Embed presentation

Download to read offline

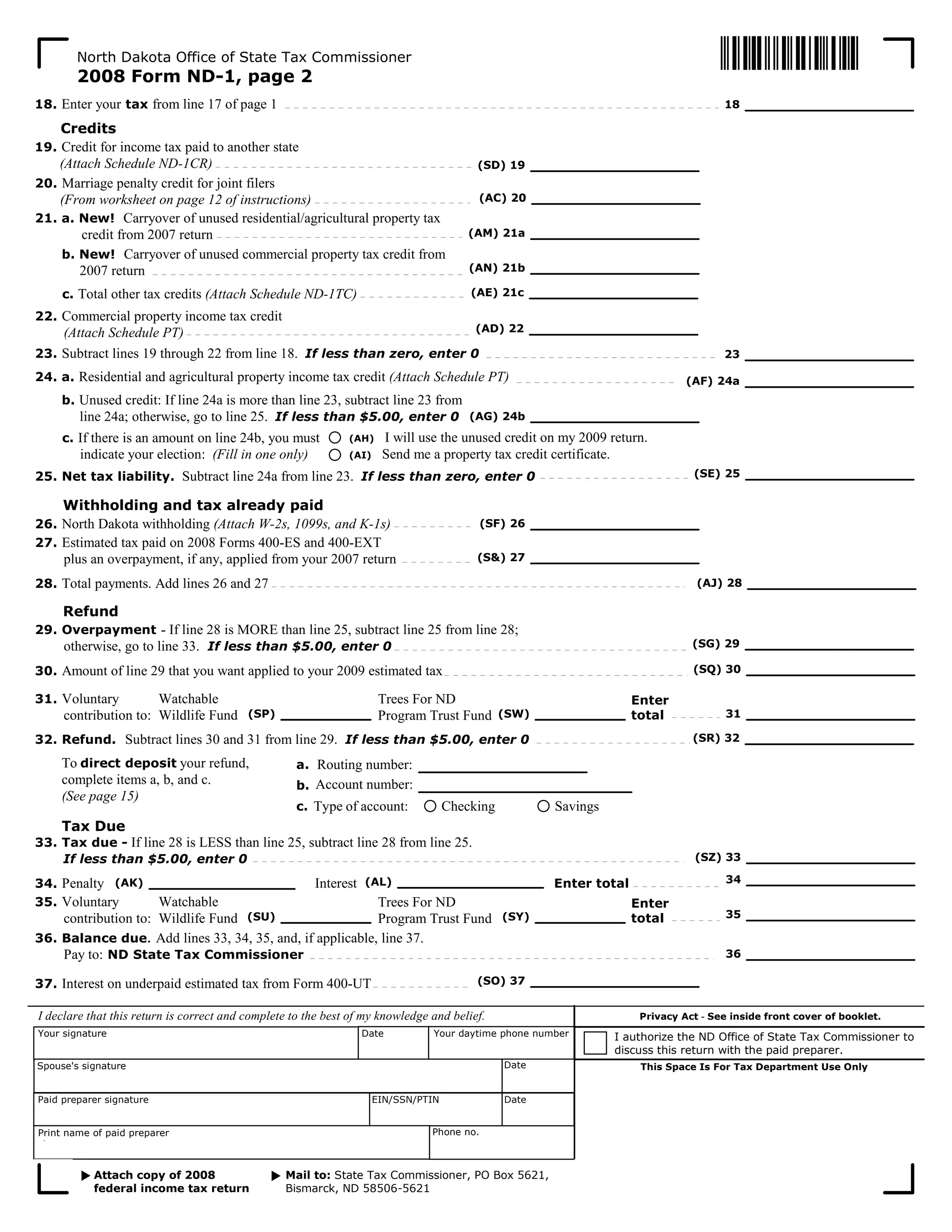

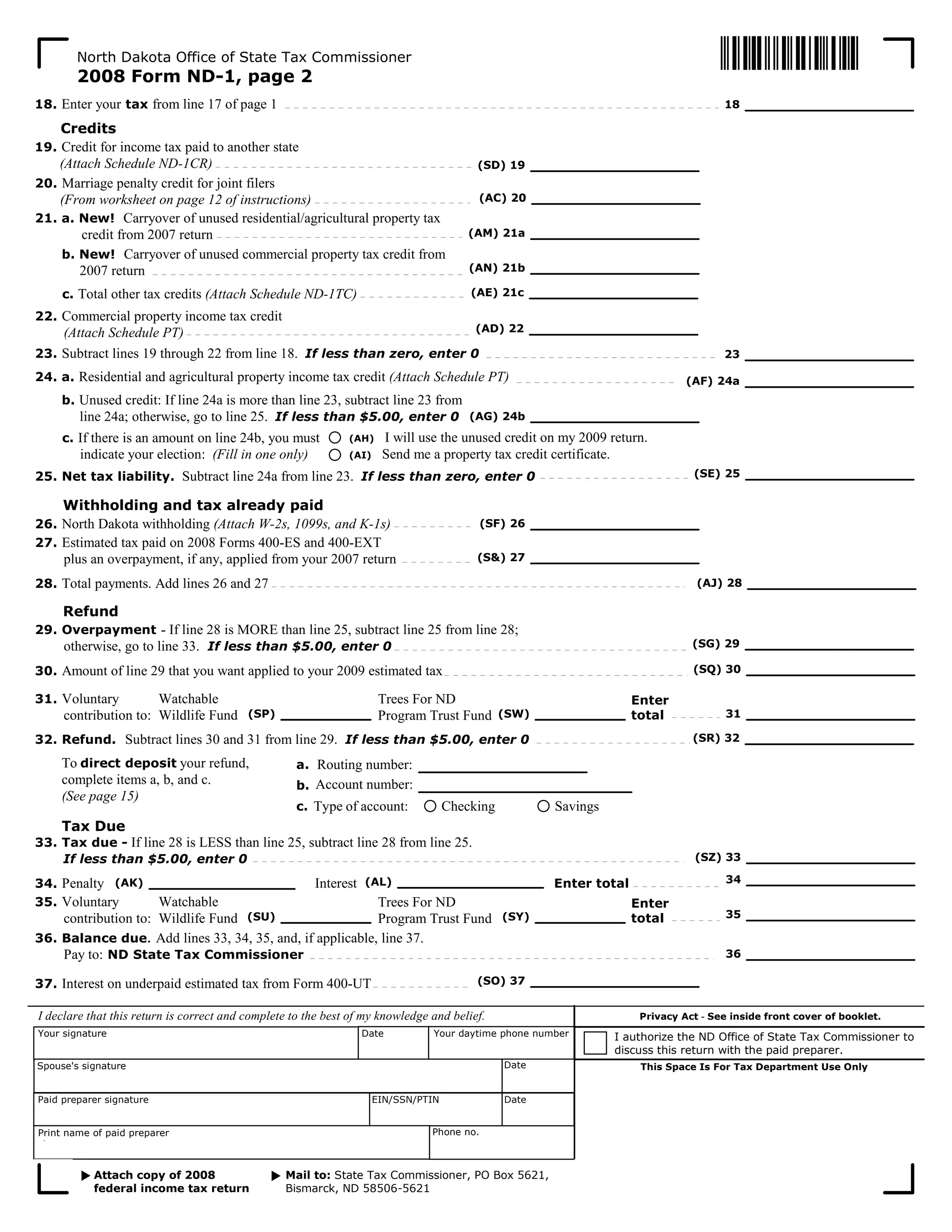

This document is an individual income tax return form for the state of North Dakota for the year 2008. It contains sections to provide personal identification information, report income and deductions, calculate tax liability, and indicate any refund or amount owed. Key details include filing status, sources of income, subtractions allowed, tax credits, payments made including withholding and estimated taxes, and optional contributions that can be directed to specific state funds.