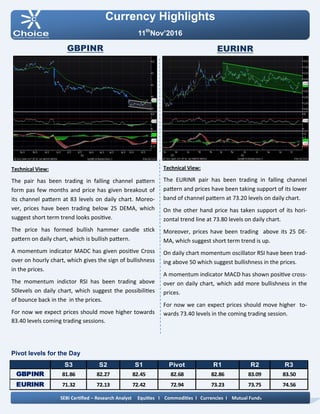

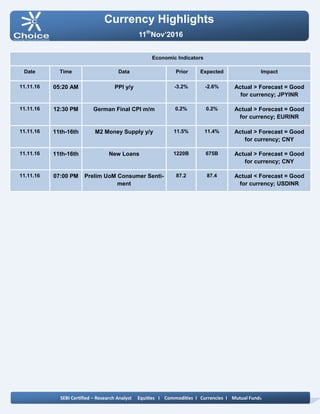

The Indian rupee depreciated against the US dollar due to strong dollar demand from banks and importers, ending at 66.62. However, the rupee's losses were limited by upbeat domestic market sentiment. The US dollar index rose on positive US economic data and Trump's election victory, while the euro fell against the dollar due to weak Eurozone data. Japan's yen also declined over 1% against the dollar on improved risk appetite.