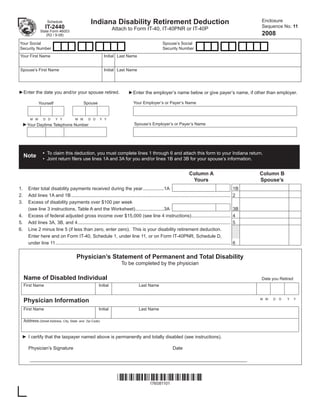

Indiana Disability Retirement Deduction

•

0 likes•170 views

This document provides instructions for claiming an Indiana disability retirement deduction. Key details include: - Taxpayers who retired on disability before the end of the tax year may be eligible to deduct up to $5,200 of disability payments from their income. - The deductible amount is limited to actual disability payments or $100 per week, whichever is less. It may also be reduced by the excess of federal adjusted gross income over $15,000. - A physician's statement is required to verify the taxpayer's permanent and total disability. - For joint filers, each spouse's eligible disability payments are calculated separately, with a combined maximum deduction of $10,400.

Report

Share

Report

Share

Download to read offline

Recommended

gov revenue formsandresources forms 2EZ_fill-in

This document is a 2008 Montana individual income tax return form. It contains sections to enter personal information, income amounts from a federal tax return, deductions, tax liability, payments and refund or amount owed. It includes worksheets to calculate the standard deduction and interest owed for underpayment of estimated taxes. The tax table lists tax rates and how to calculate tax liability based on taxable income amount.

state.ia.us tax forms 41122

This document is an Iowa amended individual income tax return form (IA 1040X). It provides instructions for taxpayers to amend their previously filed Iowa individual income tax return for a given fiscal year. The form collects identification information for the taxpayer and spouse. It allows the taxpayer to correct filing status, personal exemptions or credits, income, deductions, tax owed or refund amount from the original return. The taxpayer must provide an explanation for any changes on the back of the form and attach any additional documentation as needed to support the amended return.

azdor.gov Forms 140Af

This document is an Arizona state personal income tax return form for the year 2002. It contains sections for filing status, exemptions, income and adjustments, tax credits, payments and refund or amount owed. The taxpayer provides information such as their name, address, social security number, filing status, income, exemptions and deductions to calculate their tax liability or refund amount.

azdor.gov Forms 140PTCf

This document is an Arizona tax form for claiming a property tax refund or credit for the year 2002. It provides instructions for qualifying for the credit and calculating the amount. Key details include:

- To qualify, the filer must have been an Arizona resident in 2002 who paid property taxes or rent on their home.

- The credit amount is based on the filer's total household income and the property taxes paid, with a maximum credit of $500.

- The filer can choose to receive the refund via direct deposit or by check.

gov revenue formsandresources forms FID-3 fill-in

This document is a 2008 Montana income tax return for estates and trusts. It includes schedules for reporting income, deductions, distributions to beneficiaries, and tax calculations. The return shows interest, dividend, business, capital gain and other income. It allows for standard deductions and exemptions to be subtracted. The beneficiary schedule provides details on income distributions. The return then calculates tax liability and allows the filer to claim credits, payments and determine refund or amounts owed.

revenue.ne.gov tax current 1040xnold

1) This document is an amended Nebraska individual income tax return form for tax years before 1987.

2) It provides instructions for filing an amended return if the original federal or Nebraska return was incorrect or has been adjusted.

3) The amended return is due 90 days after filing an amended federal return or after an IRS correction becomes final. The taxpayer must attach documentation of federal adjustments.

10 5402ezm jc

This document appears to be a California state income tax return form for the year 2010. It contains fields for the taxpayer's name, address, social security number, filing status, exemptions, income sources, tax owed or refund amount, and space for voluntary contributions. The taxpayer, Joseph Chin, reported $55,000 in total wages, a tax amount of $2,510, and tax withheld of $2,510, resulting in no overpayment or tax due.

Amended Resident Return Form and Instructions

This document is a New Jersey Form TR-1040-X for amending or withdrawing a 2008 tenant homestead rebate application. It provides instructions on when and how to use the form to amend information reported on the original TR-1040 application or withdraw an application filed in error. Key details include that the form can be used to change information on the original application or withdraw if the taxpayer is determined to be ineligible for the rebate. Both spouses must sign a joint amended application.

Recommended

gov revenue formsandresources forms 2EZ_fill-in

This document is a 2008 Montana individual income tax return form. It contains sections to enter personal information, income amounts from a federal tax return, deductions, tax liability, payments and refund or amount owed. It includes worksheets to calculate the standard deduction and interest owed for underpayment of estimated taxes. The tax table lists tax rates and how to calculate tax liability based on taxable income amount.

state.ia.us tax forms 41122

This document is an Iowa amended individual income tax return form (IA 1040X). It provides instructions for taxpayers to amend their previously filed Iowa individual income tax return for a given fiscal year. The form collects identification information for the taxpayer and spouse. It allows the taxpayer to correct filing status, personal exemptions or credits, income, deductions, tax owed or refund amount from the original return. The taxpayer must provide an explanation for any changes on the back of the form and attach any additional documentation as needed to support the amended return.

azdor.gov Forms 140Af

This document is an Arizona state personal income tax return form for the year 2002. It contains sections for filing status, exemptions, income and adjustments, tax credits, payments and refund or amount owed. The taxpayer provides information such as their name, address, social security number, filing status, income, exemptions and deductions to calculate their tax liability or refund amount.

azdor.gov Forms 140PTCf

This document is an Arizona tax form for claiming a property tax refund or credit for the year 2002. It provides instructions for qualifying for the credit and calculating the amount. Key details include:

- To qualify, the filer must have been an Arizona resident in 2002 who paid property taxes or rent on their home.

- The credit amount is based on the filer's total household income and the property taxes paid, with a maximum credit of $500.

- The filer can choose to receive the refund via direct deposit or by check.

gov revenue formsandresources forms FID-3 fill-in

This document is a 2008 Montana income tax return for estates and trusts. It includes schedules for reporting income, deductions, distributions to beneficiaries, and tax calculations. The return shows interest, dividend, business, capital gain and other income. It allows for standard deductions and exemptions to be subtracted. The beneficiary schedule provides details on income distributions. The return then calculates tax liability and allows the filer to claim credits, payments and determine refund or amounts owed.

revenue.ne.gov tax current 1040xnold

1) This document is an amended Nebraska individual income tax return form for tax years before 1987.

2) It provides instructions for filing an amended return if the original federal or Nebraska return was incorrect or has been adjusted.

3) The amended return is due 90 days after filing an amended federal return or after an IRS correction becomes final. The taxpayer must attach documentation of federal adjustments.

10 5402ezm jc

This document appears to be a California state income tax return form for the year 2010. It contains fields for the taxpayer's name, address, social security number, filing status, exemptions, income sources, tax owed or refund amount, and space for voluntary contributions. The taxpayer, Joseph Chin, reported $55,000 in total wages, a tax amount of $2,510, and tax withheld of $2,510, resulting in no overpayment or tax due.

Amended Resident Return Form and Instructions

This document is a New Jersey Form TR-1040-X for amending or withdrawing a 2008 tenant homestead rebate application. It provides instructions on when and how to use the form to amend information reported on the original TR-1040 application or withdraw an application filed in error. Key details include that the form can be used to change information on the original application or withdraw if the taxpayer is determined to be ineligible for the rebate. Both spouses must sign a joint amended application.

1040X-ME amended income tax return

This document is a Maine Form 1040X, which is used to file an amended individual income tax return. It provides instructions for taxpayers to correct their original Maine tax return. The form includes sections to report income, deductions, exemptions, payments and the refund or amount owed. Taxpayers must explain any changes on page 2 and attach supporting documents. The instructions provide guidance on filing amended returns, reporting income and deductions, and claiming refunds for deceased taxpayers.

