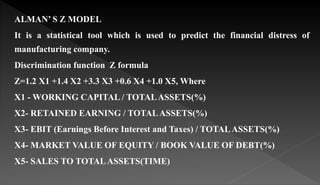

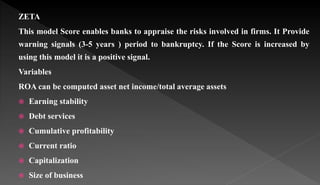

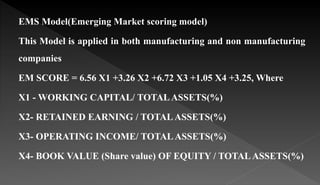

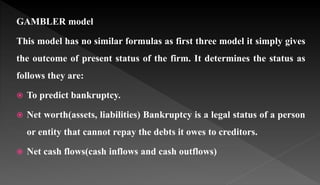

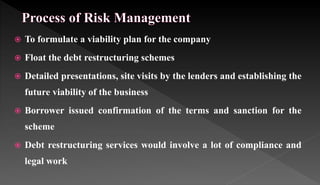

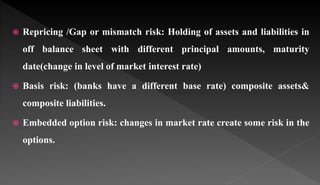

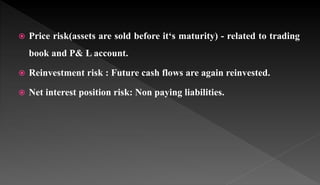

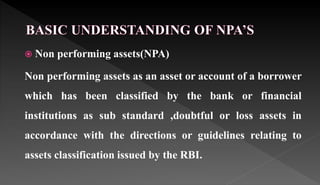

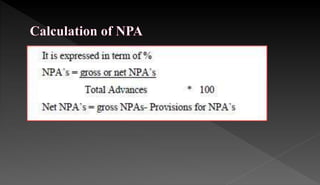

This document provides an overview of credit monitoring and risk management in banks. It discusses the need for credit monitoring to ensure funds are used as intended and loan terms are followed. It describes methods to monitor borrowers' financial status. It also explains models to predict financial distress and the rehabilitation process. The document outlines different types of risks faced by banks including interest rate, liquidity, foreign exchange, credit, market, operational, and solvency risks. It discusses the risk measurement and mitigation process as well as non-performing assets and asset-liability management.