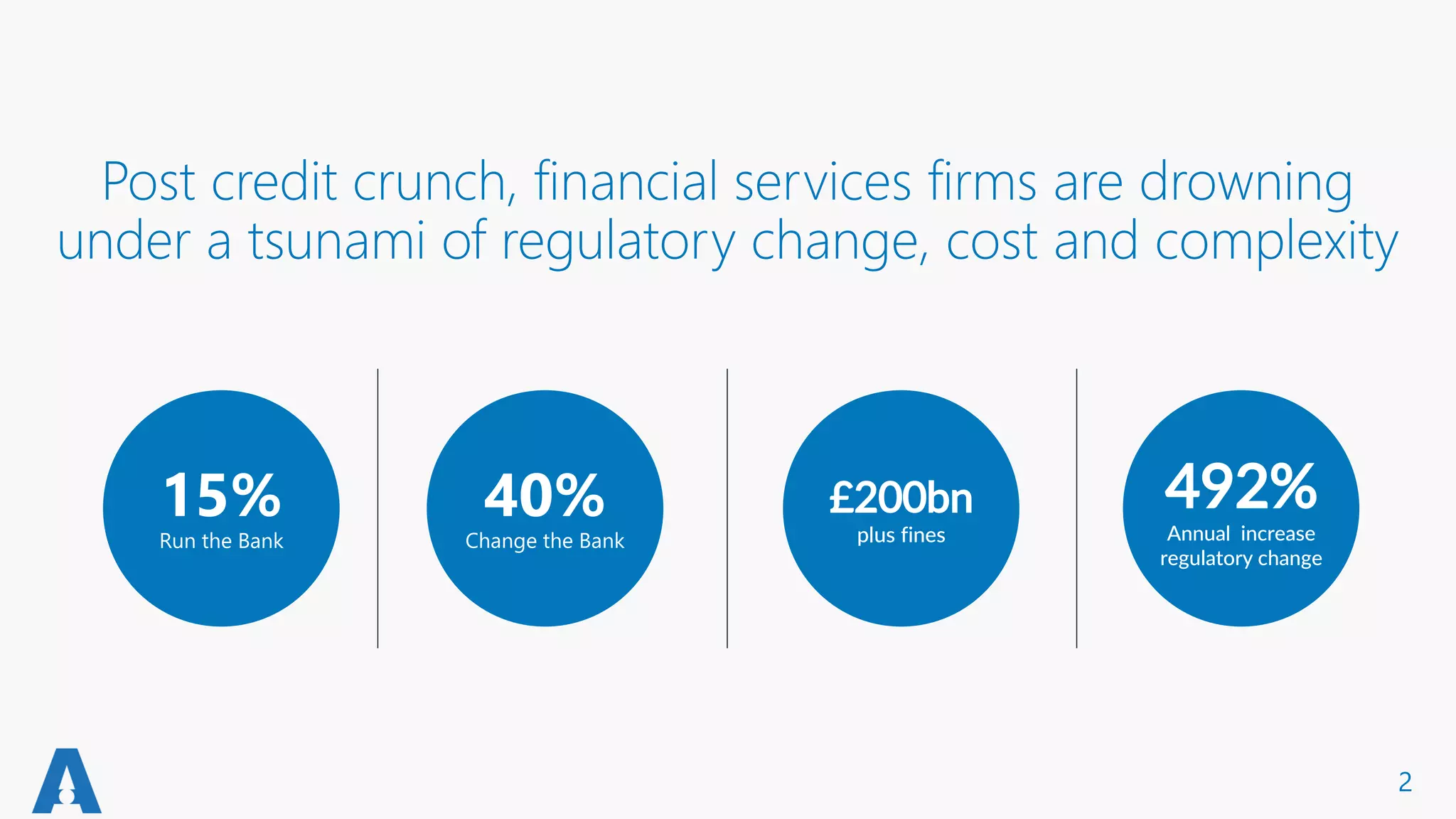

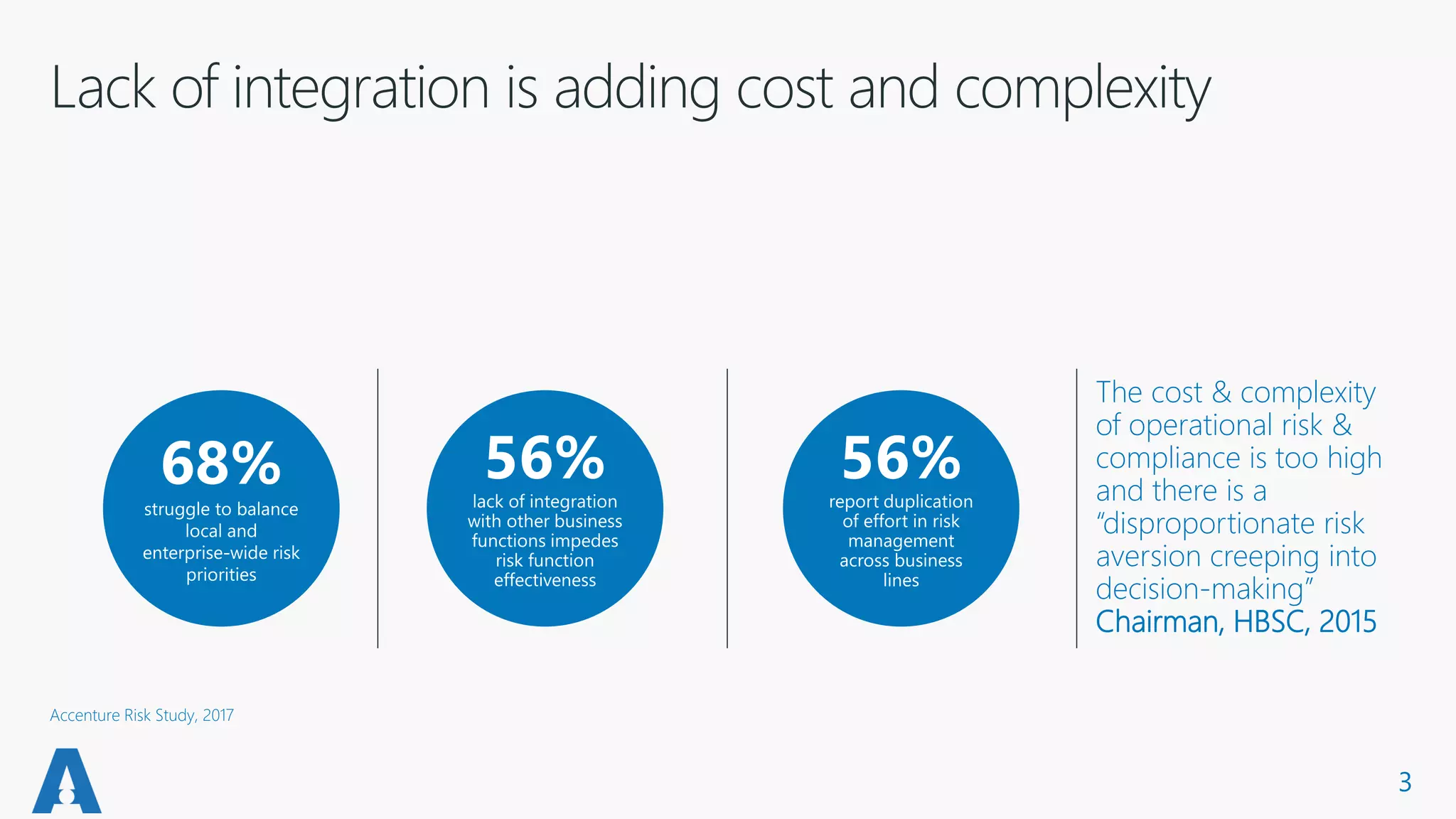

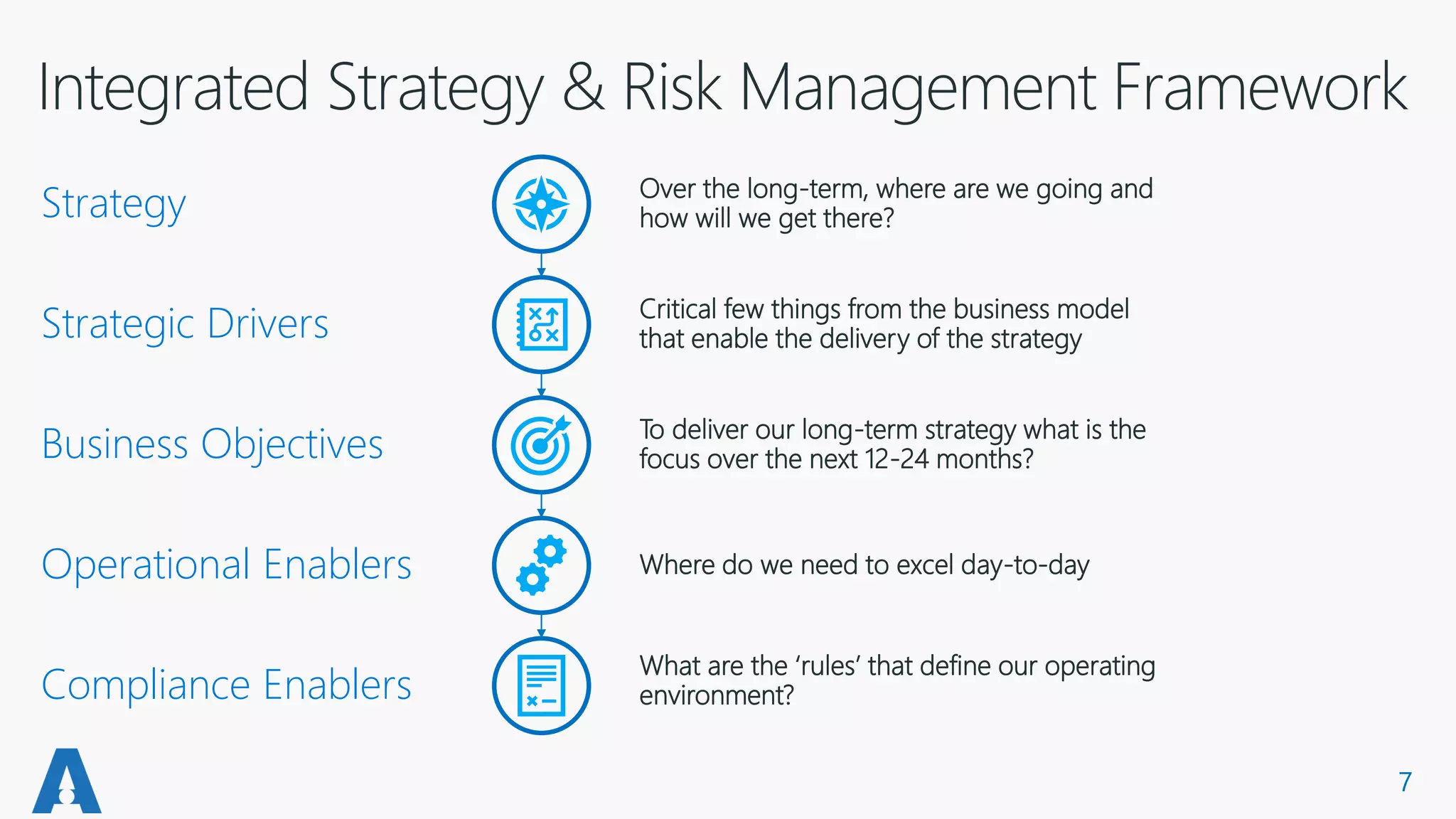

