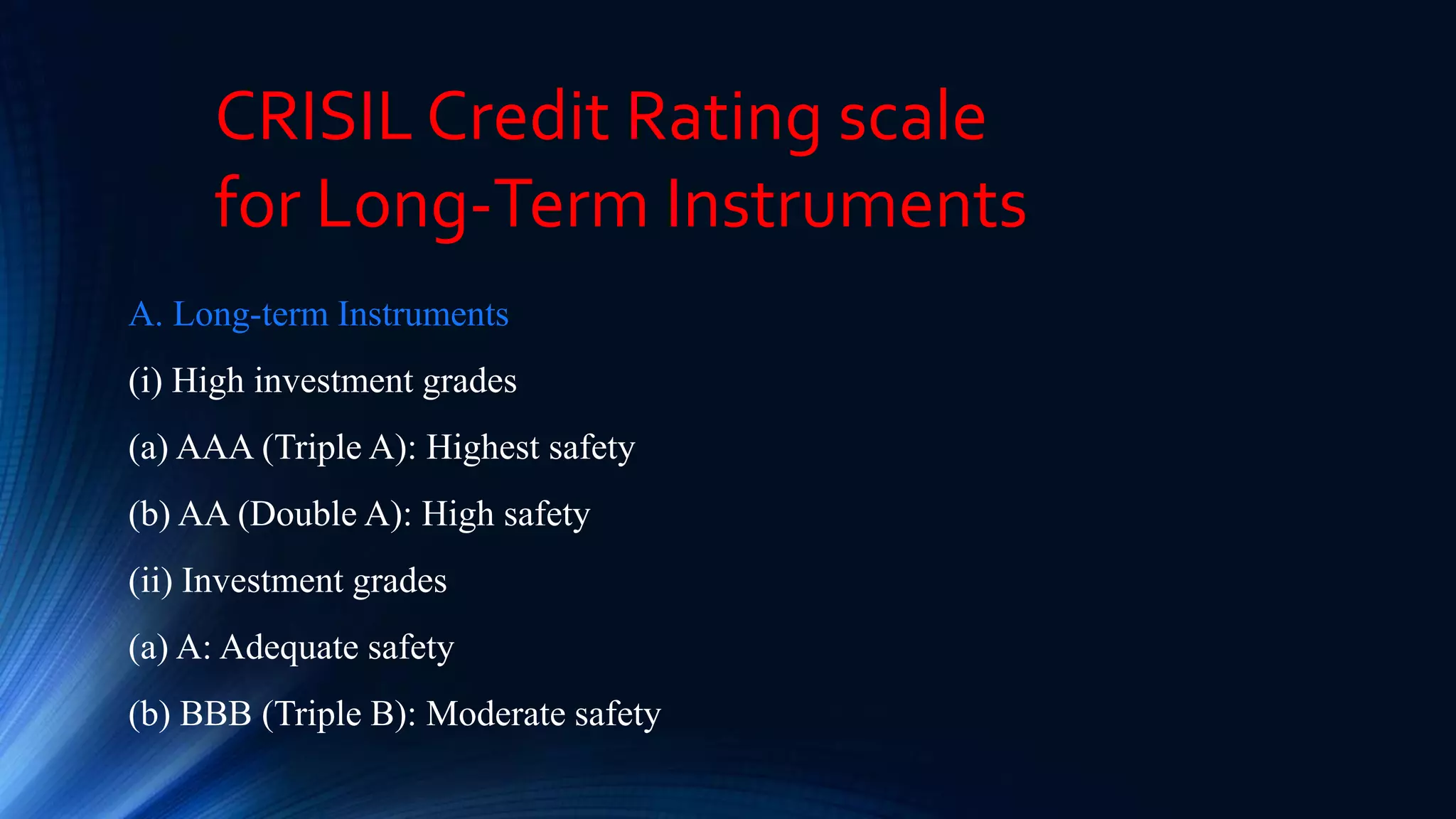

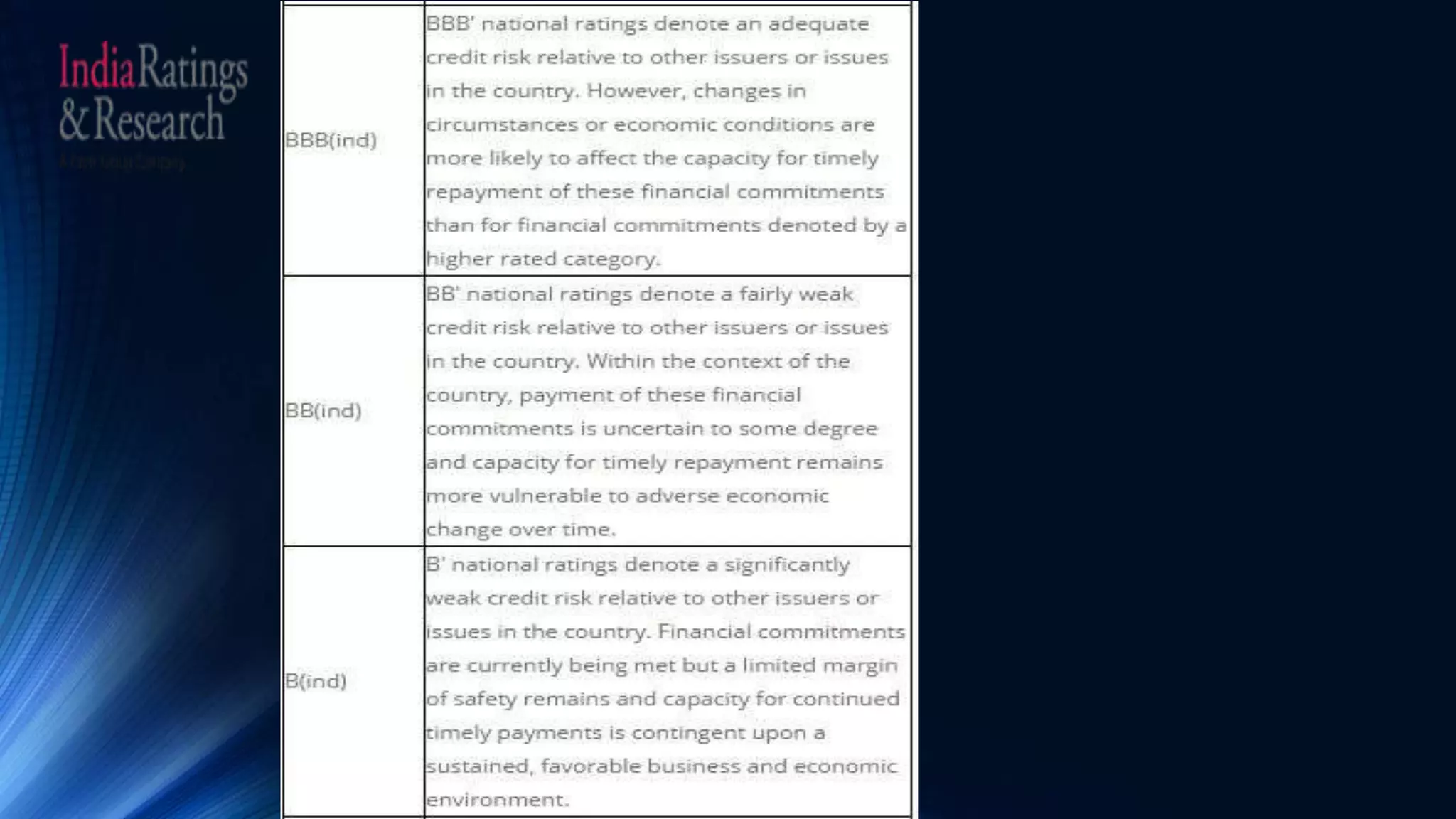

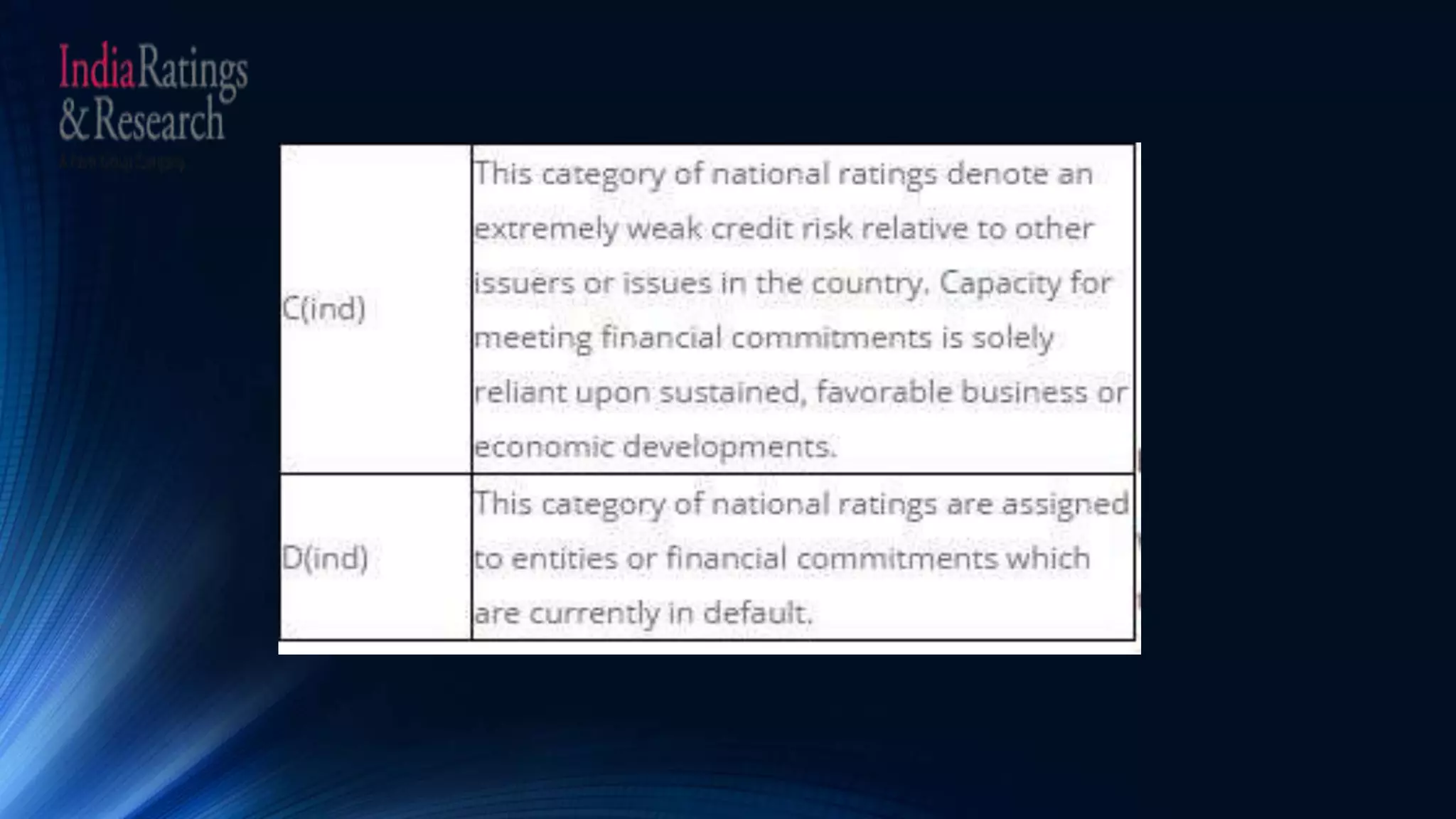