2008 IT-40 PNR Form

1. This document is an Indiana state tax return form for part-year or full-year nonresidents.

2. It provides instructions for nonresidents to calculate their Indiana state income tax liability based on income earned while living in Indiana.

3. The form walks through calculating Indiana adjusted gross income, exemptions, tax credits, tax owed or refund amount.

gov revenue formsandresources forms DS-1_fill_in

This document is a form for claiming Montana's disability income exemption. It provides instructions for determining eligibility for the exemption and calculating the exemption amount. To qualify, one must be under 65, permanently disabled, and receiving retirement disability benefits reported on a 1099-R tax form. The form guides the user to report their disability benefits and adjusted gross income to calculate their allowable exemption amount to claim on their state tax return. Proof of disability may be requested from government agencies or other documentation.

140PTCf

This document is an Arizona property tax refund claim form for tax year 2001. It allows taxpayers to claim a refund for property taxes paid or rent paid in lieu of property taxes. The form collects information about the claimant's residency, income, property taxes or rent paid, and requests a signature to verify the accuracy of the information provided. It provides instructions for calculating the refund amount and includes schedules to determine the credit based on living situation and household income.

Instructions for NJ-1040ES 2009

This document is an amended New Jersey state income tax return form (NJ-1040X) for the year 2008. It provides lines to correct or update information reported on the original 2008 state tax return such as income amounts, deductions, exemptions, credits, payments and the amount of refund or tax owed. The form also includes sections to provide identification information, dependent information, an explanation of changes being reported, and instructions on where to file the amended return.

azdor.gov Forms 140PTCf

This document is an Arizona property tax refund claim form for the year 2003. It provides instructions for homeowners and renters to claim a refund based on their property taxes paid or rent paid. The form collects information like name, address, income, property taxes or rent paid, and requests the applicant to check boxes to affirm they meet the qualifications like being an Arizona resident for all of 2003. It then calculates the refund amount and provides options to receive the refund via direct deposit or check.

Amended SC Individual Income Tax Return

This document is an amended individual income tax return form for the State of South Carolina. It contains instructions for filing an amended return, including how to fill out various sections to correct income, deductions, credits, payments and refund or balance due amounts from the original tax return. Key sections include Part I for taxpayer information, Part II for return line items, Part III for signatures, and Part IV for nonresidents to recalculate taxable income.

revenue.ne.gov tax current f_1040XN_2008

This document is a Nebraska Individual Income Tax Return form for filing an amended return for tax year 2008. It provides line items to adjust amounts reported on the original return, including federal adjusted gross income, deductions, exemptions, credits, payments, and any balance due or refund. The form requests information about reasons for the amended filing and requires explanations of changes being reported.

Application for Extension of Time to File NJ Gross Income Tax Return

This document is a 2008 New Jersey Homestead Rebate Application for tenants. It requests information such as the applicant's social security number, address, income, and rental payment information. The application is for tenants seeking a rebate of property taxes paid indirectly through rent. It must be filed if the applicant rented and occupied a property in New Jersey as their principal residence on October 1, 2008 and their total 2008 income was under $100,000.

azdor.gov Forms 140pyf

This 3 sentence summary provides the key details about the document:

This Arizona tax form is for 2000 part-year residents to file their personal income tax return. It includes sections to report income, deductions, exemptions, tax owed or refund amount. Residents must provide identification information, residency dates, income and tax details to calculate their final tax liability or refund for the 2000 tax year.

M1R taxes.state.mn.us

This document provides instructions for completing Schedule M1R for the Age 65 or Older/Disabled Subtraction for 2008. It outlines the eligibility requirements, which include being age 65 or older or disabled. It provides a table to determine eligibility based on filing status, adjusted gross income, and nontaxable benefits received. The instructions explain how to complete each line of the schedule, including how to calculate adjusted gross income if a lump-sum distribution was received.

Form 8850-Pre-Screening Notice and Certification Request

1) This document is an IRS form (Form 8850) for employers to request certification to claim the Work Opportunity Tax Credit.

2) The form collects information from job applicants such as name, address, date of birth, and whether they qualify as a member of a targeted group to claim the tax credit, such as veterans, recipients of public assistance, or ex-felons.

3) Employers complete the bottom portion with details of the job offer such as date applicant was offered the job, date they started, and certification that to the best of their knowledge the applicant qualifies for the targeted group.

101-170-05fill

This document is an Oregon Working Family Child Care Credit form for tax year 2005. It contains instructions for calculating an individual's child care credit based on their household size, adjusted gross income, qualifying child care expenses paid, and number of qualifying children. Tables are provided that correspond to different household sizes and income brackets to determine the decimal amount used in the credit calculation formula.

gov revenue formsandresources forms NR-1_fill-in

This document is an affidavit form for North Dakota residents to claim exemption from Montana state income tax under the Montana-North Dakota reciprocal tax agreement. It requires the filer to provide identifying information, the tax year, income earned and tax withheld in Montana, employer information, and an attestation that the filer was a North Dakota resident. Instructions indicate that to claim the exemption, the filer must submit this affidavit form, Montana W-2s, and a copy of their North Dakota tax return with their Montana return.

azdor.gov Forms 140pyf

This document appears to be an Arizona personal income tax return form for the 1999 tax year. It includes sections to provide personal information like name, address, social security number, as well as filing status, exemptions, income and deduction amounts. The taxpayer would use this form to file their part-year Arizona personal income taxes for the period beginning in 1999 and ending in 2000.

Scholarship Search Secrets

This document appears to be a presentation about securing scholarships for college. It discusses the large amount of student loan debt in the US and proposes increasing scholarship funds as a solution. It recommends students take proactive steps to find scholarships, including using specific tools and techniques outlined in the presenter's book "Scholarship Search Secrets". The presentation cites positive feedback from students who have used the book's strategies to receive thousands of dollars in scholarships. It concludes by inviting the audience to learn more from the presenter.

azdor.gov Forms 140Xf

This document is an individual amended income tax return for the year 2001 filed in Arizona. It contains fields for identifying information of the filer such as name, address, social security number. It includes sections to indicate filing status, residency status, and exemptions. The main sections calculate federal adjusted gross income, additions and subtractions to income, deductions, and exemptions to determine the tax amount.

740-XP - Amended Kentucky Individual Income Tax Return 2004 and Prior Years -...

This document is an amended Kentucky individual income tax return form for 2004 and prior years. It contains sections to report income and deductions, tax liability, payments and credits, and refund or amount due. The taxpayer can file as single, married filing jointly, married filing separately, or married filing separately on this combined return. It requires reporting original and corrected amounts and explaining changes in detail in an additional section. Interest rates for different years are provided to compute interest due on any additional amount owed.

VB-2 - Purchase Inventory of Vinous Beverages

This document is a 2007 Vermont fiduciary income tax return for an estate or trust. It includes sections to report the estate or trust's federal taxable income, additions and subtractions to calculate Vermont taxable income, tax computation, income adjustment calculation, and other state tax credit. Schedules are included for municipal bond income, tax computation, income adjustment, and nonresident income allocation. The return is used to calculate the estate or trust's Vermont income tax liability for the 2007 tax year.

1299-S Enterprise Zones, Foreign Trade Zones, and Sub-Zones

This document is an Illinois amended individual income tax return form (Form IL-1040-X) that provides instructions for correcting a previously filed Illinois tax return. It contains sections to enter personal information, provide the reason for filing an amended return, enter corrected financial information, calculate any refund or balance due, and sign the form. Supporting documentation must be provided for any corrected lines, such as federal tax forms if amending due to federal changes or Schedule M if amending additions or subtractions.

