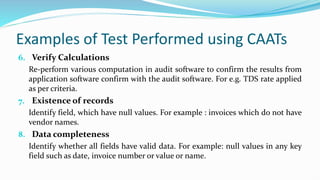

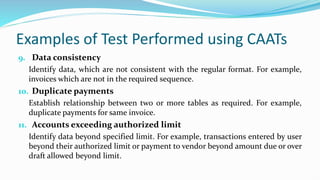

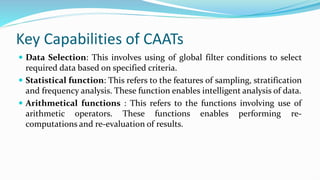

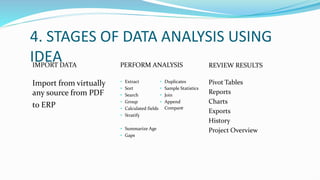

The document outlines the importance and utility of Computer Assisted Audit Techniques (CAATS) in modern auditing, particularly in the context of IT environments where information is primarily electronic. It details the methodology for effectively employing CAATS, including careful planning, data analysis, and the performance of various tests to ensure audit quality and reliability. Additionally, it introduces IDEA, a specific CAATS tool, highlighting its features and advantages for auditors in data extraction and analysis.