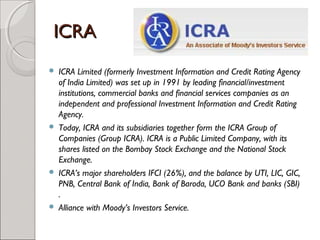

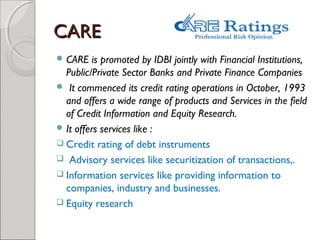

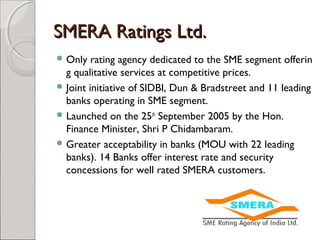

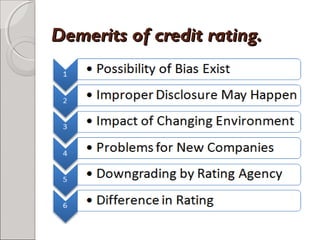

Credit ratings assess a debtor's ability to repay loans and are determined by agencies like CRISIL in India, established in 1987. These ratings help maintain investor confidence, encourage disciplined borrowing, and provide benefits like improved corporate image and informed investment decisions. Various credit rating agencies operate in India, including ICRA, CARE, and SMERA, each serving different market segments and promoting transparency and trust in financial instruments.