Sch_W_michigan.gov documents taxes

1) The document provides instructions for completing the Michigan Withholding Tax Schedule (Schedule W) to claim Michigan income tax withheld in 2008.

2) The Schedule W is used to report Michigan state and city income tax withholding and is attached to the MI-1040 Individual Income Tax Return.

3) The withholding tables are completed using information from W-2, 1099, and 4119 forms to report income and withholding amounts in the appropriate columns.

anrmap

This document displays a map of Vermont divided into 9 wastewater districts. Each district is responsible for overseeing wastewater and sewage infrastructure and regulations for the cities and towns within its boundaries. The map shows the boundaries and locations of the 9 districts across the state.

More Related Content

What's hot

1040X-ME amended income tax return

This document is a Maine Form 1040X, which is used to file an amended individual income tax return. It provides instructions for taxpayers to correct their original Maine tax return. The form includes sections to report income, deductions, exemptions, payments and the refund or amount owed. Taxpayers must explain any changes on page 2 and attach supporting documents. The instructions provide guidance on filing amended returns, reporting income and deductions, and claiming refunds for deceased taxpayers.

2008 IT-40 PNR Form

1. This document is an Indiana state tax return form for part-year or full-year nonresidents.

2. It provides instructions for nonresidents to calculate their Indiana state income tax liability based on income earned while living in Indiana.

3. The form walks through calculating Indiana adjusted gross income, exemptions, tax credits, tax owed or refund amount.

gov revenue formsandresources forms DS-1_fill_in

This document is a form for claiming Montana's disability income exemption. It provides instructions for determining eligibility for the exemption and calculating the exemption amount. To qualify, one must be under 65, permanently disabled, and receiving retirement disability benefits reported on a 1099-R tax form. The form guides the user to report their disability benefits and adjusted gross income to calculate their allowable exemption amount to claim on their state tax return. Proof of disability may be requested from government agencies or other documentation.

140PTCf

This document is an Arizona property tax refund claim form for tax year 2001. It allows taxpayers to claim a refund for property taxes paid or rent paid in lieu of property taxes. The form collects information about the claimant's residency, income, property taxes or rent paid, and requests a signature to verify the accuracy of the information provided. It provides instructions for calculating the refund amount and includes schedules to determine the credit based on living situation and household income.

Instructions for NJ-1040ES 2009

This document is an amended New Jersey state income tax return form (NJ-1040X) for the year 2008. It provides lines to correct or update information reported on the original 2008 state tax return such as income amounts, deductions, exemptions, credits, payments and the amount of refund or tax owed. The form also includes sections to provide identification information, dependent information, an explanation of changes being reported, and instructions on where to file the amended return.

azdor.gov Forms 140PTCf

This document is an Arizona property tax refund claim form for the year 2003. It provides instructions for homeowners and renters to claim a refund based on their property taxes paid or rent paid. The form collects information like name, address, income, property taxes or rent paid, and requests the applicant to check boxes to affirm they meet the qualifications like being an Arizona resident for all of 2003. It then calculates the refund amount and provides options to receive the refund via direct deposit or check.

Amended SC Individual Income Tax Return

This document is an amended individual income tax return form for the State of South Carolina. It contains instructions for filing an amended return, including how to fill out various sections to correct income, deductions, credits, payments and refund or balance due amounts from the original tax return. Key sections include Part I for taxpayer information, Part II for return line items, Part III for signatures, and Part IV for nonresidents to recalculate taxable income.

revenue.ne.gov tax current f_1040XN_2008

This document is a Nebraska Individual Income Tax Return form for filing an amended return for tax year 2008. It provides line items to adjust amounts reported on the original return, including federal adjusted gross income, deductions, exemptions, credits, payments, and any balance due or refund. The form requests information about reasons for the amended filing and requires explanations of changes being reported.

Application for Extension of Time to File NJ Gross Income Tax Return

This document is a 2008 New Jersey Homestead Rebate Application for tenants. It requests information such as the applicant's social security number, address, income, and rental payment information. The application is for tenants seeking a rebate of property taxes paid indirectly through rent. It must be filed if the applicant rented and occupied a property in New Jersey as their principal residence on October 1, 2008 and their total 2008 income was under $100,000.

azdor.gov Forms 140pyf

This 3 sentence summary provides the key details about the document:

This Arizona tax form is for 2000 part-year residents to file their personal income tax return. It includes sections to report income, deductions, exemptions, tax owed or refund amount. Residents must provide identification information, residency dates, income and tax details to calculate their final tax liability or refund for the 2000 tax year.

M1R taxes.state.mn.us

This document provides instructions for completing Schedule M1R for the Age 65 or Older/Disabled Subtraction for 2008. It outlines the eligibility requirements, which include being age 65 or older or disabled. It provides a table to determine eligibility based on filing status, adjusted gross income, and nontaxable benefits received. The instructions explain how to complete each line of the schedule, including how to calculate adjusted gross income if a lump-sum distribution was received.

Form 8850-Pre-Screening Notice and Certification Request

1) This document is an IRS form (Form 8850) for employers to request certification to claim the Work Opportunity Tax Credit.

2) The form collects information from job applicants such as name, address, date of birth, and whether they qualify as a member of a targeted group to claim the tax credit, such as veterans, recipients of public assistance, or ex-felons.

3) Employers complete the bottom portion with details of the job offer such as date applicant was offered the job, date they started, and certification that to the best of their knowledge the applicant qualifies for the targeted group.

101-170-05fill

This document is an Oregon Working Family Child Care Credit form for tax year 2005. It contains instructions for calculating an individual's child care credit based on their household size, adjusted gross income, qualifying child care expenses paid, and number of qualifying children. Tables are provided that correspond to different household sizes and income brackets to determine the decimal amount used in the credit calculation formula.

gov revenue formsandresources forms NR-1_fill-in

This document is an affidavit form for North Dakota residents to claim exemption from Montana state income tax under the Montana-North Dakota reciprocal tax agreement. It requires the filer to provide identifying information, the tax year, income earned and tax withheld in Montana, employer information, and an attestation that the filer was a North Dakota resident. Instructions indicate that to claim the exemption, the filer must submit this affidavit form, Montana W-2s, and a copy of their North Dakota tax return with their Montana return.

azdor.gov Forms 140pyf

This document appears to be an Arizona personal income tax return form for the 1999 tax year. It includes sections to provide personal information like name, address, social security number, as well as filing status, exemptions, income and deduction amounts. The taxpayer would use this form to file their part-year Arizona personal income taxes for the period beginning in 1999 and ending in 2000.

Scholarship Search Secrets

This document appears to be a presentation about securing scholarships for college. It discusses the large amount of student loan debt in the US and proposes increasing scholarship funds as a solution. It recommends students take proactive steps to find scholarships, including using specific tools and techniques outlined in the presenter's book "Scholarship Search Secrets". The presentation cites positive feedback from students who have used the book's strategies to receive thousands of dollars in scholarships. It concludes by inviting the audience to learn more from the presenter.

azdor.gov Forms 140Xf

This document is an individual amended income tax return for the year 2001 filed in Arizona. It contains fields for identifying information of the filer such as name, address, social security number. It includes sections to indicate filing status, residency status, and exemptions. The main sections calculate federal adjusted gross income, additions and subtractions to income, deductions, and exemptions to determine the tax amount.

740-XP - Amended Kentucky Individual Income Tax Return 2004 and Prior Years -...

