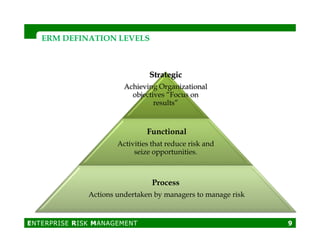

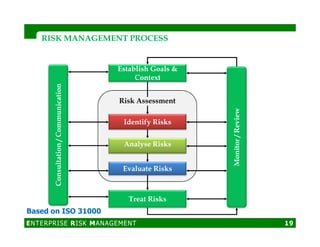

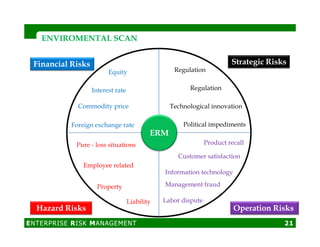

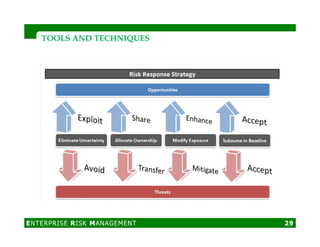

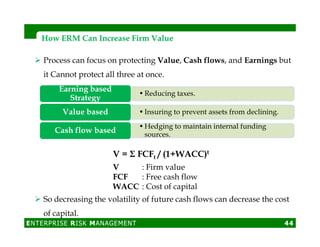

This document discusses enterprise risk management (ERM). It provides definitions of ERM, outlines its conceptual roots dating back to the 1970s-1990s, and describes what ERM is and how it can provide a framework for risk management. The document also discusses key aspects of ERM implementation including risk, uncertainty, risk attitudes, risk management processes and steps, and tools and techniques for risk assessment.