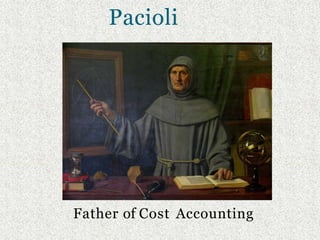

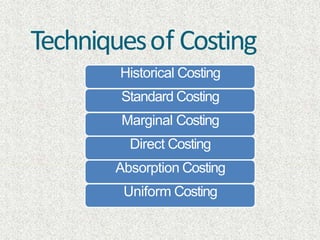

This document discusses various costing methods and techniques. It defines key terms like cost, costing, and cost accounting. It identifies Luca Pacioli as the father of cost accounting. The main costing methods discussed are specific order costing methods like job costing, contract costing, and batch costing, as well as continuous operation costing methods like process costing, single/output costing, and operating/service costing. The document also outlines techniques like historical costing, standard costing, marginal costing, direct costing, absorption costing, and uniform costing.