This document is an amended Kentucky individual income tax return form for 2004 and prior years. It contains sections to report income and deductions, tax liability, payments and credits, and refund or amount due. The taxpayer can file as single, married filing jointly, married filing separately, or married filing separately on this combined return. It requires reporting original and corrected amounts and explaining changes in detail in an additional section. Interest rates for different years are provided to compute interest due on any additional amount owed.

VB-2 - Purchase Inventory of Vinous Beverages

This document is a 2007 Vermont fiduciary income tax return for an estate or trust. It includes sections to report the estate or trust's federal taxable income, additions and subtractions to calculate Vermont taxable income, tax computation, income adjustment calculation, and other state tax credit. Schedules are included for municipal bond income, tax computation, income adjustment, and nonresident income allocation. The return is used to calculate the estate or trust's Vermont income tax liability for the 2007 tax year.

1299-S Enterprise Zones, Foreign Trade Zones, and Sub-Zones

This document is an Illinois amended individual income tax return form (Form IL-1040-X) that provides instructions for correcting a previously filed Illinois tax return. It contains sections to enter personal information, provide the reason for filing an amended return, enter corrected financial information, calculate any refund or balance due, and sign the form. Supporting documentation must be provided for any corrected lines, such as federal tax forms if amending due to federal changes or Schedule M if amending additions or subtractions.

What's hot (20)

Application for Extension of Time to File NJ Gross Income Tax Return

Application for Extension of Time to File NJ Gross Income Tax Return

Form 8850-Pre-Screening Notice and Certification Request

Form 8850-Pre-Screening Notice and Certification Request

740-XP - Amended Kentucky Individual Income Tax Return 2004 and Prior Years -...

740-XP - Amended Kentucky Individual Income Tax Return 2004 and Prior Years -...

1299-S Enterprise Zones, Foreign Trade Zones, and Sub-Zones

1299-S Enterprise Zones, Foreign Trade Zones, and Sub-Zones

Viewers also liked

Sch_W_michigan.gov documents taxes

1) The document provides instructions for completing the Michigan Withholding Tax Schedule (Schedule W) to claim Michigan income tax withheld in 2008.

2) The Schedule W is used to report Michigan state and city income tax withholding and is attached to the MI-1040 Individual Income Tax Return.

3) The withholding tables are completed using information from W-2, 1099, and 4119 forms to report income and withholding amounts in the appropriate columns.

anrmap

This document displays a map of Vermont divided into 9 wastewater districts. Each district is responsible for overseeing wastewater and sewage infrastructure and regulations for the cities and towns within its boundaries. The map shows the boundaries and locations of the 9 districts across the state.

wv8379 state.wv.us/taxrev/forms

This document provides instructions for an injured spouse to receive their portion of a captured West Virginia state tax refund from a joint return. It explains that an injured spouse's income and tax withholding reported on a joint return was subject to garnishment to pay debts owed by the other spouse. The injured spouse must complete the form to allocate income, deductions, exemptions, payments and credits between the spouses to determine what percentage of the refund each spouse is due. The form lines include actual income, additions/subtractions to income, exemptions, withholding, estimated payments, credits and use tax to allocate between the spouses.

Mergers & acquisitions challenges

Mergers and acquisitions often fail to meet their promised goals, with failure rates between 50-70% and shareholder value being destroyed in more than 60% of cases. Common problems that contribute to failure include insensitive management, a lack of trust building and communication between companies, slow execution, and power struggles. To improve success, companies should recognize that leadership and respecting people are vital, build partnerships through trust and learning from each other rather than seeking power and domination, and make changes while safeguarding self-esteem.

12 13 champion village pp

The document outlines the hours of operation, registration procedures, rates, fees, and policies for the Champion Village before and after school program. It provides details on schedules, medication administration, absences, student behavior management, and withdrawal from the program. Enrollment is based on a first-come, first-served basis and requires completion of all registration forms and payment of annual registration fees.

schedule A wv.us taxrev forms

1) This document appears to be part of a West Virginia tax form for nonresidents and part-year residents to report income sources and amounts during the time they lived in West Virginia.

2) It includes sections to report income amounts from the federal tax return, income amounts during the period of West Virginia residency, and income amounts during the nonresident period.

3) There are lines to report different types of income including wages, interest, dividends, refunds of state/local taxes, alimony, business profits/losses, capital gains/losses, pensions, farm income, and unemployment/social security.

2008 Application for Automatic Extension of Time to File

This document is Indiana's Form IT-9, which allows taxpayers to request a 60-day extension to file their state income tax return. It explains who should file, how to calculate the minimum extension payment, and where to send the completed form and payment. Key details include that the extension maintains an April 15 payment deadline to avoid penalties and interest, and the extension payment should be claimed as a credit on the eventual tax return.

IT-272 Claim for College Tuition Credit or Itemized Deduction and instructions

This document is a claim form for the New York State real property tax credit for homeowners and renters. It provides instructions for homeowners and renters to determine if they are eligible for the tax credit based on their household income and real property taxes or rent paid. The form guides filers through 6 steps: 1) entering identifying information; 2) determining eligibility; 3) calculating household gross income; 4) computing real property taxes or rent paid; 5) computing the credit amount; and 6) finishing the claim by signing, entering direct deposit information if not filing with a tax return, and mailing instructions.

Voluntary Contributions Schedule

This document is a 2008 Michigan Schedule 1 Additions and Subtractions form. It contains instructions for reporting additions to and subtractions from income on a Michigan tax return. Some key additions include interest and dividends from other states, the deduction for federal taxes, and gains/losses from other forms. Key subtractions include income from U.S. government bonds, military pay, retirement/pension benefits, and various tax credits. The purpose of this form is to reconcile a taxpayer's federal adjusted gross income with their income for Michigan state tax purposes.

IT 1040 X - Amended Individual Income Tax Return

This document is a West Virginia income tax return form from 2008. It contains fields for taxpayer information like name, address, social security number. It includes sections to report federal adjusted gross income, exemptions, West Virginia taxable income, income tax due, payments and credits, amounts owed or refunded. Instructions are provided for how to make payments including by check, direct deposit of a refund, or credit card.

Income Tax Forms Requisition - Form 40A727

This document is a requisition form from the Kentucky Department of Revenue requesting state income tax forms. It lists the various individual, partnership, corporation, and S corporation tax forms and instructions available in Package K, and allows the requester to specify the desired quantity of each. It also offers blue refund and yellow payment envelopes that can be ordered in groups of 100. The requester is asked to provide contact information and payment details to receive the ordered forms.

Schedule 1 Instructions

This document provides instructions for completing the Michigan Schedule NR form for nonresident and part-year resident taxpayers. It explains how to allocate and apportion different types of income to Michigan and other states. Key items include allocating wages, business income, capital gains, and retirement income based on residency. It also provides details on prorating exemption allowances for part-year residents.

Computation of Penalties for Individuals

This document is an Illinois Department of Revenue form for claiming a tax refund due to a deceased taxpayer. It provides instructions for completing the form. The form has two steps: 1) provide the claimant's information and relationship to the deceased taxpayer, and 2) provide the deceased taxpayer's identifying information. It also includes a Schedule A for additional details if the claimant is a surviving spouse or other representative of the deceased taxpayer's estate.

Los Colegiales BritáNicos De Primaria

El gobierno británico planea reformar la enseñanza primaria para incluir el uso de nuevas herramientas tecnológicas como blogs, podcasts, Wikipedia y Twitter. La reforma reducirá las 13 materias actuales a 6 áreas más flexibles, dando más libertad a las escuelas y maestros. Algunos critican que la historia británica podría quedar excluida, pero el ministro de educación descarta esta posibilidad. La reforma también enfatizará habilidades de comunicación y uso responsable de Internet, además de promover

Sch_CR5_michigan.gov documents taxes

This document is a Michigan Department of Treasury Schedule CR-5 form from 2008. It provides instructions for taxpayers to report taxes and allocate amounts to agreements related to Public Act 281 of 1967. The form includes sections to enter an agreement number, county code, expiration date, whether tax receipts are attached, the percentage of ownership, the taxable value for 2008, and to calculate the total tax and allocated tax credit amounts for each agreement.

