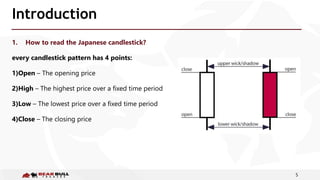

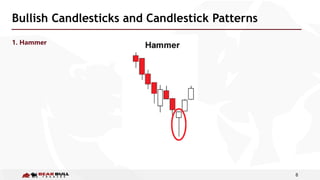

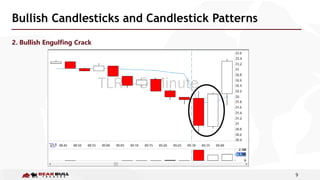

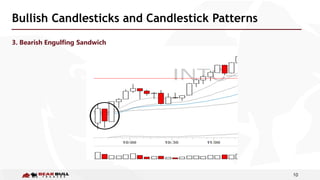

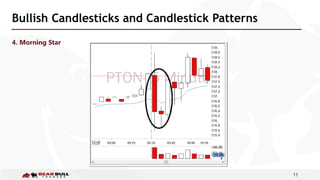

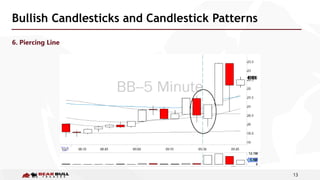

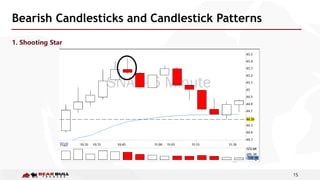

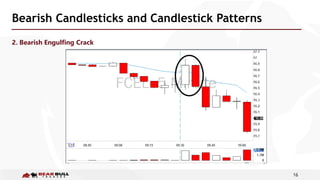

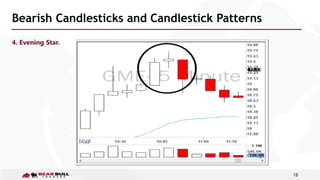

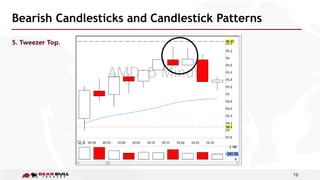

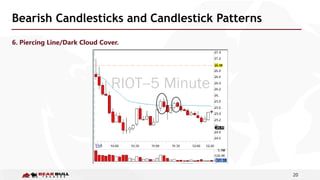

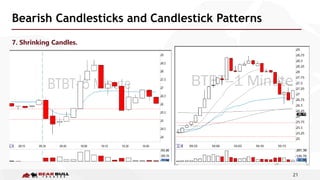

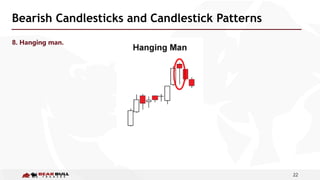

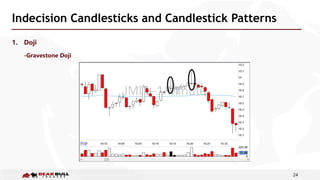

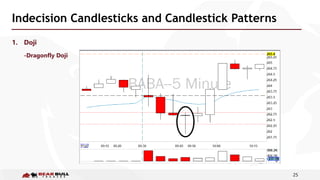

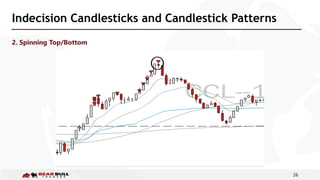

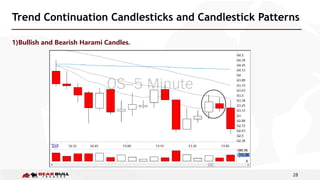

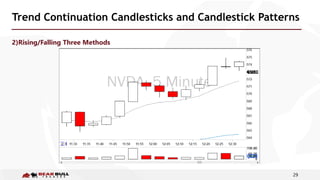

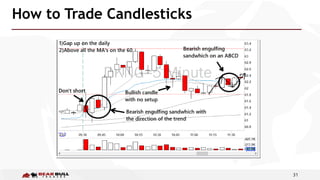

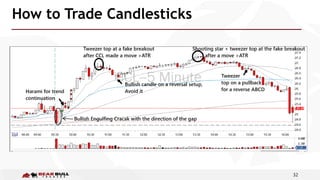

This document provides an overview of candlestick patterns for analyzing financial markets. It begins with introductions to candlestick charts and what candlesticks can tell traders about buyer and seller activity. The document then covers specific bullish, bearish, and indecision candlestick patterns. It discusses trend continuation patterns and provides tips for trading based on candlestick signals. The goal is to help traders understand how to interpret candlestick formations and use them to identify reversal and continuation opportunities in the market.