The document provides an overview of credit ratings in India. It defines credit ratings as an assessment of an issuer's ability to meet debt obligations. The key points covered include:

- The regulatory framework for credit rating agencies in India is established by SEBI.

- Credit ratings benefit both investors and companies. They provide investors with independent evaluations of credit risk and companies can access larger investor pools at lower borrowing costs.

- The major credit rating agencies operating in India are CRISIL, ICRA, CARE, and FITCH Ratings India.

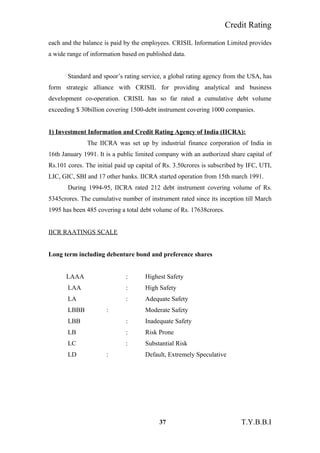

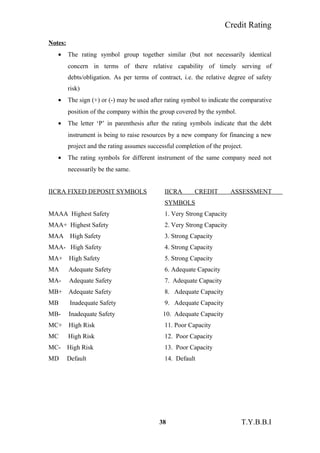

- The rating process involves a detailed analysis of companies' financials and business to determine their relative creditworthiness. Ratings are expressed using standardized symbols

![Credit Rating

1) Is not involved in any legal proceedings connected with the securities market

that may have an adverse on the interests of the investors,

2) Has not at any time in the past been convicted of any offence involving moral

turpitude or for any economic offence [in terms of Economic offences

(Inapplicability of Limitation) Act,1947].

Applicant or any person (i.e. an associate/ subsidiary/ inter-connected or group

company or a company under the same management) in the past has not been,

directly or indirectly:

1) Refused by the SEBI a certificate under these regulations or

2) Subject to any proceedings against contraviciting a SEBI Act/ any rules or

regulations made under it. An associated person in relation to a CRA includes

a person;

a. Who, directly/ indirectly by himself/ in combination with relative owns/

controls shares carrying at least 10% of the voting rights of the CRA; or

b. In respect of whom the CRA directly/ indirectly by itself/ in combination with

other persons owns/ controls not less than 10% of the voting rights; or

c. Majority of the directors who own/ control shares carrying at least 10% of the

voting rights of the CRA; or

d. Who is a director/ officer/ employee and also a director/ officer/ employee of

the CRA. Is the one, to whom grant of certificate is in the interest of the

investors and the securities market.

Grant of Certificate of Registration:

The SEBI will grant to eligible applicants a certificate of registration on the

payment of a fee of Rs. 5,00,000, subject to the conditions specified below:

A. The CRA would comply with the provisions of the SEBI Act/ regulations and

guidelines/ directions/ circulars and instructions issued by the SEBI, from time to

time, on the subject of credit rating;

B. 1) Where any information/ particulars furnished to the SEBI by a CRA,

is found to be false/ misleading in any material particulars of;

has undergone change subsequent to its furnishing at the time of application, it would

immediately inform SEBI in writing, and

13 T.Y.B.B.I](https://image.slidesharecdn.com/creditrating-130715224410-phpapp01/85/Credit-rating-13-320.jpg)