Embed presentation

Download to read offline

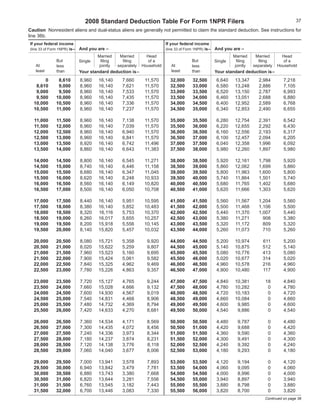

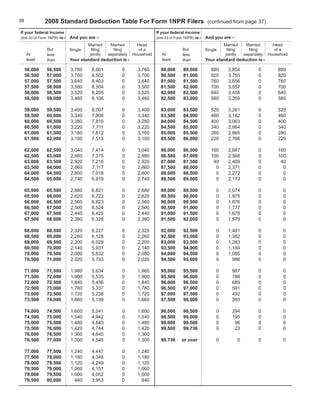

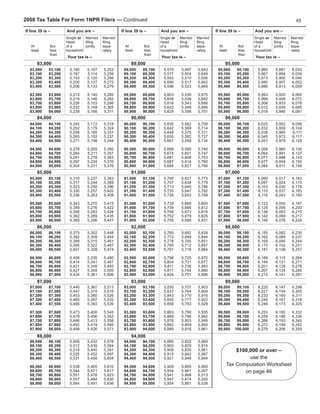

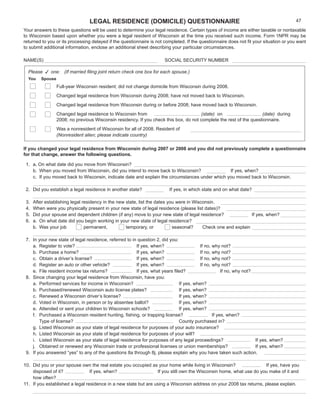

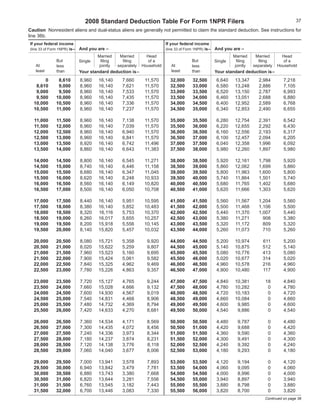

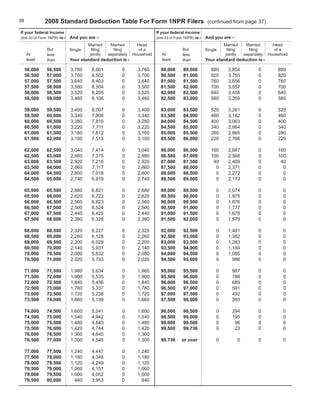

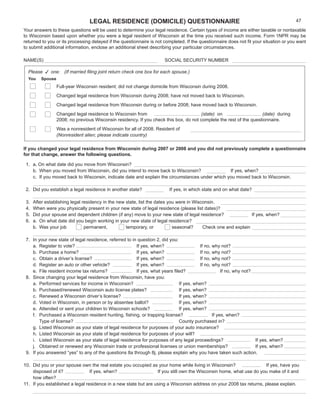

This document provides instructions for completing Wisconsin income tax form 1NPR for nonresidents and part-year residents for the 2008 tax year. Key points include: - Social security benefits are no longer taxable by Wisconsin. The maximum tuition deduction and medical care insurance subtraction are increased. Section 179 expense deductions are available for farmers. - The form includes tips for paper filing, requirements to make estimated tax payments, and guidance on legal residence, various income types, deductions, credits, and other tax situations. - The index provides page references for topics including business income, capital gains, exemptions, farm losses, retirement benefits, and instructions for specific lines on the tax form.