MI-4797_261956_7 michigan.gov documents taxes

This document is a 2008 Michigan Form MI-4797 for reporting adjustments of gains and losses from sales of business property. It contains instructions for taxpayers to report these amounts based on what was reported on their federal Form 4797. The form has sections to report gains and losses from various types of business property sales, including property held over 1 year, ordinary gains and losses, and gains from certain depreciable business property. Lines on the form carry amounts between sections to compute the total gains and losses subject to Michigan income tax.

Indiana Household Employment Taxes

This document provides instructions for filing Indiana household employment taxes. It explains that this schedule should be filed by individuals who withheld state and county income tax for household employees and want to pay those taxes with their individual income tax return. The schedule has two parts: Part I is a summary of the total state and county taxes withheld, and Part II lists each employee's name, income, and tax amounts withheld.

2012 chino valley opa performance data

See how our Subgroups (Students with Disabilities, English Learners, and more) performed on the 2012 STAR Test, leading us to an Academic Performance Index (API) score of 972!

The Standardized Testing and Reporting (STAR) Program consists of several key components, including the California Standards Tests (CSTs); and the California Modified Assessment (CMA). The CSTs show how well students are doing in relation to the state content standards. The CSTs include English-language arts (ELA) and mathematics in grades two through eleven; science in grades five, eight, and nine through eleven; and history-social science in grades eight, and ten through eleven.

s-3a

This document contains an agricultural sales tax exemption certificate for Vermont. It can be used by farmers to exempt purchases of agricultural fertilizers, pesticides, machinery and equipment from sales tax. The certificate must be filled out by the buyer and provided to the seller. It certifies that the items purchased will be used directly for agricultural production on a farm. The seller must retain the certificate for at least three years for audit purposes.

Viewers also liked (20)

2008 Application for Automatic Extension of Time to File

2008 Application for Automatic Extension of Time to File

IT-272 Claim for College Tuition Credit or Itemized Deduction and instructions

IT-272 Claim for College Tuition Credit or Itemized Deduction and instructions

Similar to Indiana Disability Retirement Deduction

Bankruptcy income tax information

Use this worksheet to complete the information we will use to complete your bankruptcy tax returns. Attach all slips (T4s etc.) and related tax information and remember to keep a copy of these for yourself.

For more information, visit us at:

http://www.djallen.ca

M1CD taxes.state.mn.us

This document provides instructions for claiming the Minnesota Child and Dependent Care Credit for tax year 2008. It includes a table to determine the credit amount based on household income and number of qualifying persons. It defines who qualifies for the credit, what expenses qualify, and how part-year residents and those with certain types of income can calculate their credit. Operators of licensed family day care homes caring for their own children under age 6 may also qualify for the credit. Taxpayers must have proof of expenses in case the department requests documentation.

Rosemary Mrazik Your_Social_Security_Statement 7 12 2016

- The document is a summary of an individual's Social Security statement, providing estimates of retirement, disability, family and survivor benefits.

- The estimated retirement benefit at full retirement age (67) is $1,198 per month, or $1,494 per month if working until age 70. The benefit would be $829 per month if claiming at age 62.

- The statement also includes the individual's lifetime earnings history and taxes paid into Social Security.

44019 Centralalized Employee Form

This document contains two forms: a Centralized Employee Registry Reporting Form for employers to report new hires, and an Iowa W4 Employee Withholding Allowance Certificate for employees. The employer form requires reporting employee information such as name, address, start date, and whether dependent health insurance is offered. The Iowa W4 form allows employees to claim withholding allowances to determine how much Iowa income tax should be withheld from their paychecks. Instructions are provided to help employees accurately calculate their allowances.

Form 1040EZ (Eric)

1. This document is an IRS Form 1040EZ for the 2010 tax year filed by Paul Eric Kim and his spouse Lee.

2. Paul reported $45,000 in wages and Lee reported $55,000 in wages, for a total adjusted gross income of $100,000.

3. With a standard deduction of $18,700 for married filing jointly and no other deductions, their taxable income was $81,300. Using the tax table, their tax due was $7,538.

Business Allocation Schedule

This document appears to be a tax return form for the State of New Jersey Gross Income Tax for estates and trusts. It includes sections to report income such as interest, dividends, business profits, capital gains, rents and royalties. It also includes sections to calculate tax liability and credits, and designate overpayment or balance due. The form must be completed and filed by the fiduciary of the estate or trust to report income earned and calculate taxes owed for the tax year.

Injured Spouse Claim and Allocation

This 3 sentence summary provides the high level information about the document:

The document is an "Injured Spouse Claim and Allocation" form from the Oklahoma Tax Commission that allows a spouse to claim their share of an overpayment on a joint tax return that was applied to their spouse's tax debt. The form requires the spouses to allocate their individual income, deductions, credits, and payments between themselves to determine what portion of the joint overpayment should be refunded to the injured spouse. The injured spouse must sign and submit the completed form along with supporting documentation to the Oklahoma Tax Commission.

schd-fc-enabled nd.gov tax indincome forms 2008

This document provides instructions for claiming North Dakota's family member care income tax credit. It defines key terms like qualified care expenses and qualifying family member. To qualify for the credit, the taxpayer must have paid expenses to care for a family member who is elderly or disabled and meets certain income requirements. The schedule walks through calculating the allowable credit amount.

Credit for Refund of Property Taxes

This form is for claiming a credit or refund of property taxes paid in Oklahoma. It must be filed by June 30, 2009. The form collects information about the claimant's household income and property taxes paid. To qualify for the credit or refund, the claimant must be an Oklahoma resident for all of 2008, be over 65 or disabled, and have a total household income of $12,000 or less. The credit or refund amount is the property taxes paid minus 1% of household income, up to a maximum of $200. The form guides the claimant to claim the credit on their state income tax return or receive a refund if not required to file a return.

2008 IT-40 Income Tax Form

This document is an Indiana state tax return form for 2008. It provides instructions for filing as an individual taxpayer and includes sections to report income, deductions, exemptions, taxes owed or refund amount. Key details include reporting federal adjusted gross income, Indiana deductions, exemptions, state and county tax amounts, credits, payments made including withholdings, and amounts owed or to be refunded.

Twenty-First Century Scholars Program Credit

This document is a schedule for computing tax credits for contributions to Indiana's Twenty-First Century Scholars Program. It provides instructions for individuals and corporations to calculate their allowable credit amount. For individuals, the credit is 50% of contributions up to $100 for single filers or $200 for joint filers, or their tax liability, whichever is less. For corporations, the credit is 50% of contributions up to $1,000 or 10% of tax liability, whichever is less. Taxpayers must keep receipts for contributions for three years.

AR1000A - Amended Income Tax Return

This document is an Arkansas individual income tax amended return form for 2008. It contains sections to report original and amended income amounts, deductions, credits, taxes owed or refund due. The form requires the filer to sign under penalty of perjury and provides space to explain any changes being made compared to the original filing.

span class="fill_but">Fill In

This document is an Arkansas individual income tax amended return form for 2008. It contains sections to report original and amended income amounts, deductions, credits, taxes owed or refund due. The form requires the filer to sign under penalty of perjury and provides space to explain any changes being made compared to the original filing.

