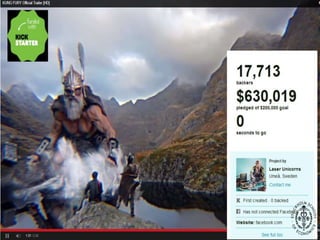

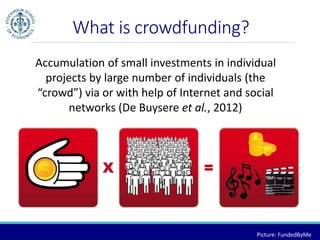

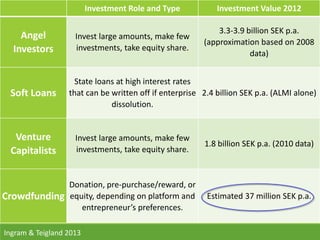

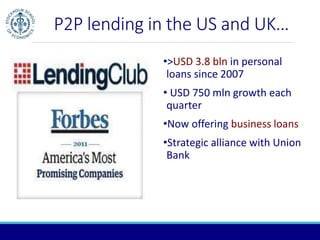

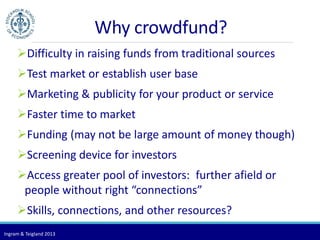

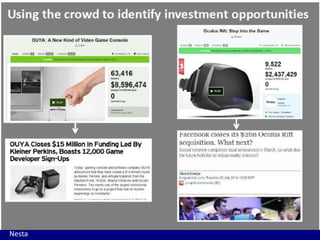

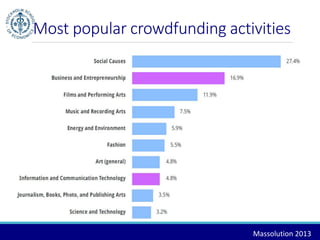

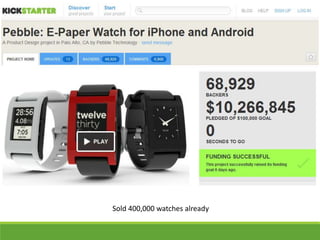

Crowdfunding has grown significantly in recent years and is challenging traditional banks and other financial institutions in their role of financing new businesses and projects. In Sweden alone, several fintech companies focusing on areas like payments, lending, and cryptocurrency have been successfully crowdfunded. The document discusses the different types of crowdfunding and provides statistics on the growth and size of the global crowdfunding industry. It also examines some of the opportunities and challenges of crowdfunding, including its potential role in democratizing access to capital.