Embed presentation

Download to read offline

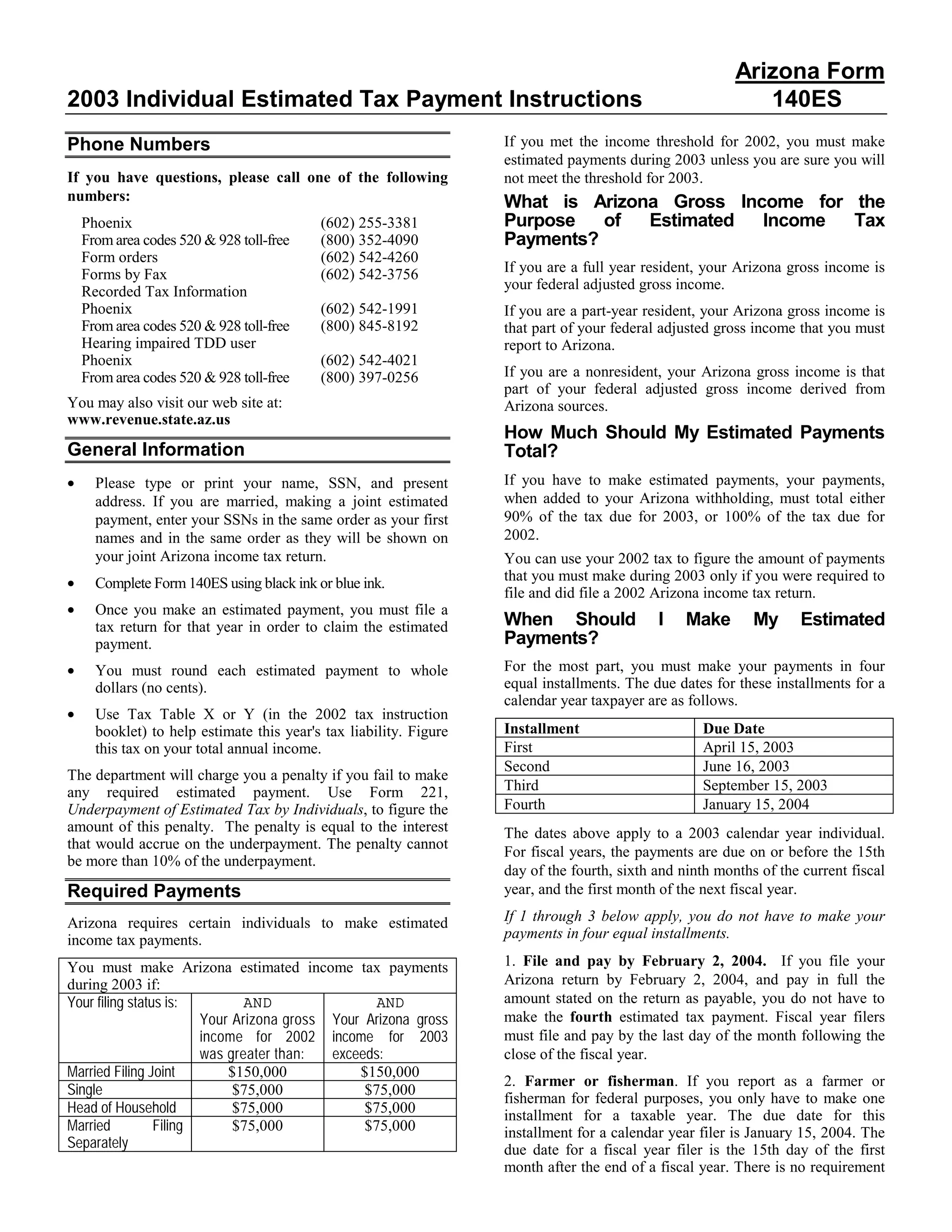

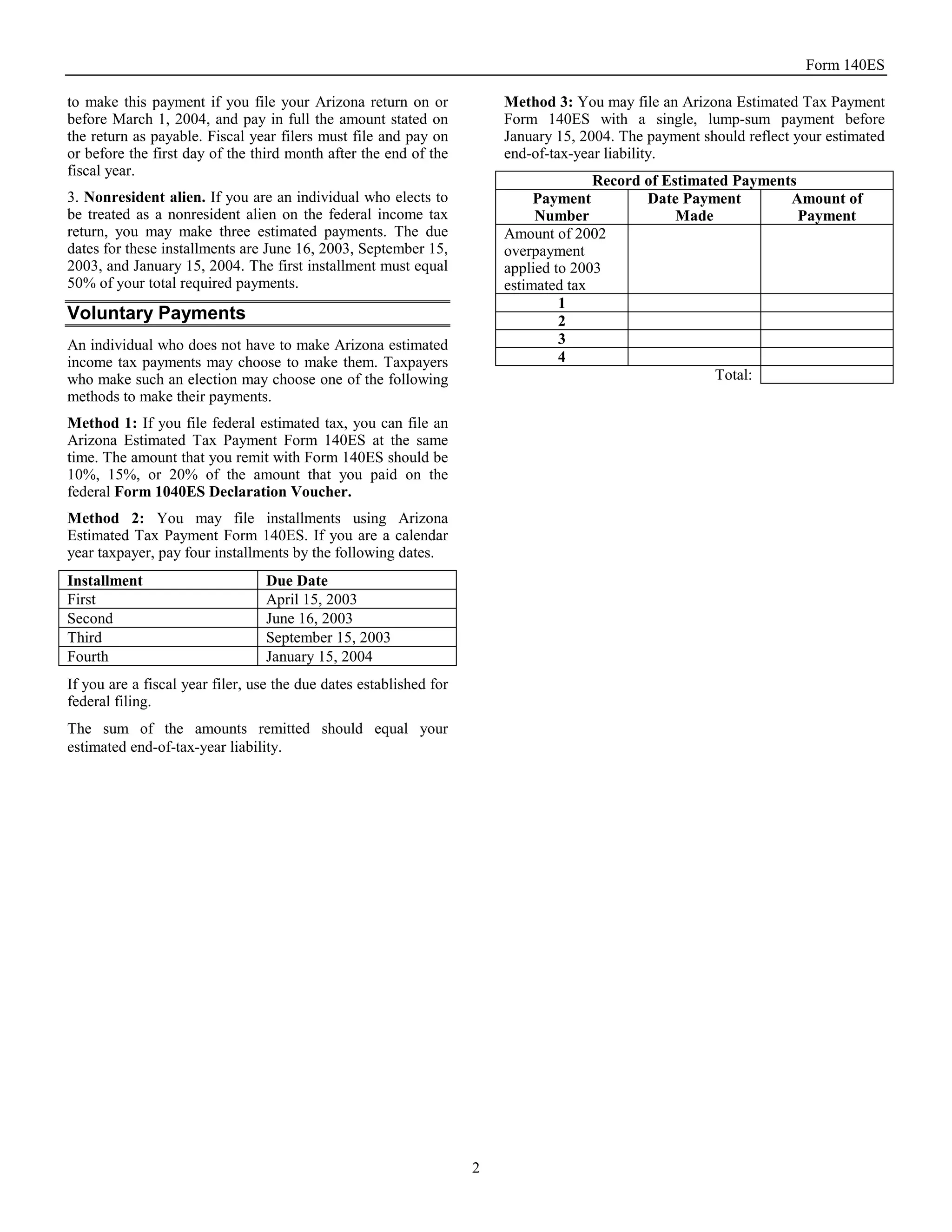

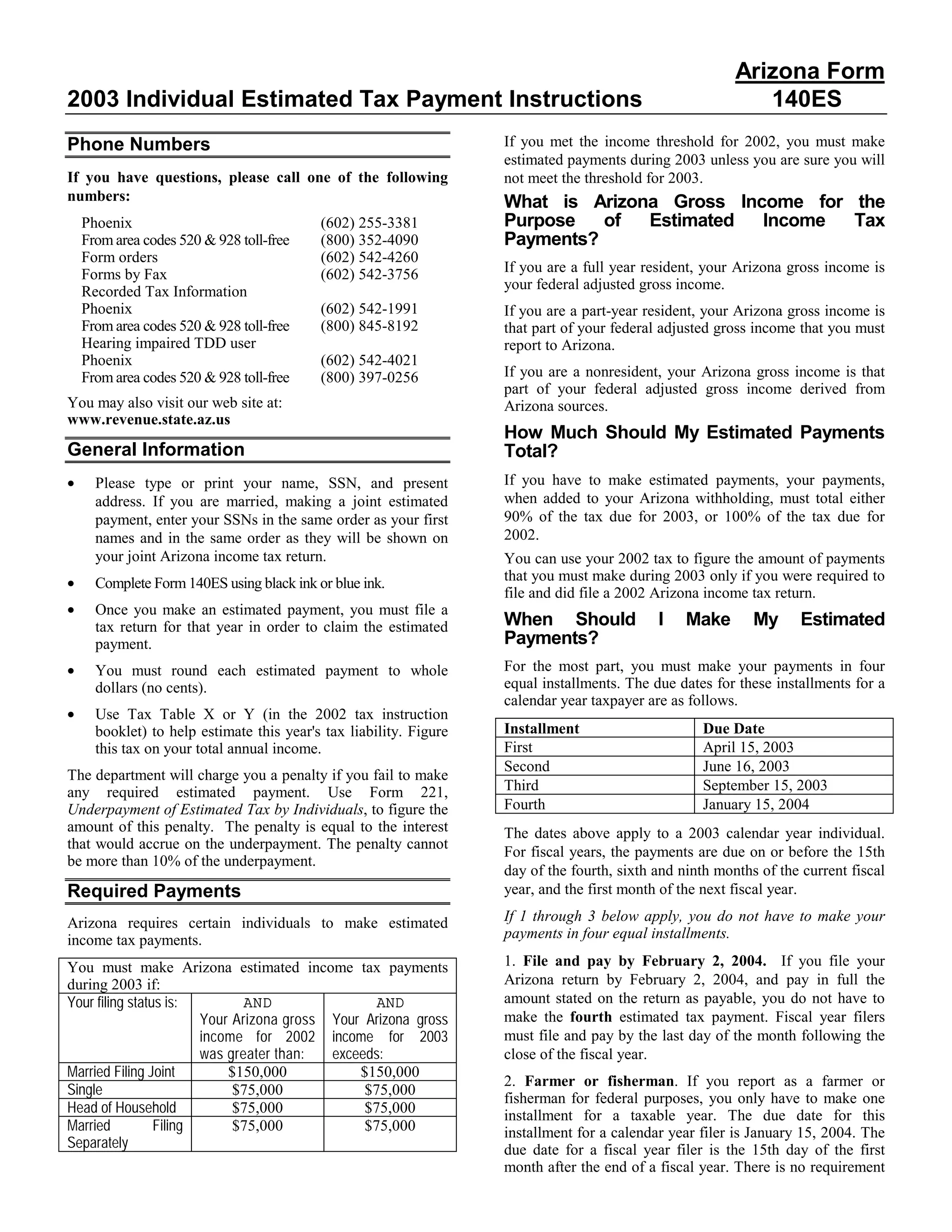

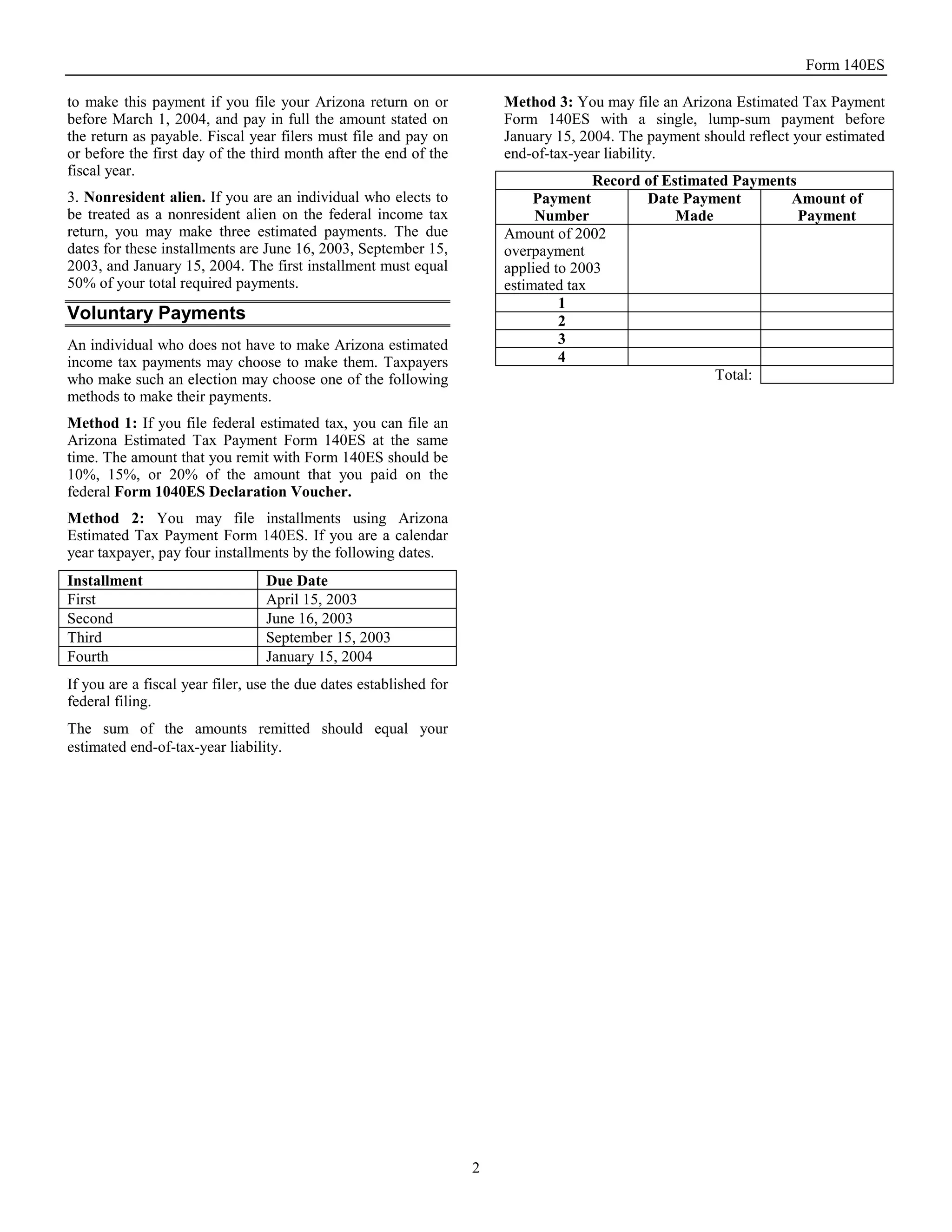

1. This document provides instructions for making Arizona estimated income tax payments for 2003. It explains that estimated payments are required if an individual's 2002 or 2003 Arizona gross income exceeds certain thresholds based on their filing status. 2. It provides the due dates for estimated tax payments, which are generally in four equal installments on April 15, June 15, September 15, and January 15 of the following year. However, farmers and fishermen only need to make one payment. 3. The document describes three optional methods for making estimated payments and provides a table to record payments made.