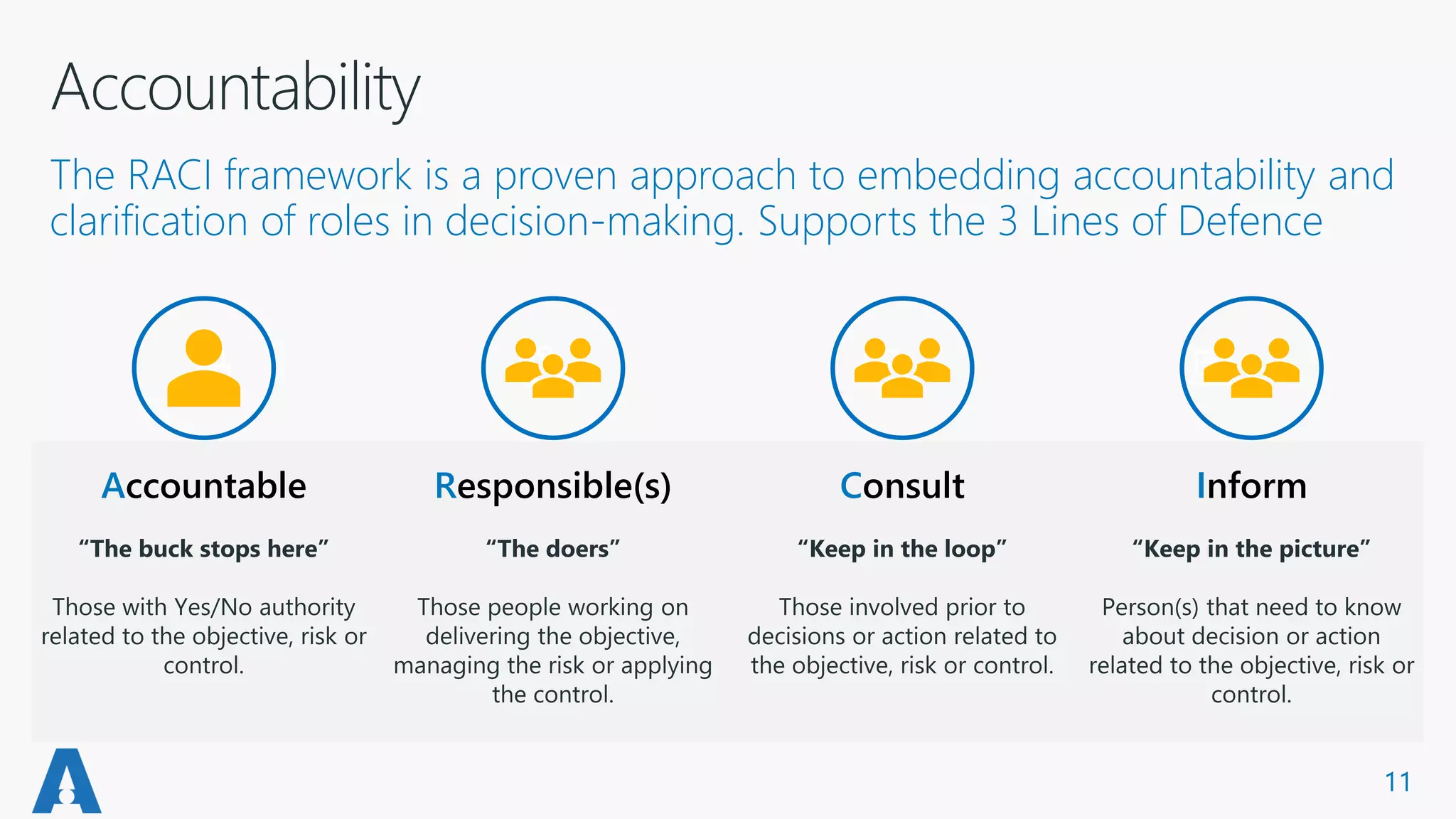

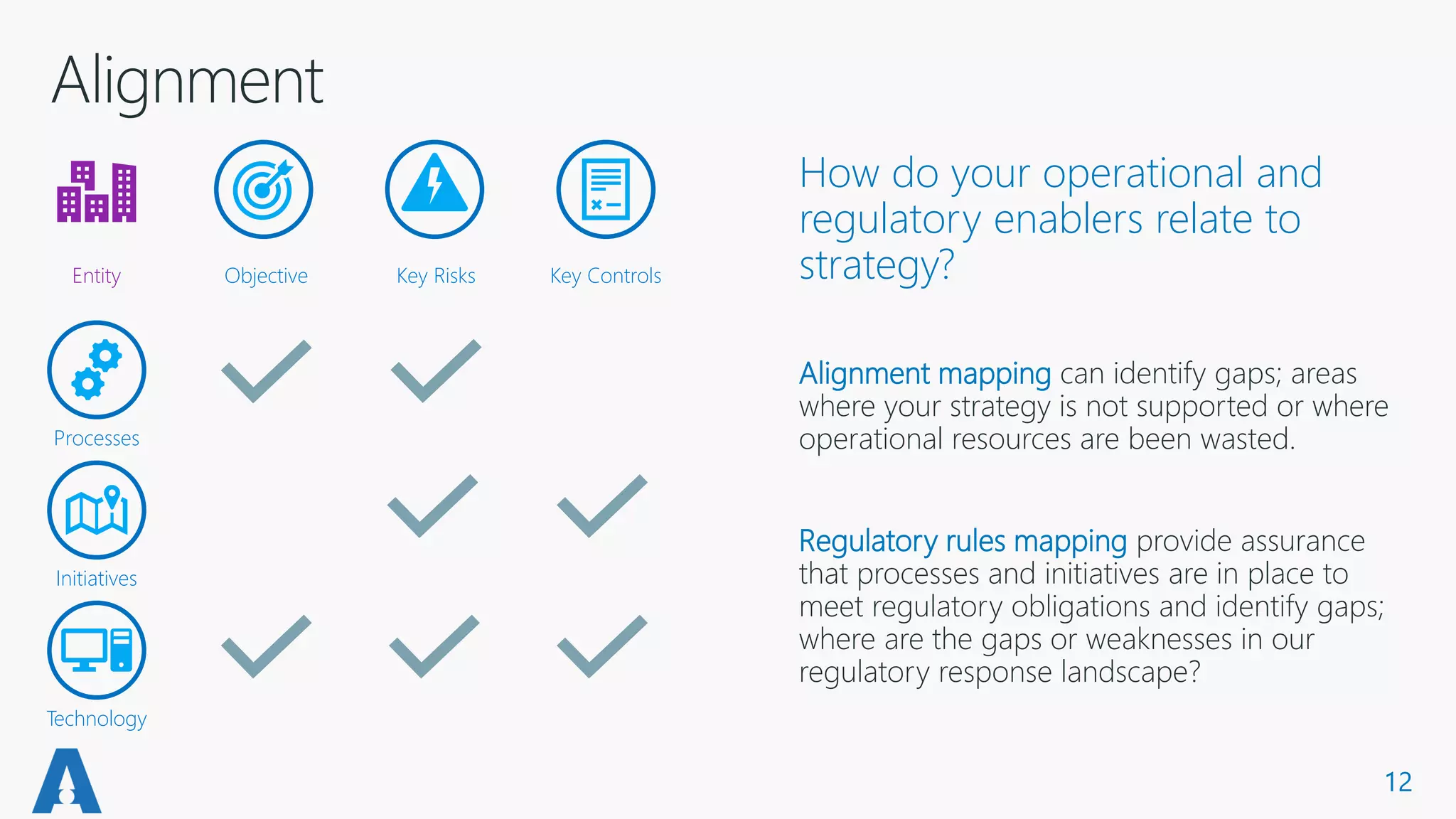

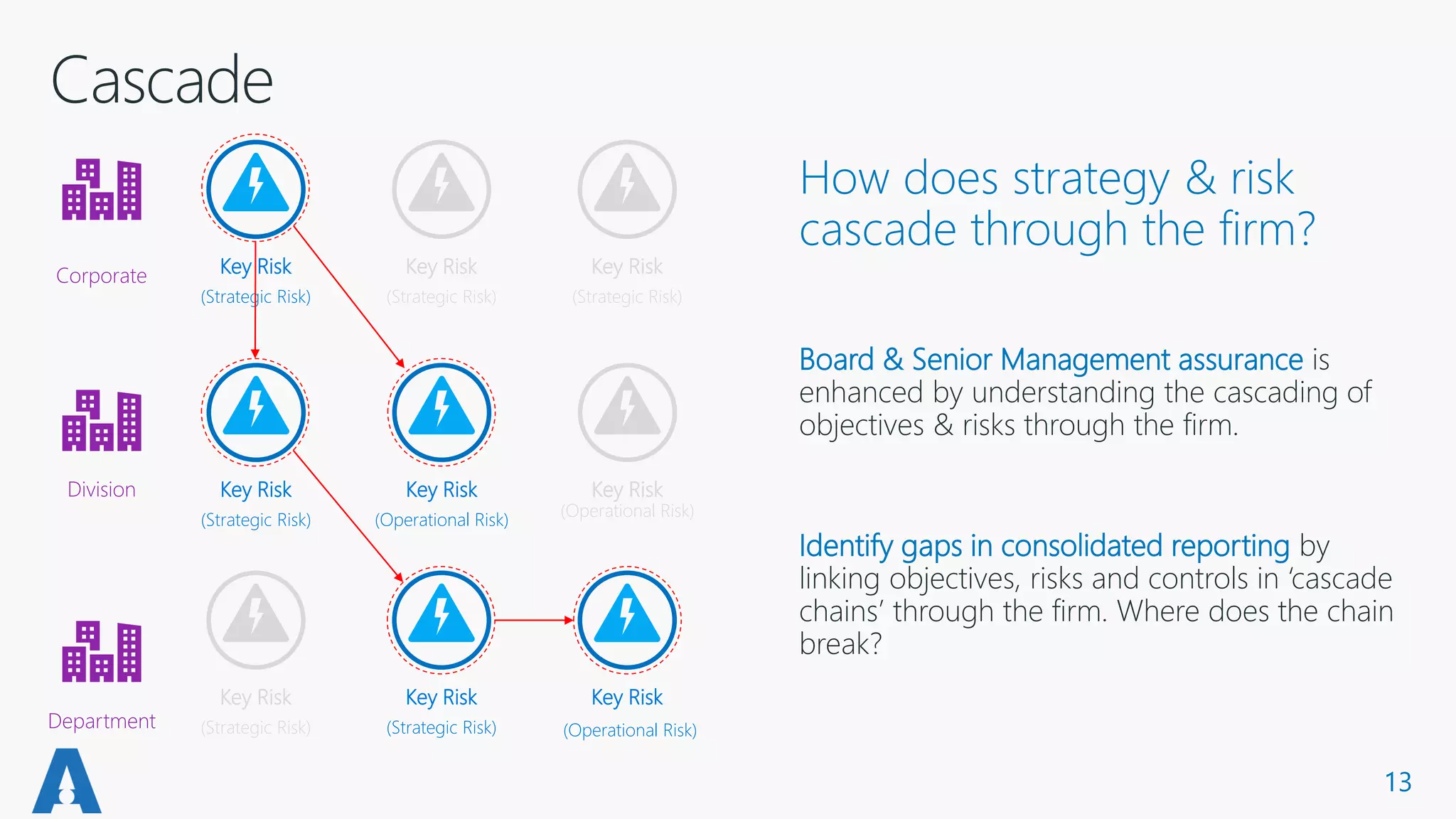

