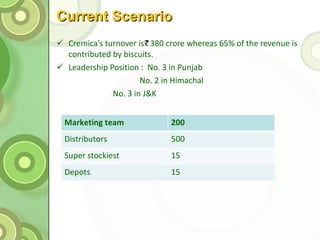

- Cremica is an Indian biscuit company established in 1978 that currently has a turnover of 380 crore rupees, with biscuits making up 65% of revenue.

- It is currently the third largest biscuit company in Punjab and second largest in Himachal Pradesh.

- The document discusses Cremica's history, products, competitors, SWOT analysis, marketing mix, research findings, recommendations, and future prospects.