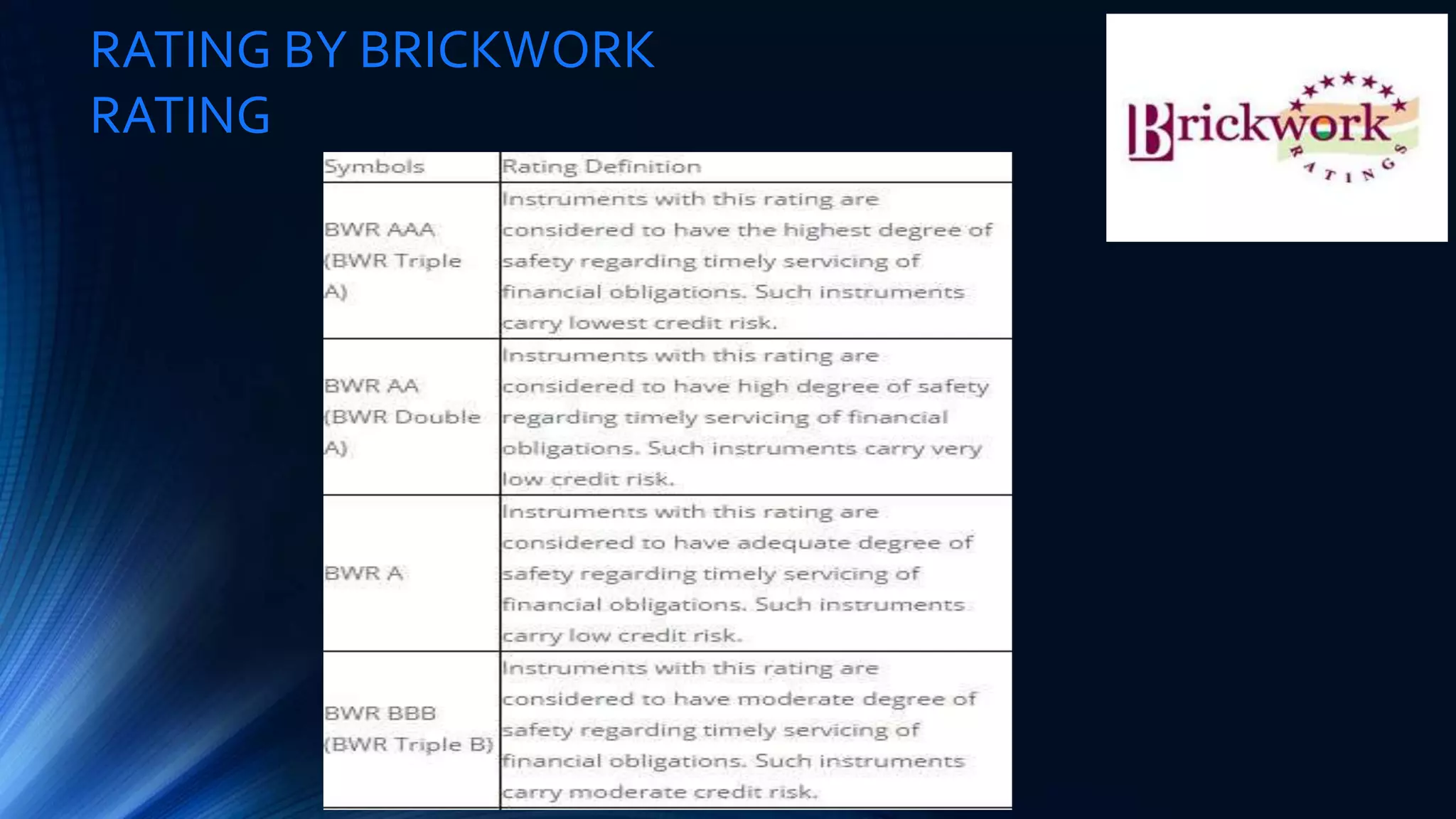

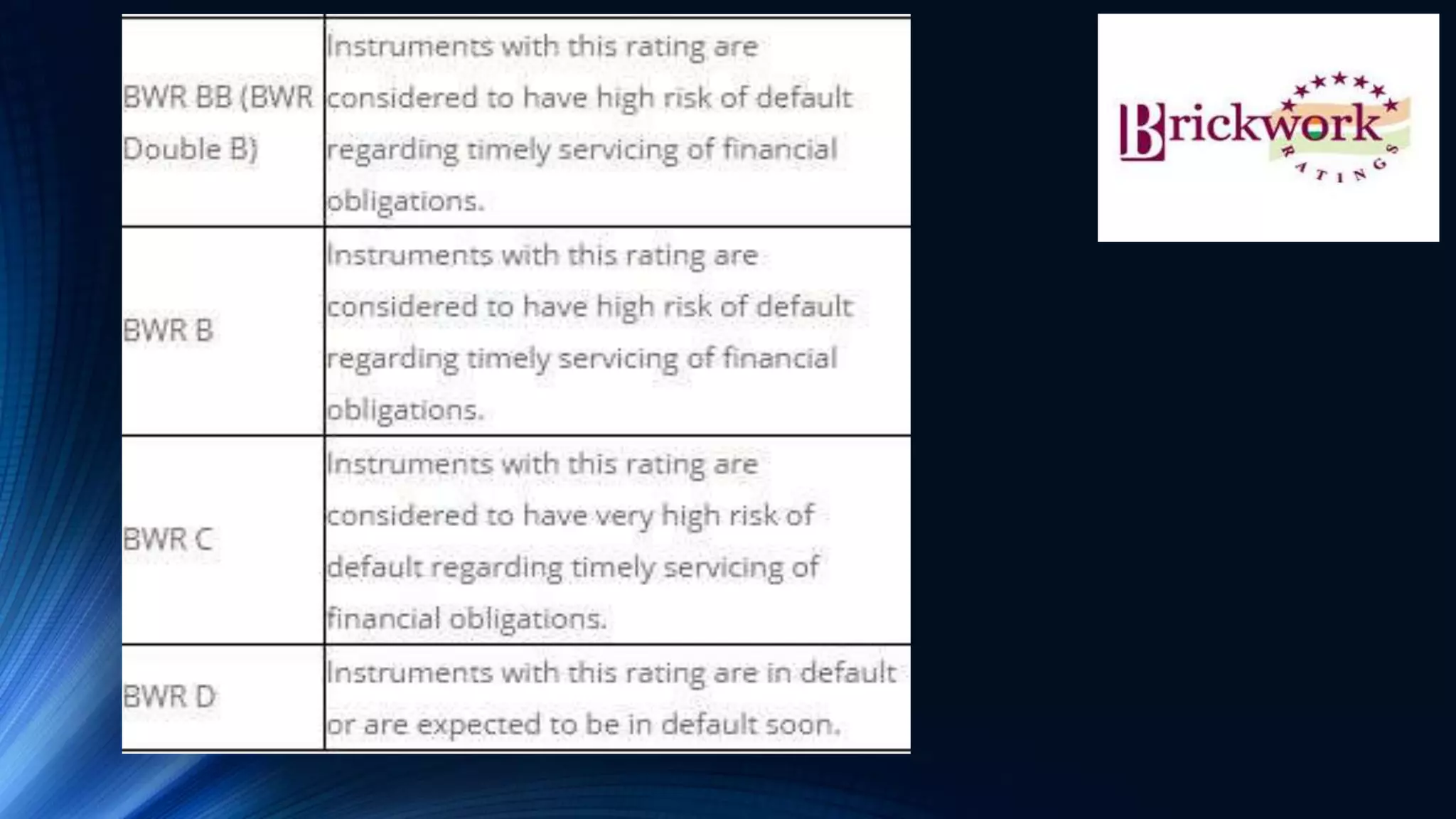

The document provides an overview of credit ratings in India, detailing the establishment of major credit rating agencies such as CRISIL, ICRA, and CARE, and their objectives and functions. It explains the credit rating scales for both long-term and short-term instruments, illustrating the levels of safety and risk associated with different ratings. Additionally, it outlines international credit rating agencies like Moody's and Standard & Poor's, highlighting their role in assessing financial instruments globally.