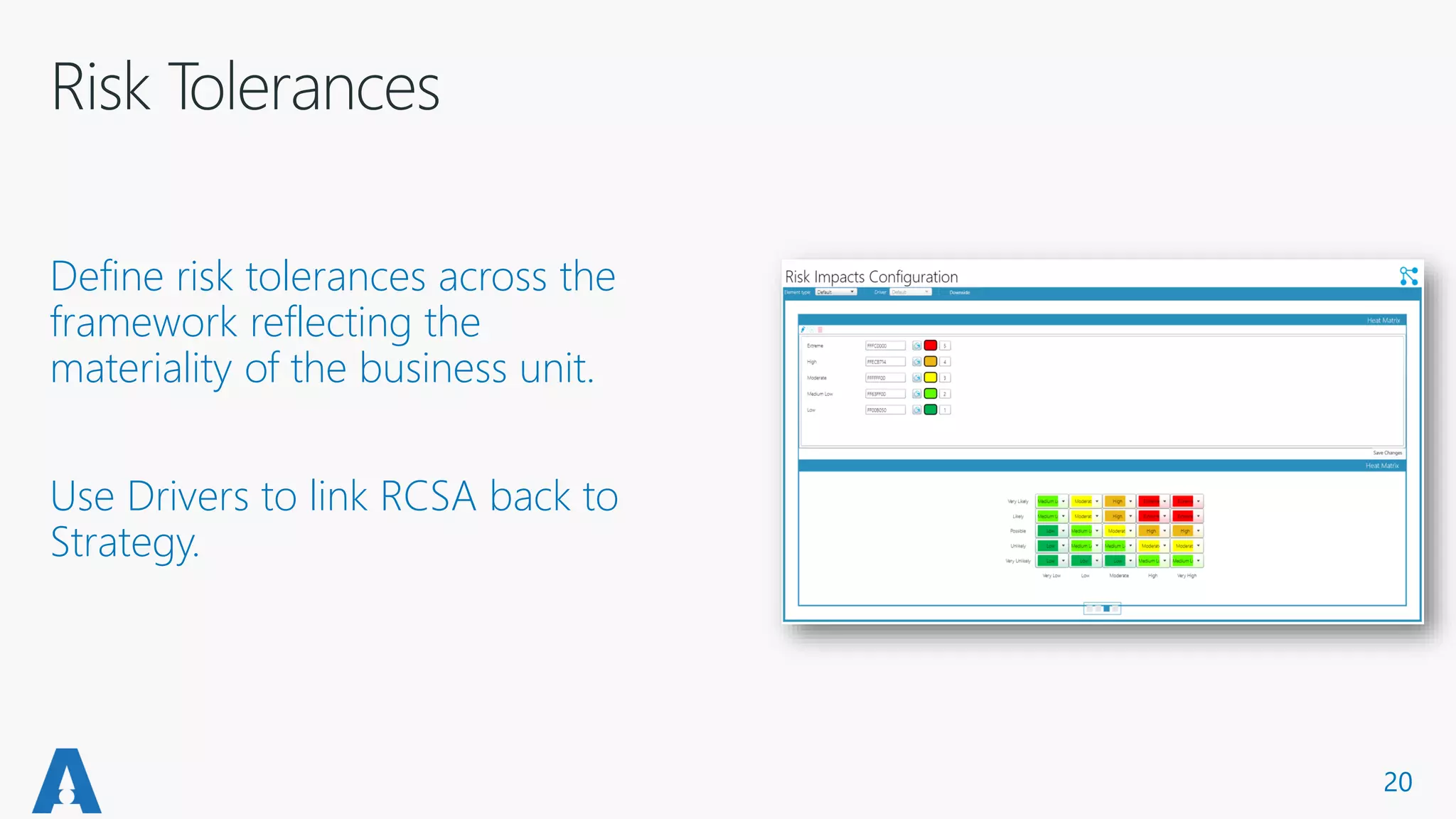

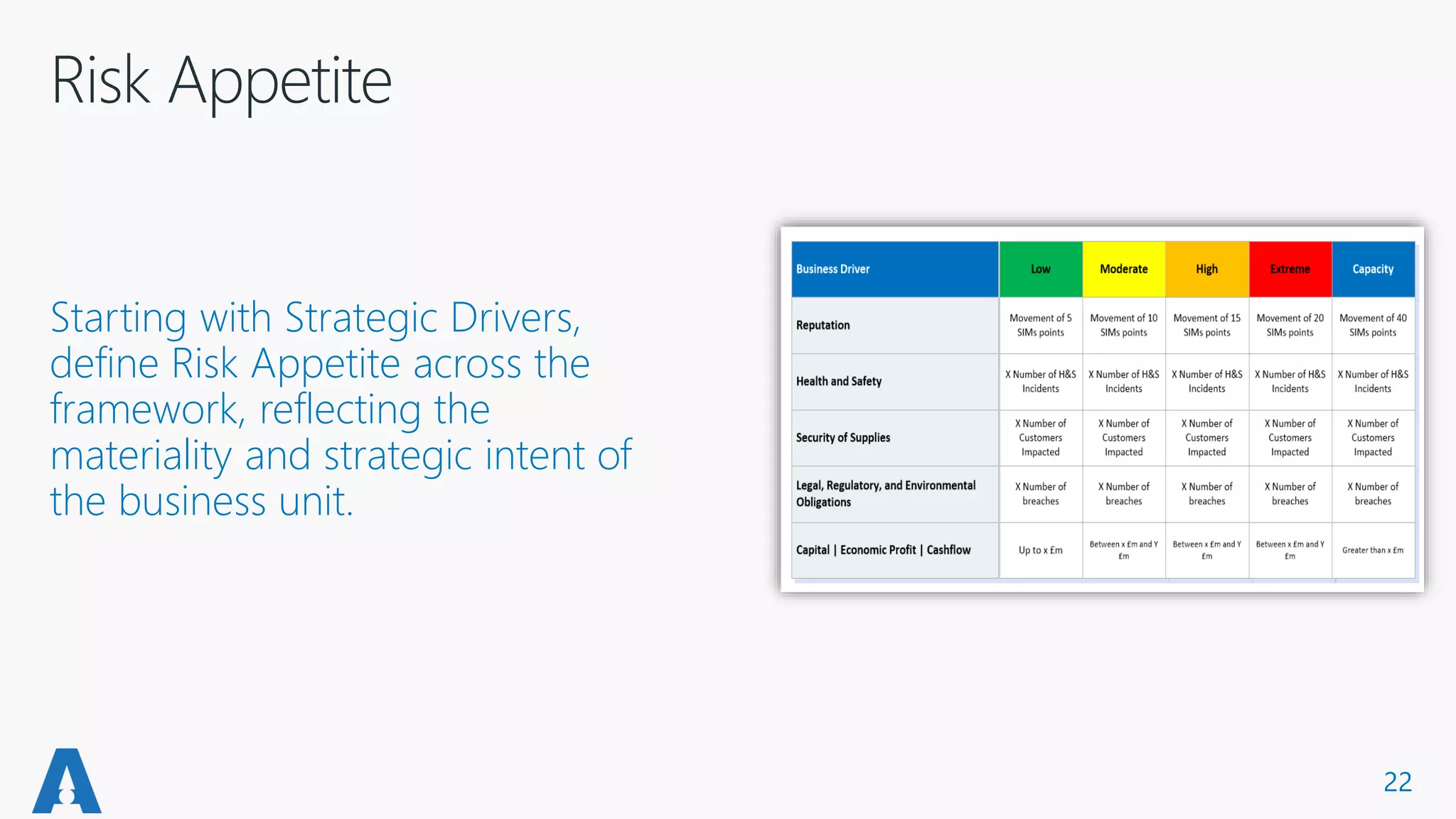

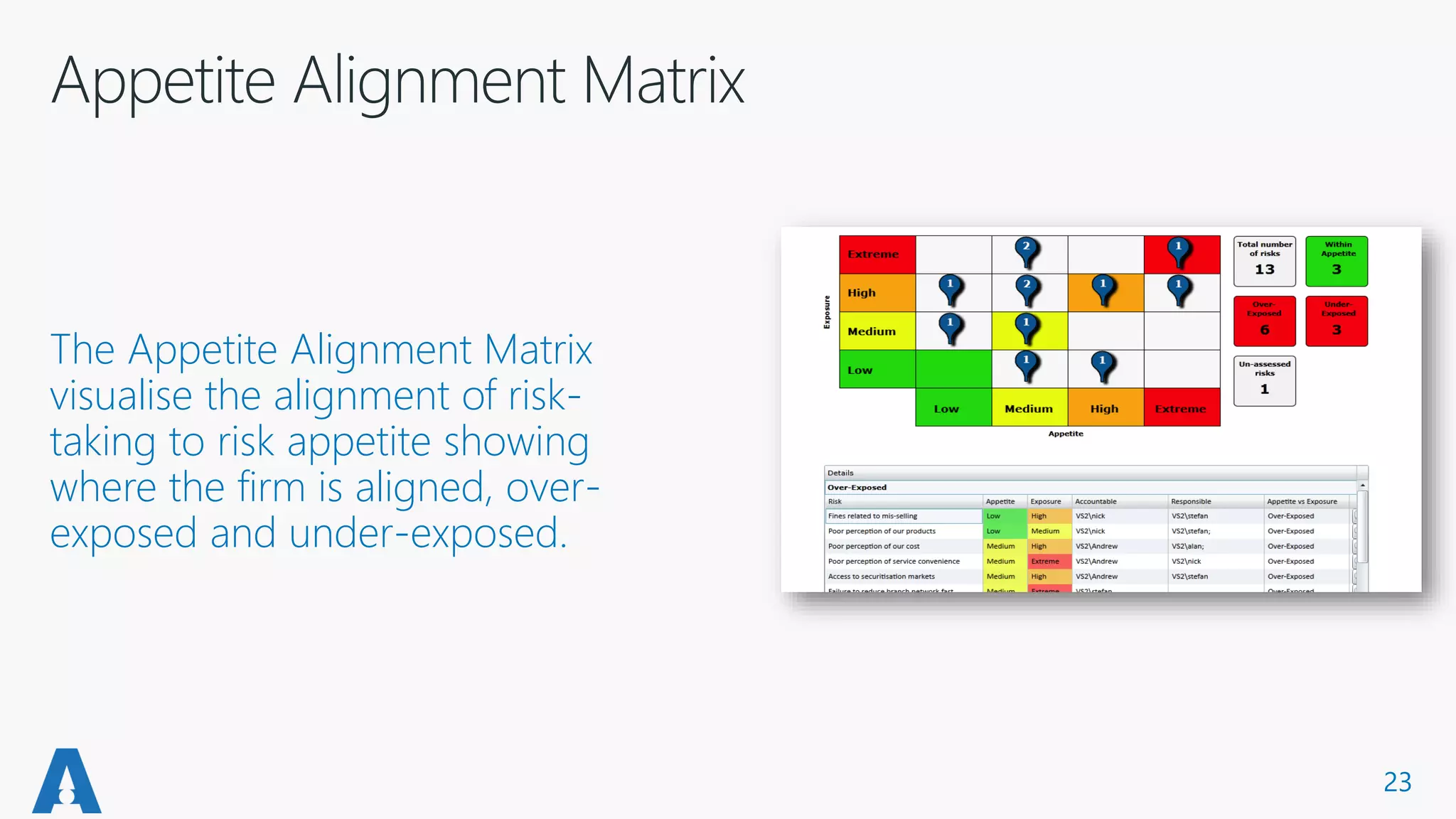