2008 Unified Tax Credit for the Elderly

This document is a tax form for claiming the Indiana Unified Tax Credit for the Elderly for tax year 2008. It provides instructions for eligible taxpayers to report their income and marital status to determine if they qualify for a tax refund of $100, $50, $40, or $0 depending on filing status and income level. Eligible filers must be Indiana residents, age 65 or older, not have been incarcerated for more than 180 days in 2008, and if married, must file jointly.

gov revenue formsandresources forms 2M_fill-in

This document is a Montana individual income tax return form for 2008. It includes sections to report income, deductions, exemptions, tax, payments and amounts owed or refunded. The form is for residents filing as single, married filing jointly, or head of household. It provides line items to report wages, interest, dividends, capital gains, retirement income and other income. It allows standard or itemized deductions and exemptions. It calculates tax, nonrefundable credits, payments and any amounts due or to be refunded.

Personal Data 2007 Tax Year

This document contains a personal tax data form for a client for the 2007 tax year. It requests information such as names, addresses, social security numbers, income sources, deductions, and credits. The form is used by a tax preparer to gather necessary information from a client to complete their tax return. It covers many common income types and deductions including W-2 wages, 1099 forms, alimony, rental income, self-employment income, itemized deductions, and various tax credits.

Va Form Va 4

The document is a personal exemption worksheet and employee Virginia income tax withholding exemption certificate (Form VA-4) used by employees in Virginia to determine personal exemptions and notify their employer of Virginia income tax withholding status. The worksheet guides the employee to calculate a subtotal of personal exemptions, exemptions for age and blindness, and total exemptions. The certificate requires the employee to provide personal information, enter the number of total exemptions, request additional withholding, and certify their Virginia withholding status.

# IT-214 Claim for Real Property Tax Credit for Homeowners and Renters and in...

1. This document is an Empire State Child Credit Claim form for New York State taxpayers to claim a child tax credit.

2. It provides instructions for taxpayers to determine their eligibility for the credit by completing steps that involve answering questions about residency, federal child tax credits claimed, and income level.

3. For eligible taxpayers, the form then guides them through calculating the amount of the Empire State Child Credit they can claim by completing steps that determine the federal child tax credit amounts and the number of qualifying children.

- E2A - Estate Tax Info & App for Tax Clearance

The document is an application for a Lifeline telephone service credit in Vermont. It provides information on eligibility requirements for the credit based on age (under 65 or 65 and older) and household income level. It then lists sections for applicants to fill out with their personal information like name, address, birthdate, income sources and amounts. By filling out and submitting the form by June 15, 2008, eligible applicants can receive at least a $13 credit toward their monthly basic telephone charges.

Schedule 2440W

This document provides instructions for claiming a disability income exclusion on a Wisconsin tax return. Key details:

- Taxpayers who receive disability income may be able to exclude a portion from taxable income. This form is used to calculate the allowable exclusion amount.

- To qualify for the exclusion in 2008, the taxpayer must have received disability income, been under age 65, retired due to a permanent and total disability, and not reached the retirement age required by their employer's plan.

- Disability income generally includes payments from an employer's accident/health plan instead of wages while absent from work due to disability. The form guides taxpayers through calculating their weekly disability pay amount and determining the excludable portion.

Similar to Indiana Disability Retirement Deduction (20)

Rosemary Mrazik Your_Social_Security_Statement 7 12 2016

Rosemary Mrazik Your_Social_Security_Statement 7 12 2016

# IT-214 Claim for Real Property Tax Credit for Homeowners and Renters and in...

# IT-214 Claim for Real Property Tax Credit for Homeowners and Renters and in...

More from taxman taxman

ftb.ca.gov forms 09_3528a

This document is an application for a California homebuyer's tax credit. It contains sections for the seller to certify that the home has never been occupied, as well as sections for the escrow company to provide closing details. Finally, there are sections for up to three qualified buyers to provide their contact and ownership information and certify that they intend to use the home as their primary residence for at least two years. The buyers will receive a tax credit of up to 5% of the home's purchase price or $10,000, whichever is less.

ftb.ca.gov forms 09_593bk

This document contains Forms 593-C and 593-E and instructions for real estate withholding in California for 2009. It explains that real estate withholding is a prepayment of estimated income tax due from gains on real estate sales in California. The Real Estate Escrow Person is responsible for providing the forms to sellers and withholding the appropriate amount based on the forms submitted.

ftb.ca.gov forms 09_593v

This document provides instructions for completing Form 593-V Payment Voucher for Real Estate Withholding Electronic Submission. Key details include:

1) Form 593-V is used to remit real estate withholding payment to the Franchise Tax Board if Form 593 was filed electronically. It must include the withholding agent's identifying information and payment amount.

2) Payments can be made by check or money order payable to the Franchise Tax Board, or through electronic funds transfer for large payments. The payment must match the electronically filed Form 593.

3) Payments are due within 20 days of the end of the month in which the real estate transaction occurred. Interest and penalties

ftb.ca.gov forms 09_593i

This document provides instructions for California real estate withholding on installment sales. It explains that for tax years beginning on or after January 1, 2009, the buyer is required to withhold taxes on the principal portion of each installment payment for properties sold via an installment sale. The form guides the buyer through providing their contact information, the seller's information, acknowledging the withholding requirement, and signing to indicate they understand their obligation to withhold taxes and send payments to the state. Escrow agents are instructed to send the initial withholding amount to the state and provide copies of documents to help facilitate ongoing withholding as future installment payments are made.

ftb.ca.gov forms 09_593c

This document is a California Form 593-C, which is a Real Estate Withholding Certificate. It allows a seller of California real estate to certify exemptions from real estate withholding requirements. The form has four parts: seller information, certifications that fully exempt from withholding, certifications that may partially or fully exempt, and the seller's signature. Checking boxes in Part II or III can allow full or partial exemption from the default 3 1/3% withholding on the sales price of California real estate.

ftb.ca.gov forms 09_593

This document is a California Form 593 for real estate withholding tax. It contains information about the withholding agent, seller or transferor, escrow or exchange details, and transaction details. The form requires the seller to sign a perjury statement if electing an optional gain on sale calculation method rather than the default 3 1/3% of total sales price withholding amount.

ftb.ca.gov forms 09_592v

This document provides instructions for completing Form 592-V, the payment voucher for electronically filed Form 592 (Quarterly Resident and Nonresident Withholding Statement) and Form 592-F (Foreign Partner or Member Annual Return). Key details include verifying complete information is provided on the voucher, rounding cents to dollars, mailing the payment and voucher to the Franchise Tax Board by the payment due date, and interest and penalties for late payments.

ftb.ca.gov forms 09_592b

This document is a California Form 592-B for the tax year 2009. It provides instructions for withholding agents and recipients regarding nonresident and resident withholding. Key details include:

- Form 592-B is used to report income subject to withholding and the amount of California tax withheld.

- It must be provided to recipients by January 31 and to foreign partners by the 15th day of the 4th month following the close of the taxable year.

