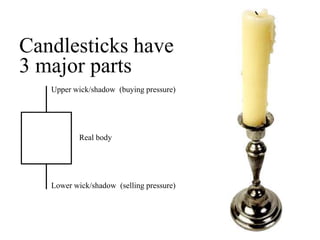

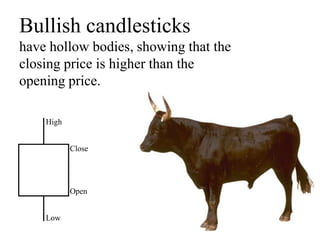

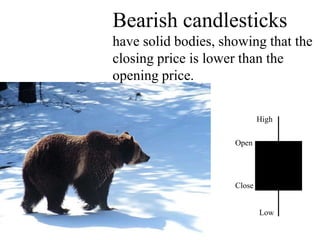

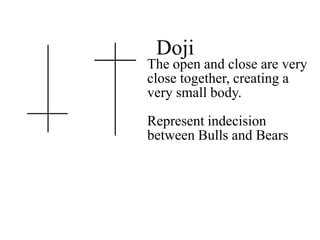

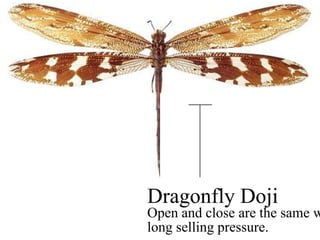

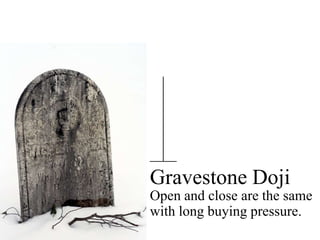

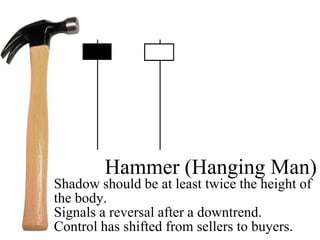

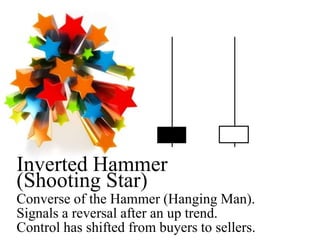

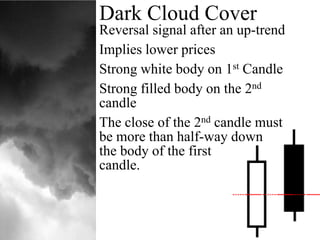

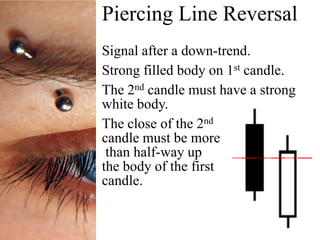

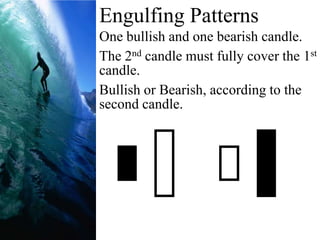

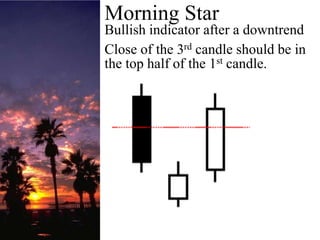

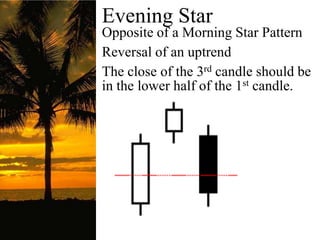

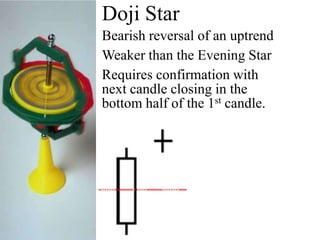

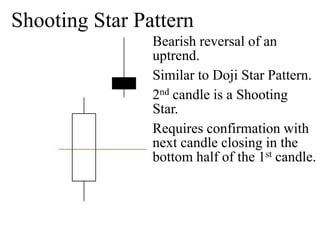

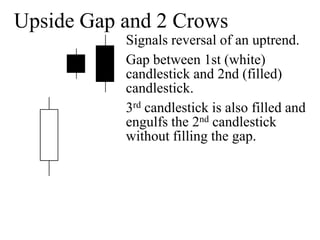

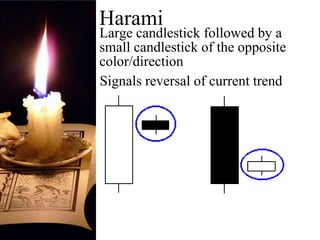

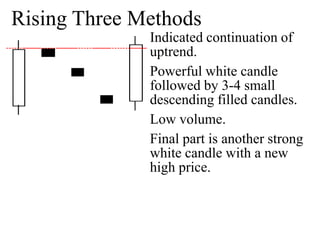

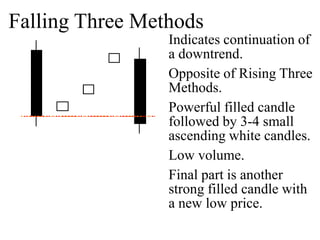

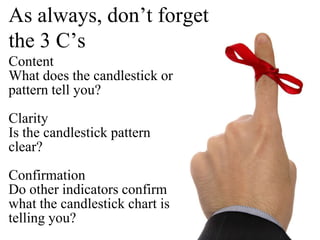

Candlestick charts display opening, closing, high, and low prices and can help traders identify trends and reversal patterns. John used candlestick charts to successfully trade stocks while others lost money using different charts. Candlestick patterns like Doji, Hammer, and Engulfing patterns can signal if a trend will continue or reverse. Traders should consider the clarity of the pattern and whether other indicators confirm the candlestick signal before making trades based on these patterns.