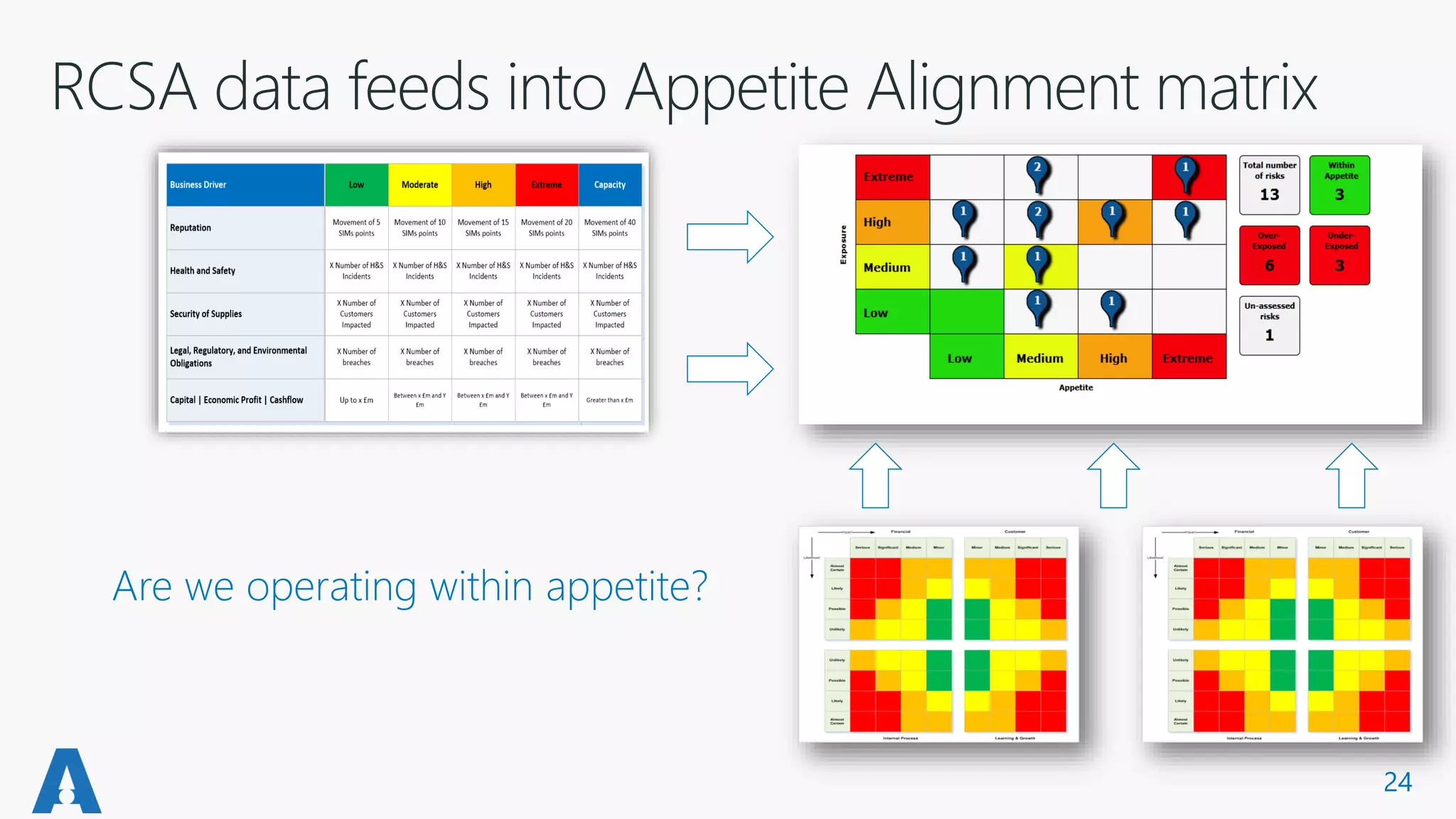

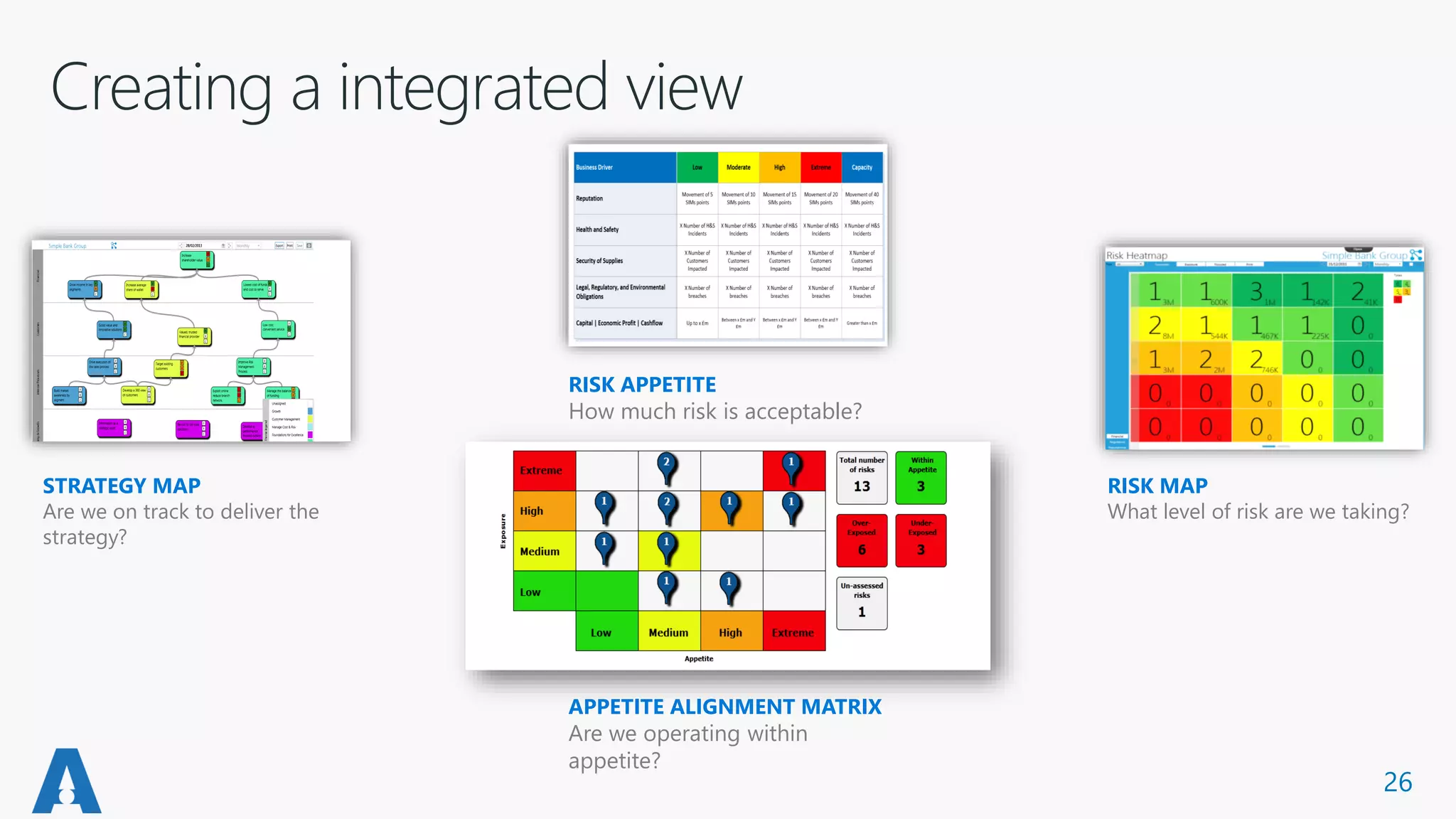

The document discusses the importance of integrating Risk and Control Self-Assessment (RCSA) into strategic planning and business strategies, especially for financial services facing increasing regulatory pressures. It emphasizes the need for better decision-making and accountability through a structured framework that aligns risk, strategy, and performance management. Key benefits of this approach include enhanced shareholder value, reduced operational losses, and improved risk management efficiency.