- The recipient should attach Copy B to their California tax return to claim the withholding amount.

ftb.ca.gov forms 09_592a

This document is a Foreign Partner or Member Quarterly Withholding Remittance Statement form for tax year 2009 from the California Franchise Tax Board. It contains instructions for three installment payments due by the 15th day of the 4th, 6th, and 9th months of the tax year. The form collects identifying information about the Withholding Agent such as name, address, ID number, and payment amounts to be remitted to the Franchise Tax Board.

ftb.ca.gov forms 09_592

This document is a Quarterly Resident and Nonresident Withholding Statement form for tax year 2009. It is used to report tax amounts withheld from payments made to independent contractors, recipients of rents/royalties, distributions to shareholders/partners/beneficiaries, and other types of income. The form includes sections to enter information about the withholding agent, types of income, amounts of tax withheld and due, and a schedule of payees listing details of payments made and tax withheld for each recipient. Instructions are provided on filing deadlines, common errors to avoid, electronic filing requirements, interest and penalties.

ftb.ca.gov forms 09_590p

This document is a Nonresident Withholding Exemption Certificate form used to certify an exemption from withholding on distributions of previously reported income from an S corporation, partnership, or LLC. It allows a nonresident shareholder, partner, or member to claim exemption if the income represented by the distribution was already reported on their California tax return. The form requires information about the entity and individual, and certification that the income has been reported. It is to be kept by the entity and presented to claim exemption from withholding requirements on distributions of prior year income.

ftb.ca.gov forms 09_590

This document is a Withholding Exemption Certificate form from the California Franchise Tax Board. It allows individuals and entities to certify an exemption from California nonresident income tax withholding. The form contains checkboxes for different types of taxpayers, including individuals, corporations, partnerships, LLCs, tax-exempt entities, and trusts, to claim an exemption based on their status. It requires the taxpayer's name, address, and signature to certify that the information provided is true and correct.

ftb.ca.gov forms 09_588

This document is a request form for a waiver of nonresident withholding in California. It requests information about the requester, withholding agent, and payees. The requester provides their name and address and selects the type of income payment for which a waiver is requested. The withholding agent's name and address are also provided. In the vendor/payee section, names, addresses, and tax identification numbers are listed along with the reason for waiver request. Reasons include having current tax returns on file, making estimated payments, being a member of a combined reporting entity, or other special circumstances. The form is signed under penalty of perjury.

ftb.ca.gov forms 09_587

This document is a Nonresident Withholding Allocation Worksheet (Form 587) used to determine if withholding of income tax is required for payments made by a withholding agent to a nonresident vendor/payee. The vendor/payee provides information about the types of payments received and allocation of income between California and other states. The withholding agent uses this information to determine if withholding of 7% is required based on the amount of California-source income payments exceeding $1,500.

ftb.ca.gov forms 09_570

This document is a tax return form for California's nonadmitted insurance tax. It provides instructions for calculating taxes owed on insurance premiums paid to insurers not authorized to conduct business in California. The form includes sections to enter the taxpayer's information, identify the tax period and insurance contracts, compute the tax amount, and make payments or claim refunds. It also provides directions on filing amended returns, payment due dates, and authorizing a third party to discuss the filing with the tax agency.

ftb.ca.gov forms 09_541es

The document provides instructions for Form 541-ES, which is used to calculate and pay estimated tax for estates and trusts. Key details include:

- Estimated tax payments for 2009 are now required to be 30% of the estimated tax liability for the 1st and 2nd installments and 20% for the 3rd and 4th installments.

- Estates and trusts with a 2009 adjusted gross income of $1,000,000 or more must base estimated tax payments on their 2009 tax liability rather than the prior year's tax.

- The form and instructions provide guidance on calculating estimated tax, payment due dates, and how to complete and submit Form 541-ES.

ftb.ca.gov forms 09_540esins

This document provides instructions for California taxpayers to estimate their tax liability and make estimated tax payments for tax year 2009. Key details include:

- Taxpayers must make estimated payments if they expect to owe $500 or more in tax for 2009 after subtracting withholding and credits.

- Payments are due April 15, June 15, September 15 of 2009, and January 15 of 2010.

- A worksheet is provided to help calculate estimated tax liability based on 2008 tax return or expected 2009 income.

- Failure to make required estimated payments may result in penalties. Electronic payment is required for payments over $20,000.

ftb.ca.gov forms 09_540es

This document provides instructions for making estimated tax payments for individuals in California. It includes:

1) Directions for making online payments through the Franchise Tax Board website for ease and to schedule payments up to a year in advance.

2) A form for making estimated tax payments by mail on April 15, June 15, September 15, and January 15 that includes fields for name, address, amounts owed, and payment instructions.

3) Reminders not to combine estimated tax payments with tax payments from the previous year and to write your name and identification number on the check.

ftb.ca.gov forms 1240

This document contains contact information for the California Franchise Tax Board. It lists phone numbers and addresses for various tax-related services, including automated phone services, taxpayer assistance, tax practitioner services, and departments within the FTB that handle issues like collections, bankruptcy, and deductions. The board members and executive officer are also named.

ftb.ca.gov forms 1015B

This document provides answers to frequently asked questions about tax audits conducted by the Franchise Tax Board of California. It explains that the purpose of an audit is to fairly verify the correct amount of taxes owed. It addresses questions about obtaining representation, responding to information requests, payment plans if additional taxes are owed, and appeal rights. The document directs taxpayers to contact their auditor or the Franchise Tax Board directly for additional assistance.

More from taxman taxman (20)

Recently uploaded

How to Buy an Engagement Ring.pcffbhfbfghfhptx

Dive into this presentation and learn about the ways in which you can buy an engagement ring. This guide will help you choose the perfect engagement rings for women.

Zodiac Signs and Food Preferences_ What Your Sign Says About Your Taste

Know what your zodiac sign says about your taste in food! Explore how the 12 zodiac signs influence your culinary preferences with insights from MyPandit. Dive into astrology and flavors!

TIMES BPO: Business Plan For Startup Industry

Starting a business is like embarking on an unpredictable adventure. It’s a journey filled with highs and lows, victories and defeats. But what if I told you that those setbacks and failures could be the very stepping stones that lead you to fortune? Let’s explore how resilience, adaptability, and strategic thinking can transform adversity into opportunity.

Innovative Uses of Revit in Urban Planning and Design

Discover innovative uses of Revit in urban planning and design, enhancing city landscapes with advanced architectural solutions. Understand how architectural firms are using Revit to transform how processes and outcomes within urban planning and design fields look. They are supplementing work and putting in value through speed and imagination that the architects and planners are placing into composing progressive urban areas that are not only colorful but also pragmatic.

2024-6-01-IMPACTSilver-Corp-Presentation.pdf

IMPACT Silver is a pure silver zinc producer with over $260 million in revenue since 2008 and a large 100% owned 210km Mexico land package - 2024 catalysts includes new 14% grade zinc Plomosas mine and 20,000m of fully funded exploration drilling.

Dpboss Matka Guessing Satta Matta Matka Kalyan Chart Satta Matka

Dpboss Matka Guessing Satta Matta Matka Kalyan Chart Satta Matka➒➌➎➏➑➐➋➑➐➐Dpboss Matka Guessing Satta Matka Kalyan Chart Indian Matka

Dpboss Matka Guessing Satta Matta Matka Kalyan Chart Indian Matka Indian satta Matka Dpboss Matka Kalyan Chart Matka Boss otg matka Guessing Satta The APCO Geopolitical Radar - Q3 2024 The Global Operating Environment for Bu...

The Radar reflects input from APCO’s teams located around the world. It distils a host of interconnected events and trends into insights to inform operational and strategic decisions. Issues covered in this edition include:

Digital Transformation Frameworks: Driving Digital Excellence

[To download this presentation, visit:

https://www.oeconsulting.com.sg/training-presentations]

This presentation is a curated compilation of PowerPoint diagrams and templates designed to illustrate 20 different digital transformation frameworks and models. These frameworks are based on recent industry trends and best practices, ensuring that the content remains relevant and up-to-date.

Key highlights include Microsoft's Digital Transformation Framework, which focuses on driving innovation and efficiency, and McKinsey's Ten Guiding Principles, which provide strategic insights for successful digital transformation. Additionally, Forrester's framework emphasizes enhancing customer experiences and modernizing IT infrastructure, while IDC's MaturityScape helps assess and develop organizational digital maturity. MIT's framework explores cutting-edge strategies for achieving digital success.

