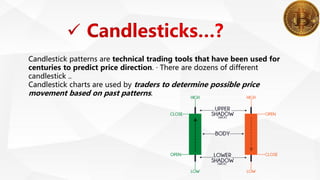

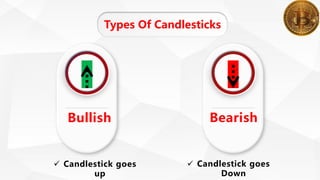

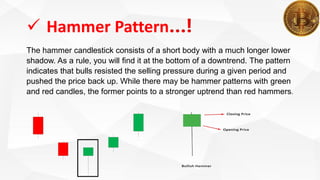

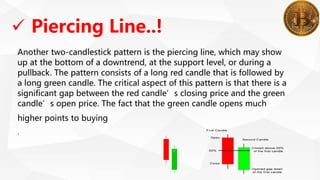

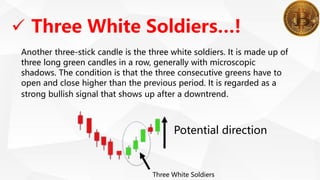

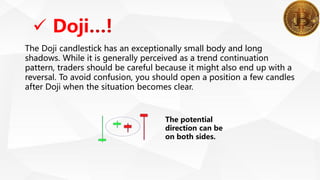

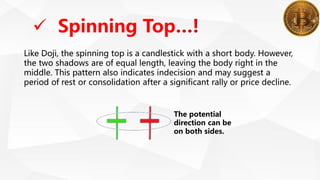

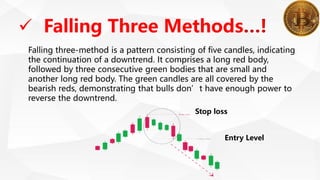

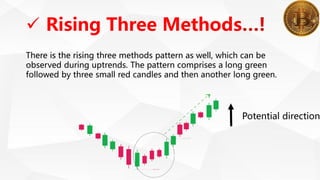

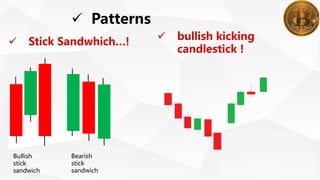

This document provides an overview of cryptocurrencies and candlestick patterns for technical analysis. It defines cryptocurrencies as digital currencies using encryption for payments and accounting. Popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin are listed. Advantages of cryptocurrencies include decentralization and low transaction costs. Candlestick patterns display market sentiment and can predict price movements. Both bullish and bearish candlestick patterns like hammer, engulfing, and doji are explained along with their potential signals for price direction changes.