1. FOREX TRADING ( LEARNING FOR DIFFERENT TYPES OF CANDLES PATTERN)

2. EXAMPLES OF STOCK WATCHLIST

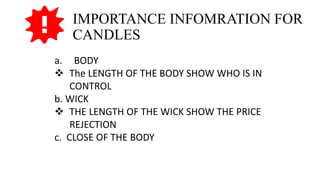

3. NOTE FOR CANDLES

A. BODY (THE LENGTH OF THE BODY SHOWS WHO IS IN CONTROL)

B. WICK( THE LENGTH OF THE WICKED SHOWS THE PRICE REJECTION)

C. CLOSE OF THE BODY

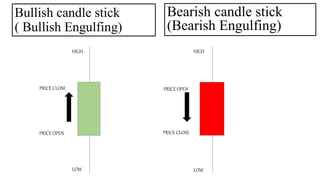

4. BULLISH CANDLES STICK ( BULLISH ENGULFING) AND BEARISH CANDLESTICK ( BEARISH ENGULFING)

5. PIERCING PATTERN

• NOT STRONG AS BULLISH ENGULFING

• SECONDARY TO BULLISH ENGULFING

• BULLISH REVERSAL PATTERN

• BUYERS ARE IN CONTROL

• THE LARGER, THE MORE SIGNIFICANT

6. DARK CLOUD COVER

• NOT STRONG AS BEARISH ENGULFING

• SECONDARY TO BEARISH ENGULFING

• BEARISH REVERSAL PATTERN

• SELLERS ARE IN CONTROL

• THE LARGER, THE MORE SIGNIFICANT

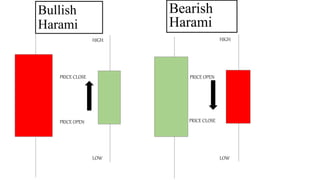

7. BULLISH HARAMI AND BEARISH HARAMI

BULLISH HARAMI

• REVERSAL PATTERN APPEAR AT THE BOTTOM OF THE DOWNTREND

• A BEARISH CANDLES WITH A LARGE BODY, FOLLOW BY A SMALL BODY ENCLOSED WITH THE BODY OF THE PRIOR CANDLE

• THE SMALL BULLISH CANDLES OPEN NEAR THE MID RANGE OF THE PREVIOUS CANDLE.

• THE BODY OF THE SMALL GREEN CANDLE NO MORE THAT 25% OF THE PREVIOUS BEARISH CANDLE

BEARISH HARAMI

• REVERSAL PATTERN APPEAR AT THE UPWARD

• REVERSAL IN BULL PRICE MOVEMENT

• THE SMALLER THE SECOND RED CANDLES, THE HIGHER THE CHANCE FOR REVERSAL

• OPPOSITE OF THE BULLISH HARAMI

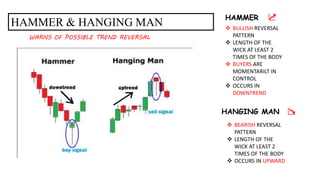

8. HAMMER & HANGING MAN

HAMMER

• BULLISH REVERSAL PATTERN

• LENGTH OF THE WICK AT LEAST 2 TIMES OF THE BODY

• BUYERS ARE MOMENTARILY IN CONTROL

• OCCURS IN DOWNTREND

HANGING MAN

• BEARISH REVERSAL PATTERN

• LENGTH OF THE WICK AT LEAST 2 TIMES OF THE BODY

• OCCURS IN UPWARD

9. SHOOTING STAR & INVERTED HAMMER

SHOOTING STAR

• BEARISH REVERSAL PATTERN

• LENGTH OF THE WICK AT LEAST 2 TIMES OF THE BODY

• SELLERS ARE MOMENTARILY IN CONTROL

• OCCURS IN UPTREND

INVERTED HAMMER

• BULLISH REVERSAL PATTERN

• LENGTH OF THE WICK AT LEAST 2 TIMES OF THE BODY

• OCCURS IN DOWNTREND

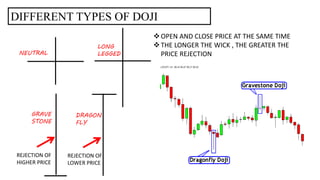

10. DIFFERENT TYPES OF DOJI

• OPEN AND CLOSE PRICE AT THE SAME TIME

• THE LONGER THE WICK, THE GREATER THE PRICE REJECTION

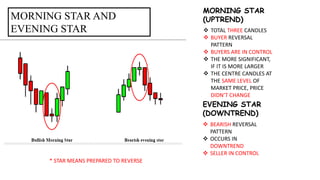

11. MORNING STAR AND EVENING STAR

MORNING STAR

• TOTAL of THREE CANDLES

• BUYER REVERSAL PATTERN

• BUYERS ARE IN CONTROL

• THE MORE SIGNIFICANT, IF IT IS MORE LARGER

• THE CENTRE CANDLES AT THE SAME LEVEL OF MARKET PRICE, PRICE DIDN’T CHANGE

EVENING STAR

• BEARISH REVERSAL PATTERN

• OCCURS IN DOWNTREND

• SELLER IN CONTROL

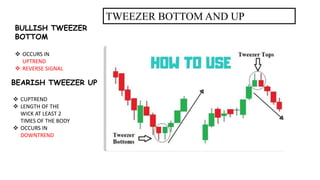

12. TWEEZER BOTTOM AND UP

BULLISH TWEEZER BOTTOM

• OCCURS IN UPTREND

• REVERSE SIGNAL

• BEARISH TWEEZER UP

• UPTREND

• LENGTH OF THE WICK AT LEAST 2 TIMES OF THE BODY

• OCCURS IN DOWNTREND

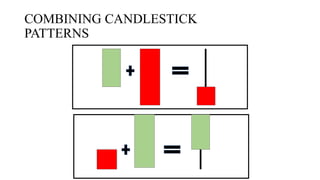

13. COMBINING CANDLESTICK PATTERNS

14. CONCLUSION