These materials are perfect for enhancing your business or classroom presentations, offering visual aids to supplement your insights. Please note that while comprehensive, these slides are intended as supplementary resources and may not be complete for standalone instructional purposes.

Frameworks/Models included:

Microsoft’s Digital Transformation Framework

McKinsey’s Ten Guiding Principles of Digital Transformation

Forrester’s Digital Transformation Framework

IDC’s Digital Transformation MaturityScape

MIT’s Digital Transformation Framework

Gartner’s Digital Transformation Framework

Accenture’s Digital Strategy & Enterprise Frameworks

Deloitte’s Digital Industrial Transformation Framework

Capgemini’s Digital Transformation Framework

PwC’s Digital Transformation Framework

Cisco’s Digital Transformation Framework

Cognizant’s Digital Transformation Framework

DXC Technology’s Digital Transformation Framework

The BCG Strategy Palette

McKinsey’s Digital Transformation Framework

Digital Transformation Compass

Four Levels of Digital Maturity

Design Thinking Framework

Business Model Canvas

Customer Journey Map

Sustainable Logistics for Cost Reduction_ IPLTech Electric's Eco-Friendly Tra...

Sustainable Logistics for Cost Reduction_ IPLTech Electric's Eco-Friendly Transport Solution

2022 Vintage Roman Numerals Men Rings

Discover timeless style with the 2022 Vintage Roman Numerals Men's Ring. Crafted from premium stainless steel, this 6mm wide ring embodies elegance and durability. Perfect as a gift, it seamlessly blends classic Roman numeral detailing with modern sophistication, making it an ideal accessory for any occasion.

https://rb.gy/usj1a2

Innovation Management Frameworks: Your Guide to Creativity & Innovation

Innovation Management Frameworks: Your Guide to Creativity & InnovationOperational Excellence Consulting

[To download this presentation, visit:

https://www.oeconsulting.com.sg/training-presentations]

This PowerPoint compilation offers a comprehensive overview of 20 leading innovation management frameworks and methodologies, selected for their broad applicability across various industries and organizational contexts. These frameworks are valuable resources for a wide range of users, including business professionals, educators, and consultants.

Each framework is presented with visually engaging diagrams and templates, ensuring the content is both informative and appealing. While this compilation is thorough, please note that the slides are intended as supplementary resources and may not be sufficient for standalone instructional purposes.

This compilation is ideal for anyone looking to enhance their understanding of innovation management and drive meaningful change within their organization. Whether you aim to improve product development processes, enhance customer experiences, or drive digital transformation, these frameworks offer valuable insights and tools to help you achieve your goals.

INCLUDED FRAMEWORKS/MODELS:

1. Stanford’s Design Thinking

2. IDEO’s Human-Centered Design

3. Strategyzer’s Business Model Innovation

4. Lean Startup Methodology

5. Agile Innovation Framework

6. Doblin’s Ten Types of Innovation

7. McKinsey’s Three Horizons of Growth

8. Customer Journey Map

9. Christensen’s Disruptive Innovation Theory

10. Blue Ocean Strategy

11. Strategyn’s Jobs-To-Be-Done (JTBD) Framework with Job Map

12. Design Sprint Framework

13. The Double Diamond

14. Lean Six Sigma DMAIC

15. TRIZ Problem-Solving Framework

16. Edward de Bono’s Six Thinking Hats

17. Stage-Gate Model

18. Toyota’s Six Steps of Kaizen

19. Microsoft’s Digital Transformation Framework

20. Design for Six Sigma (DFSS)

To download this presentation, visit:

https://www.oeconsulting.com.sg/training-presentationsDearbornMusic-KatherineJasperFullSailUni

My powerpoint presentation for my Music Retail and Distribution class at Full Sail University

Best practices for project execution and delivery

A select set of project management best practices to keep your project on-track, on-cost and aligned to scope. Many firms have don't have the necessary skills, diligence, methods and oversight of their projects; this leads to slippage, higher costs and longer timeframes. Often firms have a history of projects that simply failed to move the needle. These best practices will help your firm avoid these pitfalls but they require fortitude to apply.

Best Competitive Marble Pricing in Dubai - ☎ 9928909666

Stone Art Hub offers the best competitive Marble Pricing in Dubai, ensuring affordability without compromising quality. With a wide range of exquisite marble options to choose from, you can enhance your spaces with elegance and sophistication. For inquiries or orders, contact us at ☎ 9928909666. Experience luxury at unbeatable prices.

❼❷⓿❺❻❷❽❷❼❽ Dpboss Matka Result Satta Matka Guessing Satta Fix jodi Kalyan Fin...

❼❷⓿❺❻❷❽❷❼❽ Dpboss Matka Result Satta Matka Guessing Satta Fix jodi Kalyan Fin...❼❷⓿❺❻❷❽❷❼❽ Dpboss Kalyan Satta Matka Guessing Matka Result Main Bazar chart

❼❷⓿❺❻❷❽❷❼❽ Dpboss Matka Result Satta Matka Guessing Satta Fix jodi Kalyan Final ank Satta Matka Dpbos Final ank Satta Matta Matka 143 Kalyan Matka Guessing Final Matka Final ank Today Matka 420 Satta Batta Satta 143 Kalyan Chart Main Bazar Chart vip Matka Guessing Dpboss 143 Guessing Kalyan night Unveiling the Dynamic Personalities, Key Dates, and Horoscope Insights: Gemin...

Explore the fascinating world of the Gemini Zodiac Sign. Discover the unique personality traits, key dates, and horoscope insights of Gemini individuals. Learn how their sociable, communicative nature and boundless curiosity make them the dynamic explorers of the zodiac. Dive into the duality of the Gemini sign and understand their intellectual and adventurous spirit.

Income Tax exemption for Start up : Section 80 IAC

A presentation on the concept of Exemption of Profits of Start ups from Income Tax

Recently uploaded (20)

Zodiac Signs and Food Preferences_ What Your Sign Says About Your Taste

Zodiac Signs and Food Preferences_ What Your Sign Says About Your Taste

Innovative Uses of Revit in Urban Planning and Design

Innovative Uses of Revit in Urban Planning and Design

Dpboss Matka Guessing Satta Matta Matka Kalyan Chart Satta Matka

Dpboss Matka Guessing Satta Matta Matka Kalyan Chart Satta Matka

The APCO Geopolitical Radar - Q3 2024 The Global Operating Environment for Bu...

The APCO Geopolitical Radar - Q3 2024 The Global Operating Environment for Bu...

Digital Transformation Frameworks: Driving Digital Excellence

Digital Transformation Frameworks: Driving Digital Excellence

Sustainable Logistics for Cost Reduction_ IPLTech Electric's Eco-Friendly Tra...

Sustainable Logistics for Cost Reduction_ IPLTech Electric's Eco-Friendly Tra...

Innovation Management Frameworks: Your Guide to Creativity & Innovation

Innovation Management Frameworks: Your Guide to Creativity & Innovation

Best Competitive Marble Pricing in Dubai - ☎ 9928909666

Best Competitive Marble Pricing in Dubai - ☎ 9928909666

❼❷⓿❺❻❷❽❷❼❽ Dpboss Matka Result Satta Matka Guessing Satta Fix jodi Kalyan Fin...

❼❷⓿❺❻❷❽❷❼❽ Dpboss Matka Result Satta Matka Guessing Satta Fix jodi Kalyan Fin...

Unveiling the Dynamic Personalities, Key Dates, and Horoscope Insights: Gemin...

Unveiling the Dynamic Personalities, Key Dates, and Horoscope Insights: Gemin...

Income Tax exemption for Start up : Section 80 IAC

Income Tax exemption for Start up : Section 80 IAC

Indiana Disability Retirement Deduction